New research shows that “quality” stocks — companies with high operating profitability but which are out of favor on Wall Street — are the type of stocks most likely to do well if inflation heats up. This same research also determined which stocks are the best bets if inflation cools: quality stocks.

The research was published earlier this month by Northern Trust Asset Management. Entitled “Navigating Inflation—An Analysis of Equity Factor Performance Over 150 Years,” the study was conducted by three of the firm’s quantitative strategists: Guido Baltussen, Milan Vidojevic, and Bart Van Vliet. Baltussen also is chair of the Behavioral Finance and Financial Markets department at Erasmus University in Rotterdam.

The finding represents a major advance over prior studies of what type of stock performs best in different inflationary environments. Earlier studies were hampered by limited data; until this new study, data weren’t available for periods earlier than around 1970. That meant the analysis included just one extended stretch of high inflation — the decade of the 1970s.

The Northern Trust study was able to take advantage of a new database that includes U.S. stock data back to 1875. The authors were therefore able to measure the performance of various types of stocks—called “factors” — that include many bouts of high inflation.

The authors calculated the performance of five different factors since 1875 across different inflationary environments. In addition to the quality factor, the researchers focused on:

- Low risk: Stocks with low betas

- Size: Stocks of companies with the smallest market caps

- Momentum: Stocks with the best trailing-year returns

- Value: Stocks with the lowest price/book ratios and highest dividend yields

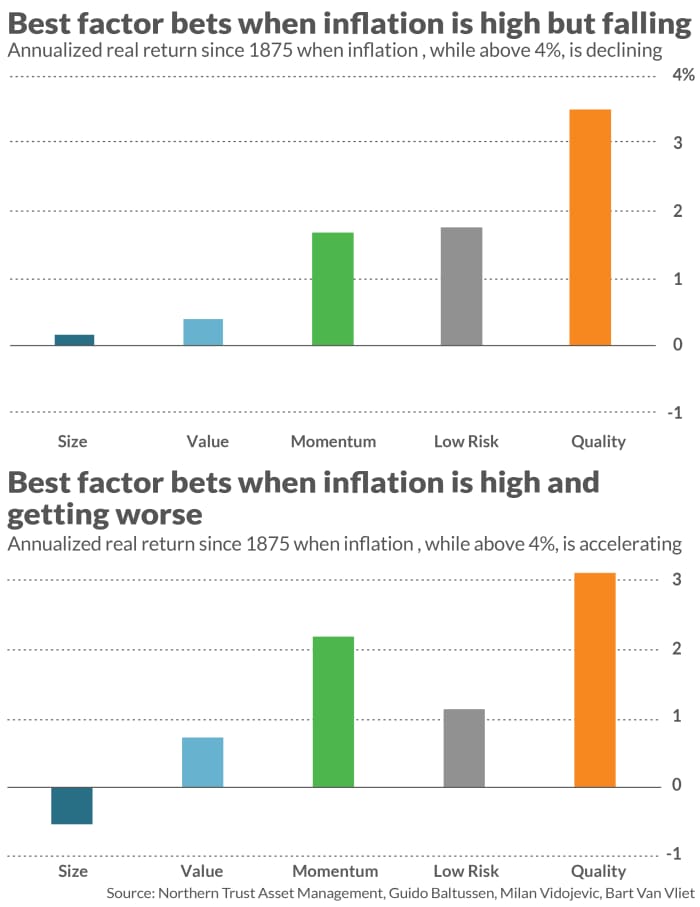

The results most relevant to today’s inflationary environment reflect two scenarios. In the first, inflation was already high and continued even higher, and in the second inflation was high but declining. As you can see from the accompanying chart, the quality factor came out on top in each scenario.

You need not worry that quality stocks will perform poorly in other inflation scenarios, furthermore. When inflation was “mild,” defined as between 2% and 4%, its historical performance was decent: third place out of the five factors. When inflation was “low,” defined as between 0% and 2%, quality came in second out of five.

The researchers aren’t claiming that the other four factors are not valuable, even if they haven’t performed as well as quality. In an interview, Baltussen suggested that a good approach would be, once you are focusing on high-quality stocks, to favor those with low betas and price-to-book ratios, smaller market caps, and higher trailing-year returns.

To illustrate which stocks you might choose, the following is a list of 10 stocks (courtesy of FactSet) that satisfy the criteria that Baltussen suggested.

| Company | 5-year beta | Price/Book ratio | Total return last 12 months | Market Cap ($ billions) |

|

Antero Midstream Corp. AM, |

0.83 | 2.78 | 27% | $5.98 |

|

CoreCivic, Inc. CXW, |

1.08 | 1.09 | 35% | $1.61 |

|

Curtiss-Wright Corporation CW, |

1.08 | 3.85 | 35% | $8.98 |

|

Innoviva, Inc. INVA, |

0.81 | 1.62 | 27% | $1.01 |

|

Otter Tail Corporation OTTR, |

0.97 | 2.57 | 28% | $3.71 |

|

PACCAR Inc. PCAR, |

0.85 | 3.54 | 48% | $56.18 |

|

Radian Group Inc. RDN, |

1.19 | 0.96 | 27% | $4.21 |

|

SLM Corp SLM, |

1.08 | 2.74 | 43% | $4.58 |

|

Tennant Company TNC, |

1.02 | 3.47 | 48% | $1.91 |

|

Warrior Met Coal, Inc. HCC, |

0.90 | 1.55 | 38% | $2.91 |

|

S&P 500 SPX |

1 | 4.19 | 27% |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: Hotter PCE inflation report to be another ’bump’ in the road for the Fed

More: The U.S. stock market isn’t as concentrated as ‘Magnificent Seven’ talk would have us believe

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Excellent blog here Also your website loads up very fast What web host are you using Can I get your affiliate link to your host I wish my web site loaded up as quickly as yours lol