Stay informed with free updates

Just sign up for china economy myFT Digest — delivered straight to your inbox.

Chinese investors and households have been buying gold as a haven from turmoil in local property and stock markets, supporting record prices for the haven asset.

Disappointment in local real estate, stock and currency markets following the lifting of China’s coronavirus lockdown will hurt gold jewelery and investment flows in 2023, according to a quarterly report from industry group World Gold Council. China has become the world’s major bright spot.

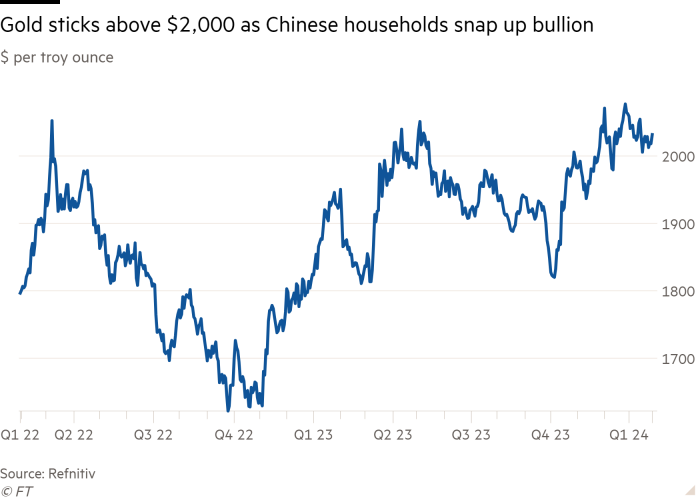

China’s demand, combined with “surging” demand from central banks, helped push gold prices to record highs last month and keep them above $2,000 per ounce this year, the WGC said.

China’s investment demand for gold (across bars, coins and exchange-traded funds) rose 28% to 280 tonnes, almost offsetting the steep decline in Europe. Last year, the country’s jewelery consumption rose 10% to 630 tonnes, despite flat global demand.

“China was key to a lot of what happened last year,” said Louise Street, senior market analyst at WGC. “If you look at the consumer sector, China is not a pricing factor, but it does provide a floor.”

The country’s CSI 300 stock index fell by more than a fifth last year, and new home sales from the country’s biggest developers fell 35% in December from a year earlier.

BMO analyst Colin Hamilton said Chinese investors were facing an “ugly battle” over where to put the huge savings they accumulated during the coronavirus pandemic. “Gold exposure has become essential for China portfolios as China continues to expect disinflation and income uncertainty,” he said.

Analysts at UBS said Chinese demand was an “underappreciated” driver of gold prices.

Overall gold demand fell by 5% last year to 4,448 tonnes, slowing from a strong year in 2022, the WGC report said. But annual demand rose to a record high in 2019 after accounting for over-the-counter and stock flows that captured opaque purchasing sources by wealthy individuals, sovereign wealth funds and futures market speculators, as well as changes in exchange inventories. It became. 4,899 tons.

Rising interest rates last year led to record demand levels and soaring prices for gold, even as bonds became more attractive compared to non-yielding assets. This pushed investment demand for gold to 945 tonnes, the lowest level in 10 years.

However, the weakness in investment demand was compensated for by purchases by central banks, mainly in China, Poland, and Singapore, and net purchases were able to remain above 1,000 tons.

However, more than half of central bank purchases are mysterious purchases, as official financial institutions hide the actual amount of purchases from the IMF or use other government agencies to obtain the gold. It is believed that this was caused by someone.

BMO’s Hamilton said gold has entered a “new era” where its correlation with real interest rates has broken down and is instead driven by central banks and Chinese household asset allocation.

“The surge in demand in gold’s biggest consumer shows no signs of slowing down,” said Adrian Ash, research director at BullionVault, an online precious metal investment service.