What are the keys to a successful finance career?

Eric Sim, CFA, has thought about that question a lot. As a university lecturer and author, he had to give his students and readers a logical framework to follow, and 20-odd unconnected tips were not going to do it. So he looked back on his professional life: How had he gone from a teenager in Singapore washing bowls at his father’s prawn noodle stand to serving as a managing director at UBS Investment Bank and achieving financial independence? What were the common threads that tied the seemingly random twists and turns, the unexpected setbacks and equally unanticipated strokes of good fortune, into a comprehensible narrative?

It all came down to capital, Sim concluded: specifically, human capital, financial capital, and social capital. Where he succeeded, such capital had been essential. Where he failed, a lack of capital in some form had been determinative.

So, what are these three forms of capital, and how has Sim’s career demonstrated their influence?

Human Capital

“So human capital is our knowledge and skills,” Sim said. “We need to have human capital so that we are useful to people. And when we are useful to people, we can then build other forms of capital.” We gain human capital through education and experience. The first in his family to go to college, Sim graduated from the National University of Singapore with a degree in engineering. Though his bachelor’s in science was not an obvious fit, he parlayed it into a corporate sales position at DBS Bank thanks to a well-told anecdote about what he learned serving drinks at a crowded nightclub.

Sim spent the next two years working in foreign exchange (FX) before deciding to roll the dice and take a big chance. And that’s where financial capital came in.

Financial Capital: Not Rolex, But Timex

With his blue collar background, Sim had little experience with the bonus culture in banking and finance. “When I got my bonus when I was a junior banker, a lot of my peers went on big holidays,” he recalled. “Some bought watches and spent $30,000.”

It didn’t make sense.

“Who looks at your hand?” Sim said. “I don’t look at people’s watches, and I assume nobody will look at mine. So why spend the money?”

So, rather than blow his windfall on a fancy Rolex, Sim bought a Timex and invested the rest in stocks. And when he was ready to make a bet on his future, he had $30,000 to invest in himself and a master’s in finance program at Lancaster University in the United Kingdom.

Sim had done the research. The 10-month program was the most economical and the only one he could afford. Similar programs in London were way out of his price range, but Sim thought if he did well at Lancaster, it would open up some doors and expand his horizons.

“I’ll spend $30,000,” he thought. “I can then work in London, make money, and change my fate a little bit.”

Culture Shock

It didn’t work out quite as well as he expected. First there was adjusting to a new culture on the other side of the world. Novelty was everywhere. Growing up in Singapore, Sim had never even seen sheep. Now they were grazing outside his bedroom window. He hadn’t anticipated how pricey food and housing costs would be either. “Everything was three or four times more expensive than what I thought,” he said, “I couldn’t eat anything, except a slice of pizza for each meal. . . . One slice of pizza is not a full meal.”

But the culture shock went beyond that: As a non-native English speaker, Sim was automatically at a disadvantage. He wasn’t wealthy or well-traveled, and now for the first time, he was far away from home, from family and friends. He was also insecure. The legacy of colonialism in Singapore affected his confidence. Indeed, one of his first big doubletakes in the United Kingdom was seeing Caucasians laying bricks and mixing cement at building sites. “That blew me away. White people doing construction work — never in my life. So I was shocked,” he said.

“I was hit by this colonial mindset,” Sim continued. “I come from selling food and never read widely and didn’t think I could compete.”

Whatever doubts he had, he quickly put them to rest in his financial mathematics course. Sitting next to Cambridge-educated peers, Sim outperformed everyone, earning the top score in the class. That was a pattern he repeated throughout his course of study.

After 10 months in Lancaster, Sim was confident and ready to take the next step. He had bonded with his classmates, built friendships, and excelled in his coursework. He had no doubt he would find a finance job in London and embark on the next phase of his career.

But first he needed a suit.

The Chicken Suit

While Sim’s studies may have improved his human capital, the same could not be said for his financial capital. All his savings were gone, and he had to somehow finance a new business suit as well as several days’ stay in London to sit for interviews. London wasn’t like Singapore where the heat made a collared shirt, tie, and dress pants acceptable business attire. So Sim went clothes shopping, and Savile Row was not an option. Money was so tight that he had to go to the Oxfam charity where the secondhand suit selection was decidedly limited.

