Shares of Terran Orbital Corp. were propelled toward a two-month high Monday, after the satellite-products maker disclosed that it received an unsolicited all-cash buyout proposal from Lockheed Martin Corp.

In response, Terran said it adopted a limited-duration stockholder rights plan, also known as a “poison pill,” in an attempt to thwart a buyout attempt at a price deemed as undervalued.

The stock

LLAP,

rallied 9.4% in morning trading, to put it on track for the highest close since Jan. 3. Trading volume swelled to 5.9 million shares, compared with the full-day average over the past 30 days of about 2.3 million shares.

Lockheed’s stock

LMT,

gained 1.2%.

Terran said the rights plan was adopted after it received on March 1 a “non-binging proposal” from Lockheed to buy all outstanding shares of Terran.

Separately, Lockheed had disclosed late on March 1 that it proposed buying all the Terran shares it didn’t own for $1 in cash per share, which represented a 6.5% discount to Friday’s closing price of $1.07.

Lockheed said in that disclosure that it already owned 28.3% of Terran’s shares outstanding, which would make Lockheed the largest shareholder.

Terran said the rights plan, which is effective immediately, can be exercised if an investor acquires 15% or more of the company’s stock in a deal that is “not approved” by the board of directors. If the rights plan is exercised, the holder of each right can buy at an exercise price common stock valued at “equal to twice” the exercise price.

“The ‘rights plan’ will reduce the likelihood that any person or group gains control of the company through open market accumulation, or other coercive tactics potentially disadvantaging the interests of all stockholders, without paying all stockholders an appropriate control premium or providing the board sufficient time to make informed decisions in the best interest of all stockholders,” the company said in a statement.

A month ago, Terran said it had reached an agreement with an investor group that included Sophis Investments LLC, which was the largest shareholder before Lockheed’s ownership disclosure, to appoint an independent director to fill a vacant seat.

The company said then it that remained committed to exploring “a number of value-creating initiatives” as part of a strategic review process.

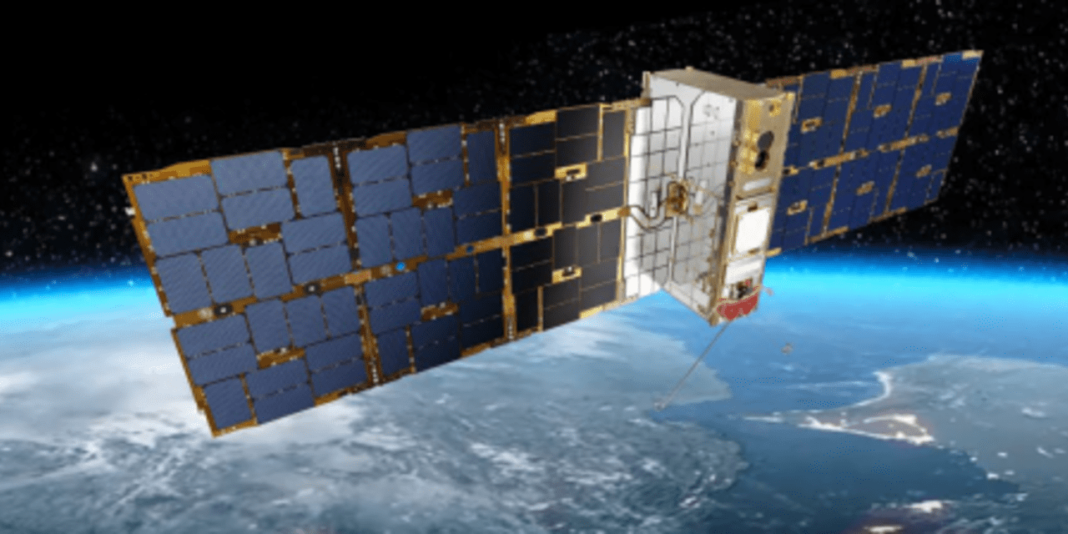

And in October 2023, the company updated investors about its “continued success and partnership” with Lockheed, as Terran was in the process of building 42 satellite buses for Lockheed.

Terran’s stock has gained 2.6% so far this year, but has tumbled 51.9% over the past 12 months. In comparison, the Ark Space Exploration & Innovation ETF

ARKX

has tacked on 1.7% over the past year and the S&P 500 index

SPX

has advanced 26.9%.