In this scenario, NETS assumes the role of primary acquirer for the merchant and takes full responsibility for the merchant-acquirer relationship. This includes overseeing critical functions such as onboarding, payments, and reconciliation, which greatly simplifies the process for sellers.

From SGQR+ Paving the way for cross-border connectivity

Globally, the potential of interoperable QR payments has been recognized, and countries are implementing strategies to develop interconnected and comprehensive payment ecosystems. Notable systems in Southeast Asia include Indonesia’s Quick Response Code Indonesia Standard (QRIS), Malaysia’s DuitNow QR, the Philippines’ QR Ph, and Thai QR established by the Bank of Thailand. These systems not only facilitate seamless payments for inbound customers, but also increase inbound transactions through cross-border collaboration.

These countries have established cross-border linkages with each other, achieving varying degrees of interoperability, and some have implemented well-connected cross-border QR payment systems. There are also countries. SGQR+ aims to increase inbound transactions through these collaborations, while ensuring a seamless payment experience for inbound customers with established cross-border connections.

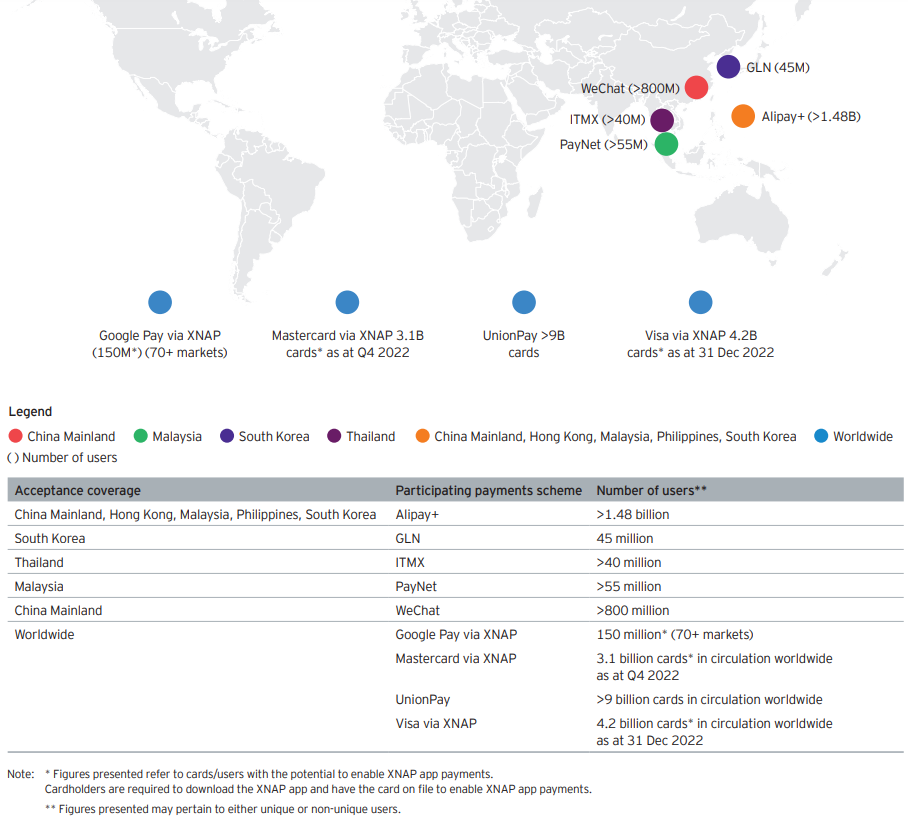

SGQR+ POC supports payment schemes in mainland China (AliPay+ and WeChat), South Korea (GLN), Thailand (ITMX), Malaysia (PayNet), as well as global schemes via XNAP cards and app store payment options . A wider range of merchant acquirers, local issuers, and participating international schemes have expressed interest and are moving towards establishing seamless QR payments in many countries.

Strengthen financial inclusion and unleash the potential of MSMEs

SGQR+ gives acquirers a more comprehensive view of a merchant’s cash flow, as opposed to a closed-loop payment ecosystem like SGQR. This broader perspective could foster alternative credit scoring methodologies and increase lending to previously unserved or underserved segments.

Source: Singapore Interoperable QR Payments, MAS

SGQR+ aims to address existing merchant challenges and open new avenues of digital inclusion by seamlessly connecting payment providers and merchants. With a focus on interoperability, scheme participants are encouraged to develop service offerings that focus on both merchants and consumers. This is facilitated by leveraging an enhanced offer made possible through the scheme’s incentives and favorable unit economics.

For many of Singapore’s neighbors, MSMEs participating in an interoperable QR system payment rail will help improve financial inclusion for the unbanked and underbanked, thereby boosting the economies of these regions. Promote development.