“Of course they didn’t have my size,” Sim said. “I’m already on the small side in Asia. Then in the UK, I’m like extra small. So I bought a suit so big that I could have hidden a chicken inside.”

The ill-fitting double-breasted suit did not make a good impression on the well-tailored London bankers he interviewed with.

“It was ridiculous. How could I expect to pass an interview with Goldman or Morgan Stanley?” Sim said. “All the interviews ended early, and none of them called me back.”

It was a valuable lesson in financial capital.

Social Capital

Social capital is the third form of capital we need for success, but what is social capital? Unlike human and financial capital, it is a bit more subtle and less tangible.

“When you treat people with respect, when you help them, you deposit some social capital. It’s a bit like putting money in your bank account,” Sim said. “To have social capital, you need to have something to offer to people. Why do people come to you, right?”

Sim lacked the financial capital to buy a suit, but social capital could have made up for that. If he had had more UK connections — family nearby, a professional track record in the country that demonstrated what he had to offer — he could have borrowed the money and gotten referrals from former colleagues about other jobs. But he didn’t have that strong local network.

“I had good social capital with my classmates, but all of us were looking for jobs,” he said. “They couldn’t help me.” So the calculation remained the same in Sim’s mind: His lack of financial and social capital in the UK — his inability to find 300 pounds in cash or credit to buy a nice suit — meant no job in London.

So Sim made up his mind not to fall into that trap again.

“If I fail because of ability, fine — I’m not good enough,” he said. “But if I fail because of what I’m wearing, that can’t happen.”

Still, with no job in London and no money left, he had no choice but to fly home to Singapore and right into the Asian economic crisis of 1997.

Social Capital at Work

Despite his new master’s degree, the financial crisis meant finance jobs were in short supply. So Sim settled for a risk management position at Standard Charter Bank. While there he studied for and earned the CFA charter.

Why the CFA charter? Because of the human capital gained by learning the curriculum. The rigorous course of study made him better at his job and expanded his knowledge in other areas of finance. And it let people know he knew his stuff. Finance professionals in China may not have any context for Lancaster University. Their counterparts in Frankfurt may not have any for the National University of Singapore. But they all understand those three initials. “Whichever country I go to, they recognize the CFA designation,” he said.

After four years at Standard Charter, Sim wanted to take his career in a new direction. But he found he had been typecast. “Because I was a risk manager, people wanted to hire me only as a risk manager,” he said.

But that’s where the social capital he had accrued paid off. Terence, a former colleague from DBS called up. “Hey Eric, my boss is looking for someone with your skill set. Are you keen to try?”

It was for a front office position on Citi’s Asia risk advisory desk. “It was a big upgrade,” Sim said. After three rounds of interviews, he got the job.

For the next eight years at Citi, Sim focused on excelling at his work, but he also worked to increase his social capital.

“There were a lot of people on the way up that I knew when they were junior,” he said. “I helped them, and when they became senior, they’d refer jobs to me, they’d point me in the right direction. The capital has grown. If you buy someone just one cup of coffee, in 10 year’s time they might remember your kindness. But of course, the key is not to expect anything in return.”

The Foundation of Social Capital: Trust

Sim’s corporate career reached its pinnacle in 2011. His friend and coworker Paul had moved to UBS, and when a managing director position came up, he recommended Sim for the role. After nine rounds of interviews, he was hired.

“How did I get the job? MD jobs — a lot of people want them — but they’re not advertised,” Sim said. “Again, based on the social capital that I had with Paul. We were colleagues from different departments back in Citi. But I tried to be fair, so when I closed the deals, I shared the credit. When there’s an opening, people remember you.”

So what was the key to the social capital Sim had generated with Terence and Paul? It wasn’t just human capital, the skills and expertise that he had acquired and demonstrated across his career. It really all came down to trust. “Besides rapport,” he said, “you also need trust to build your social capital.”

