Not for syndication. This article cannot be republished without the express permission of RBC Global Asset Management Inc.

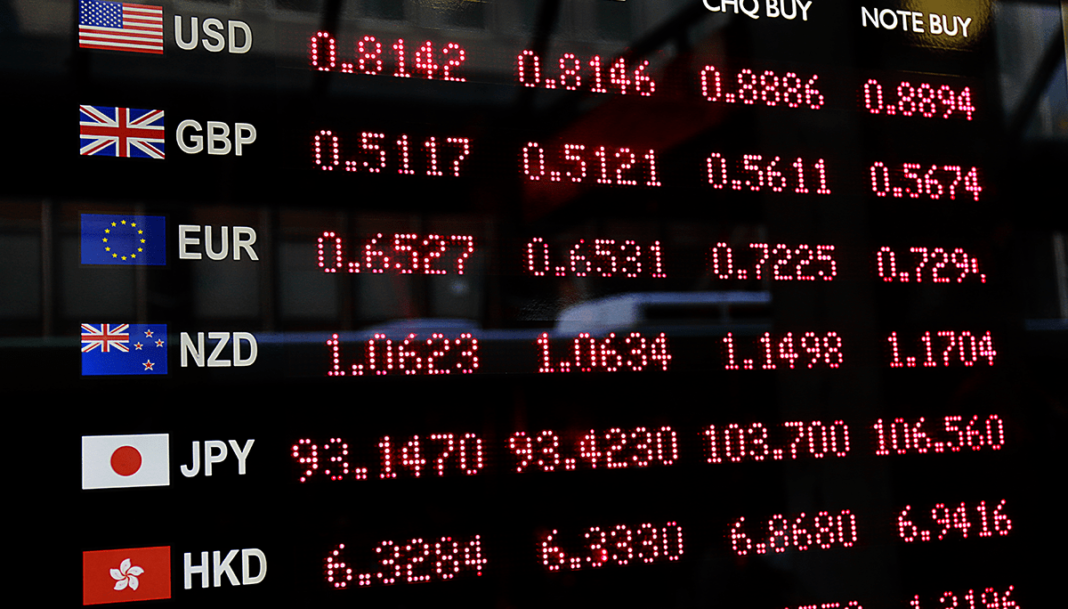

What if I told you that the largest, most liquid market in the world is also one of the least understood? Its $2.1 trillion daily spot turnover dwarfs that of bonds or equities, and all its transactions are conducted over the counter (OTC). The market also connects thousands of participants in 52 different jurisdictions and facilitates a further $5 trillion daily in forwards, swaps, and options, in addition to spot transactions.

I am talking, of course, about the highly fragmented foreign exchange (FX) market.

Such a large and interconnected market should operate in an open, liquid, fair, robust, and transparent manner. Since the global financial crisis (GFC), the FX market’s daily turnover has approximately doubled. That has raised expectations regarding transparency and liquidity and has necessitated increased oversight. I have had a front-row seat to the FX market’s evolution over the last 20 years and recall all too well how it often made headlines for all the wrong reasons as information imbalances between dealers and clients led to abuses. “Suspicion of Forex Gouging Spreads,” the Wall Street Journal blared in February 2011: “Some of the largest investment firms in the U.S. have been overcharged by banks for currency trades, bank insiders and others claim, broadening the scope of alleged abuses in pockets of the $4 trillion foreign-exchange market.”

In response to such excesses, G10 central bank governors launched a global initiative to establish the FX Global Code (“the Code”) in May 2015. Over the next several years, representatives from 16 central banks, in collaboration with private market participants from both the buy-side and sell-side, drafted a comprehensive document. RBC Global Asset Management (RBC GAM) participated in one of the working groups.

The final 70-plus-page document, published in 2018, went beyond ethics to embody industry best practices. Organized around six leading principles, the Code outlined what market participants expected from themselves and each other:

- Ethics: “To behave in an ethical and professional manner to promote the fairness and integrity of the FX market.”

- Governance: “To have a sound and effective governance framework to provide for clear responsibility for and comprehensive oversight of their FX market activity, and to promote responsible engagement in the FX market.”

