ken fisher

work

A surprising number of investors cling to the idea that China is inevitably on the rise, destined to surpass the United States and the West, no matter how many bad headlines come out of the East.

Such people should pay more attention to the stock market.

In 2023, Chinese stocks extended their three-year bear market, while the rest of the world rose 22%.

It is almost incomprehensible that stock markets have been predicting China’s decline for so long, even as they fear that China will outperform the West.

It didn’t always look like this. Starting around 1980, Chinese leader Deng Xiaoping and his successors rolled out a series of market-oriented reforms called “socialism with Chinese characteristics.”

They threw open the door to capitalism, allowing privatization, the profit motive, and innovation.

The spirits of animals imprisoned by communism under Mao Zedong’s regime have escaped, and the spigot of the “Chinese Miracle” has been opened. A growing wave of capitalism has enriched China, with total exports soaring from less than $200 billion in 1999 to more than $1. Trillion In 2007.

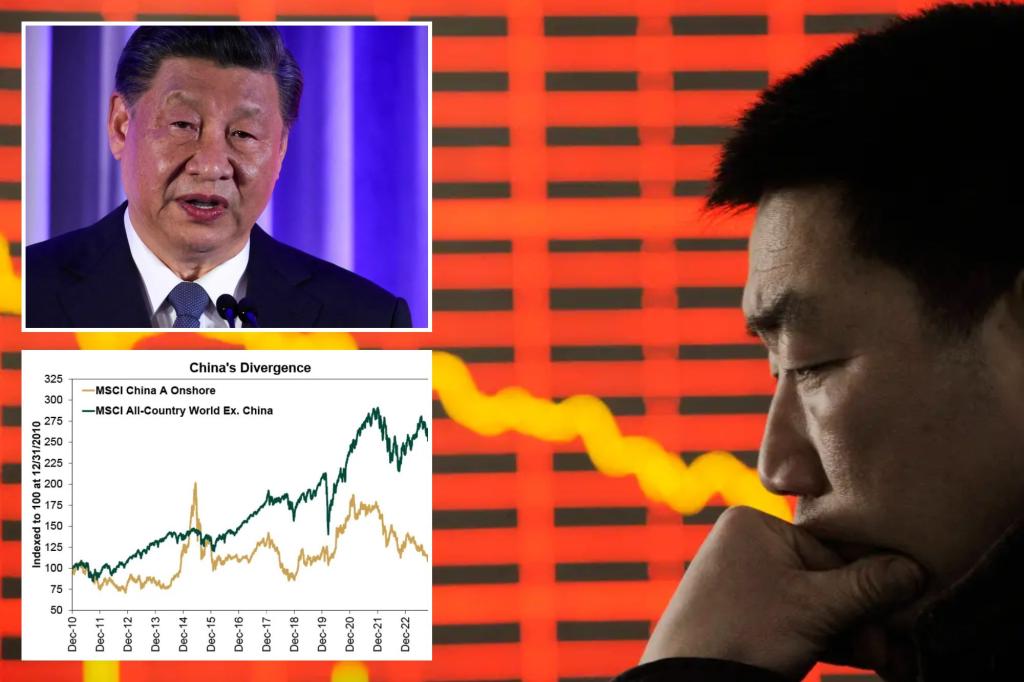

Stocks too. From the late 2000s to 2010, MSCI China rose 276% in dollar terms, offsetting the remaining 36% return in MSCI All Country.

Know-it-alls in the ivory towers of the West mistakenly assumed it was the expertise of technocrats. After that, President Xi Jinping began to seize power, suppressing those spirits and gradually corralling Chinese capitalism.

Did you know that since 2010, Chinese stocks with high volatility voting machines have ended up going nowhere? We have had no net income, including dividends, since 2012, 2014, 2016, or 2018. After adjusting for inflation, Chinese stocks have fallen about 40% over 14 years. That compared to a 200% return for stocks excluding China.

This is different from the occasional sharp bear market in US stocks, such as from 2000 to 2009, which temporarily checks long-term growth from the peak of the first market to the bottom of the second market. This will only continue, like in Japan, where stock prices slumped in 1990. From the 1960s he began to herald the end of his worldwide rise in the 1980s. The stock market “knows” that China’s problems are not temporary. The longer the Xi regime lasts, the worse the situation will become, and the more it will tighten its dictatorial grip on capitalism.

Some say China is cheap, but over the long term, stock prices don’t lie. Mr. Xi is steadily building a new Great Wall, choking basic industries, communications, finance, media, real estate, and technology with more than 100 new regulations to thwart the magic of capitalism. He has stifled innovation and stifled growth, all in order to create, in his words, “a new modern socialist power.”

The edict brings cash from China’s overseas companies back into the country, propping up the country’s decline. Meanwhile, private private capital secretly flees. In seven years, China has gone from being one of the top five investors in the United States to the third-largest player behind Norway and Qatar.

Currently, China is vacillating and failing to increase its stock holdings through direct government purchases and short-selling restrictions.

These are never useful. Capitalism helps.

According to official data, China grew by 5% in 2023, achieving the government target. I know the market well. If that’s even remotely close to the truth, global companies’ sales in China will increase. it’s not. Most companies have reported declining sales in China, including Apple, Volkswagen, Procter & Gamble, and L’Oréal.

In summary, there is no middle ground in the Middle Kingdom. Unless we change direction and embrace the magic of capitalism again, China’s golden goose will not be cooked. That also applies to military power. (Military power always accompanies economic boom.)

Trust the long-term truth in stocks. China’s imagined rise is nothing to fear.

Ken Fisher is the founder and executive chairman of Fisher Investments, a New York Times bestselling author, and a regular columnist in 21 countries around the world.

Load more…

{{#isDisplay}}

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSR video}}