At 17, just before his compulsory national service began, Sim washed dishes at his father’s noodle stand. The stall had only one water faucet, and his father needed that for cooking. So, they used a three-pail method to wash the noodle bowls. The first pail was filled with water and cleaning solution, the next two with clean water. Each bowl would be dunked in the cleaning solution pail, sponged off, then dipped in succession into the buckets of clean water, and then dried and put back into service.

But once, when preparing his lunch, Sim took one of the bowls that had gone through that three-step cleaning process and washed it again under the faucet. “I was cooking for myself,” he recalled, “and I didn’t trust my own washing.”

Though no customers were around and nobody could see what he was doing, his father spoke to him softly but sternly. “Don’t do that,” he said. “If it is clean enough for the customer, it is clean enough for you.”

That admonishment stuck with Sim, and he took it to heart and applied the principle throughout his professional life.

“When you do your job under scrutiny, it’s tough,” he said. “But when nobody is watching, it’s even tougher because you need to uphold an even higher standard.”

That’s what he considers the major differentiator in his career. His human capital gave him the technical skills to do his job well, the financial capital he accrued helped him acquire the education that he needed, but his social capital, and the trust that it was built on, were what truly advanced his career.

“That’s where it came from,” he said. “That’s why people were willing to put their head or their neck on the line for me.”

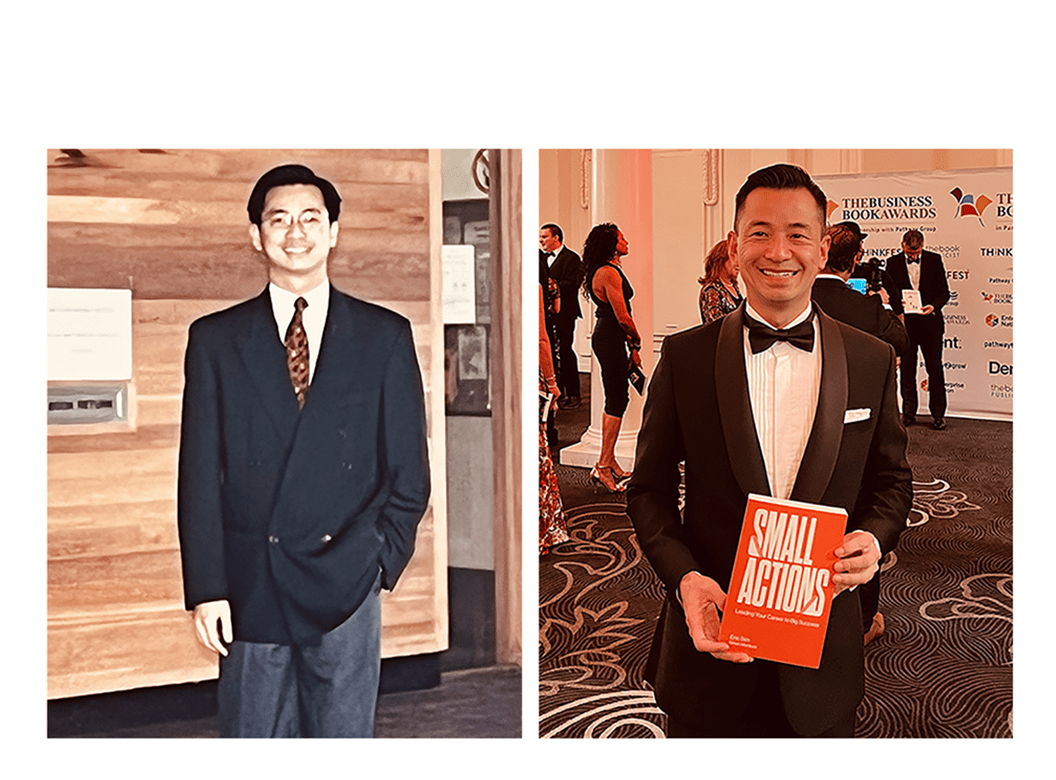

When Sim returned to London for a business book award dinner earlier this year, he made sure not to repeat his sartorial blunder from years before. He had a tuxedo tailored specially for the occasion, one with no room to hide a chicken.

For more from Eric Sim, CFA, don’t miss Small Actions: Leading Your Career to Big Success.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Images courtesy of Eric Sim, CFA

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.