For some speculators, the excitement of investing in a company that has the potential to reverse its fortunes is a big draw, so even a company with no revenue or profits and an underperforming track record can still manage to find investors. I can. Unfortunately, these high-risk investments often have little chance of return, and many investors pay a price to learn their lesson. Although cash-rich companies may suffer losses for years, they must eventually generate profits. Otherwise, investors will move on and the company will decline.

In contrast to all this, many investors prefer to focus on companies that: singapore news (SGX:Z74), which not only generates revenue but also profits. This is not to say that the company offers the best investment opportunities, but profitability is a key factor in business success.

Check out our latest analysis for Singapore Telecommunications.

How fast is Singapore Telecommunications growing its earnings per share?

If a company can continue to grow its earnings per share (EPS) over a long enough period of time, the stock price should eventually follow suit. That makes his EPS growth an attractive quality for any company. Shareholders will be pleased to know that Singapore Telecommunications Limited’s EPS grew by 24% compounded each year over his three years. If the company can maintain that kind of growth, we expect shareholders to go home satisfied.

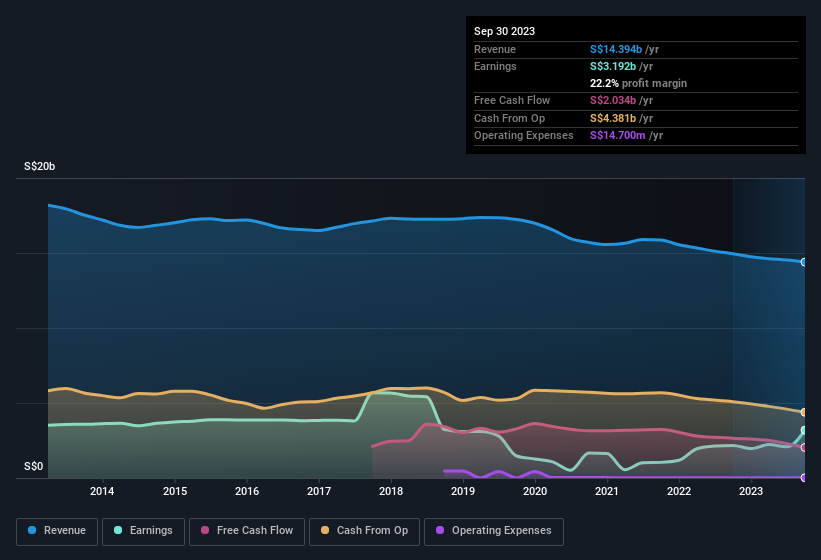

To reassess the quality of a company’s growth, it’s often useful to look at its earnings before interest and tax (EBIT) margin, as well as its revenue growth. Singapore Telecommunications may have been able to maintain its EBIT margin last year, but its revenue declined. Suffice it to say, it’s not a great sign of growth.

You can see the company’s revenue and profit growth trends in the chart below. Click on the graph to see exact numbers.

Fortunately, we have access to Singapore Telecommunications analyst forecasts. future profit. You can make your own predictions without looking at anything, or you can take a look at the predictions of experts.

Are Singapore’s telecom stakeholders aligned with all shareholders?

It’s worth considering how much the CEO is paid, as unreasonably high remuneration is generally considered to be against shareholder interests. The median total CEO compensation for companies of Singapore Telecommunications’ size and with a market capitalization of over S$11 billion is approximately S$7.4 million.

Singapore Telecommunications CEO received total compensation of just S$3.4 million in the year to March 2023. Initial impressions seem to indicate a shareholder-friendly remuneration policy. Although CEO pay levels are not the most important indicator for investors, modest pay can support stronger alignment between CEOs and public shareholders. More generally, it can also be a sign of good governance.

Is Singapore Communications worth adding to your watchlist?

If you believe that share prices follow earnings per share, then you should dig deeper into Singapore Telecommunications’ strong EPS growth. Solid EPS growth is a great outlook for the company, and reasonable CEO compensation makes the deal sweet for investors, as it hints that management is conscious of wasteful spending. Therefore, this stock is worth adding to your watchlist as it has the potential to provide significant value to shareholders. Remember, there may still be risks. For example, we identified 3 warning signs for Singapore Communications Note (1 is important).

Selecting stocks with low earnings growth and no insider buying can still yield results, but for investors who value these important metrics, promising growth potential and insider confidence can yield results. Below is a selected list of companies in Singapore with .

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we help make it simple.

Please check it out singapore news Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.