The latest hot spots in commercial real estate aren’t in Manhattan or Miami.

Instead of snazzy hotels or glistening office towers, the new property darlings are power-hungry data centers, often in places like Northern Virginia; Columbus, Ohio; and Salt Lake City.

Traditionally box style, these buildings are all about function: A place for racks and racks of computers to be stacked up high, kept cool, and girded for the boundless stream of images, videos, chats, text, internet searches and the digital detritus of our lives.

Their goal isn’t merely to contain, host and sort data billowing from computers and smart devices, but increasingly to provide a place where machines can learn from it.

“Everything is AI right now,” said Sean Farney, a veteran of the data-center industry and a vice president of data center strategy at real estate firm Jones Lang LaSalle. “The most immediate impact is this huge, new organic demand for hosting the tech that makes AI work.”

Farney, who helped Microsoft Corp. 15 years ago open a 120-megawatt data center in Chicago, one of the largest at the time, said the release of ChatGPT in late 2022 marked an industry turning point.

It galvanized Microsoft

MSFT,

Google parent Alphabet Inc.

GOOG,

Meta Platforms Inc.

META,

and others to more quickly deliver their own artificial intelligence products. It also added to a gold rush in what had been a niche area of commercial real estate, an otherwise battered sector, especially when it comes to office buildings.

Power-hungry AI

ChatGPT, which reached an estimated 100 million monthly users in its first two months, can generate text, images and more. Enthusiasm on Wall Street for all things AI provided rocket fuel to shares of chip-maker Nvidia Corp.

NVDA,

and other “Magnificent Seven” tech stocks.

Listen: Nvidia’s path from videogame darling to AI powerhouse

Server maker Super Micro Computer Inc.

SMCI,

has been among the latest stocks to benefit. And AI also has a hyper-focus on real estate that can handle the boom.

“It’s already past being niche,” said Patrick Wilson, a portfolio manager who has specialized in data centers for more than a decade at global real-estate investors CenterSquare Investment Management.

Wilson said a wildcatting approach to new supply, in the past, would “shoot landlords in the foot,” but that pricing power has clearly shifted in favor of data-center owners in the wake of the pandemic.

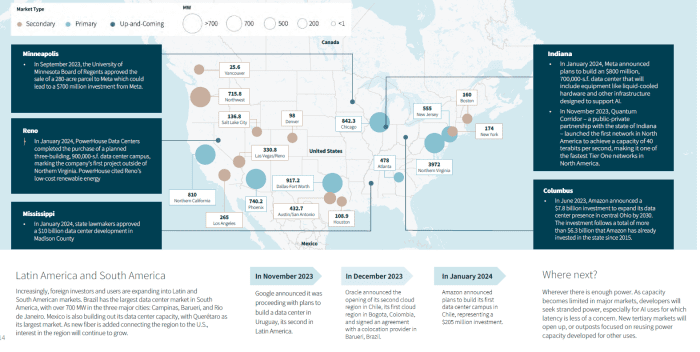

Companies in recent years have been vying to lease space at data centers in primary markets like Northern Virginia, with demand spilling into secondary and up-and-coming markets like Central Ohio, where Amazon.com Inc. has a $7.8 billion development in the works.

Northern Virginia has long been a bellwether of the U.S. data center industry, but high demand for space to contain, sort and learn from our data has pushed developers into new frontiers.

JLL’s most recent North American data center report

CenterSquare’s Wilson talked of an astonishing amount of capital that has been flowing into data centers, communication infrastructure, fiber, cell towers and related tech-enabling opportunities since 2020 when remote work took hold. “More capital is going into that vertical than any other area of commercial real estate by leaps and bounds,” he said.

Much of the capital has been flowing from deep-pocketed “hyperscalers,” a group that includes many of Wall Street’s Magnificent Seven stocks and companies like Oracle Corp.

ORCL,

big tech companies that have been building data centers globally on their own at a 20% to 30% compounded annual growth rate, according to JLL’s Farney. They can be seen plunking down as much as $1 billion for new facilities.