- Execution: “To exercise care when negotiating and executing transactions.”

- Information Sharing: “To be clear and accurate in their communications and to protect confidential information.”

- Risk Management and Compliance: “To promote and maintain a robust control and compliance environment to effectively identify, manage, and report on the risks associated with their engagement in the FX market.”

- Confirmation and Settlement Processes: “To put in place robust, efficient, transparent, and risk-mitigating post-trade processes to promote the predictable, smooth, and timely settlement of transactions in the FX market.”

The Code is not part of regulatory frameworks in most jurisdictions, so adherence to it is voluntary and signifies the participant’s commitment to good governance and good practices as well as promoting fair, transparent, liquid, and robust markets. The Code is meant to apply to all wholesale FX market participants — both buy- and sell-side as well as trading venues and other entities that provide brokerage and execution services. The Code allows for proportional implementation, however, as specific circumstances and variations in business activities may dictate. This acknowledges that dealers’ activities are inherently different from those of asset managers, corporations, or central banks, and not every principle applies to every participant. For example, as an asset manager, RBC GAM doesn’t make markets for clients and doesn’t conduct any proprietary trading on behalf of the firm, so many of the sell-side rules don’t apply to us. Determining which principles apply is the first step before a market participant can confirm adherence to the Code.

As a living document, the Code is maintained and updated to reflect market changes, which is a key objective of the Global Foreign Exchange Committee (GFXC). The GFXC website is an excellent resource for information and tools to facilitate adoption. The original 2018 version of the Code was updated in 2021, and with each triennial revision, participants are expected to re-affirm their commitment to the latest document.

In the four years since the Code’s release, most sell-side FX market participants have signed on. Buy-side adoption, however, has been slow to follow. Limited resources, that FX constitutes a small part of their business, the Code’s voluntary nature, and the perception that it’s a “sell-side thing” are among the reasons cited for the poor buy-side uptake.

Having worked as a portfolio manager for more than 20 years, I find this perplexing. We have relied on our in-house FX desk for execution for more than 25 years at RBC GAM. Based on our experience, we believe that as an ecosystem, the FX market requires all participants to know, follow, enforce, and uphold the principles. We care about best execution in FX just as we do in fixed income and equities: It’s an important part of our governance framework.

So, how has adhering to the Code helped us?

- It has become a training and education tool for new members of our FX, trade support, and operations teams and is part of our onboarding materials.

- It has prompted a review of our policies and an in-depth discussion about the Code’s applicability, which has strengthened our understanding of how the market functions as well as its best practices.

- It has empowered our trading staff to demand best execution practices, and all our counterparties must sign the Code.

- It has enabled us to continuously improve our policies and procedures. Each update has removed ambiguity.

- It has increased our confidence in our internal policies and procedures and highlighted the strength of our governance framework to clients.

As corporations and asset managers look to demonstrate their commitment to environmental, social, and governance (ESG) values, they should embrace an opportunity for a thorough review of the governance framework supporting their FX business.

Signing the Code has also benefitted our clients. It has integrated a global standard that contributes to an efficient and ethical functioning of an otherwise fragmented and decentralized FX market. Counterparties that have signed the Code can use it as a guide in unexpected circumstances or disputes, such as fair treatment of all clients with settlement transactions on Queen Elizabeth II’s funeral, an unexpected public holiday. Initiatives have also sought to reward firms that sign on to the Code with access to additional pockets of liquidity. For example, the global FX trading platform 360T announced that as of 1 October 2022 only Code signatories or market makers offering firm liquidity will be able to make prices anonymously on its electronic communication network (ECN), 360TGTX.

As the FX market grows and evolves, more needs to be done to improve its functioning and integrity. Progress requires all buy-side professionals to commit to globally recognized best practices. And progress continues with engagement in continually improving them. We have sought to do this at RBC GAM and hope other asset managers will recognize the benefits of signing on to the Code and adhering to its principles.

Reproduced with the permission of RBC Global Asset Management Inc.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Heiko Küverling

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.