All told, JLL

JLL,

has tracked more than 5.3 gigawatts in data center capacity under construction in North America, or “enough energy to power all the households in the San Francisco metro area for one year.”

Land, water and power

The race to power AI has developers scouring for ever more precious plots of land, with the right natural resources and permits.

Upgrades, redesigns and alternative cooling technologies have been a focus at existing facilities. But new AI-focused data centers often can be built with a smaller physical footprint and in more remote areas if enough power can be sourced, according to JLL.

Finding available power and land, in a municipality open to zoning development projects, is an area Jackson Garton, co-chief investment officer at Menlo Park-based Makena Capital Management, and his team have been exploring, with an eye to eventually selling to larger players, corporations or infrastructure funds.

Makena has its roots in Silicon Valley, as it was spun out of Stanford University’s endowment about 19 years ago. It currently has about $22 billion in assets under management.

“Demand for data consumption and external processing of data is here to stay,” Garton told MarketWatch. He also foresees data centers as likely poised to eventually rival industrial, hospitality and other core parts of commercial real estate.

Growth, however, won’t come easily, given that power and land constraints already are major industry hurdles. In a sign of recent pushback, Google’s permit for a planned, but not yet under construction $200 data center in Santiago Chile was partially revoked this week by an environmental court that wants the tech giant to make revisions to its application to take the effects of climate change into account, specifically on the capital’s water supply.

Google said it already made design changes in February 2022 “to use air-based cooling, in alignment with our commitment to climate-conscious data center cooling,” in a statement to MarketWatch. “We will continue to cooperate with the local authority’s requirements.”

The company also said sustainability is a core focus, including at its data centers. For scope, Google pegged its data centers as the second-biggest component of $11 billion in total capital expenditures for the quarter, in a January earnings call.

Supply can’t be built fast enough

“Competition for data center space is as fierce as ever: properties are consistently pre-leased while still in the early stages of development,” Ermengarde Jabir, a senior economist at Moody’s Analytics, wrote in a February report about AI and commercial real estate.

Jabir sees potential for more office-to-data center conversions to take place, given the amount of underused suburban and city central business districts that could add extra capacity beyond the “concrete box” style of most data centers.

Still, AI’s needs put further strain on “overextended” infrastructure, Jabir said, noting the massive amounts of electricity they consume to operate, as well as water to keep cool.

Farney at JLL said today’s hyperscale data centers consume as much power as a city. But new servers running AI applications like GPTs require five to 10 times more power, he said.

That likely means using more efficient designs, layouts, materials and repurposing other buildings to feed the growing AI beast, especially if the sector is to grow in a more environmentally conscious path, Farney said.

‘AI factories’

Tech titans are among the big, obvious owners of U.S. data centers, but they aren’t the only ones. Their need is also so big that they lease space from others.

Digital Realty Trust Inc.

DLR,

Equinix Inc.

EQIX,

and other real-estate investment trusts have been among the established players making far-reaching inroads in the sector over the years, in part because clients have been reluctant to give up locations or long-term leases, for fear it could potentially disrupt daily business operations. These existing players need to find a way to compete in the AI gold rush, while also dealing with legacy data-center assets that risk obsolescence.

In the past few years, major infrastructure funds have joined the bandwagon, including Brookfield Infrastructure Partners and funds of Blackstone Inc. have made a series of splashy investments in data centers as global demand mushroomed.

“We believe AI is going to take a decade or more to build, and with 50 gigawatts of global data center capacity today, over the next six to 10 years, we will double that capacity to 100 gigawatts,” said Marc Ganzi, DigitalBridge Group’s chief executive, in a February earnings call.

The company, which invests in cell towers, data centers and other digital infrastructure, had about $80 billion in assets under management at the end of 2023, and is counting on further growth in the sector.

“As we see it, data centers are becoming AI factories with data as the input and intelligence and insights as the output,” Ganzi said.