(Bloomberg) — Asian stocks fell following a tech-led setback on Wall Street, with Chinese markets giving a mixed reaction to Beijing’s latest steps to restore investor confidence.

Most Read Articles on Bloomberg

The index of Chinese companies listed in Hong Kong rose 1.6% after opening lower, while the CSI300 index of mainland stocks fell 0.2%. China’s two main stock exchanges have frozen the accounts of a major quantitative hedge fund for three days after the fund’s manager sold large amounts of stocks within a minute starting Monday. Meanwhile, banks also stepped up financial support for the troubled real estate sector.

The index tracking Asian stocks fell as much as 0.5%, dragged down by declines in Japan, South Korea and Australia, ending its winning streak after four days. Stock prices also fell in Japan, South Korea, and Australia. The region’s weakness came as the Nasdaq 100 fell nearly 1% and the S&P 500 fell below 5,000.

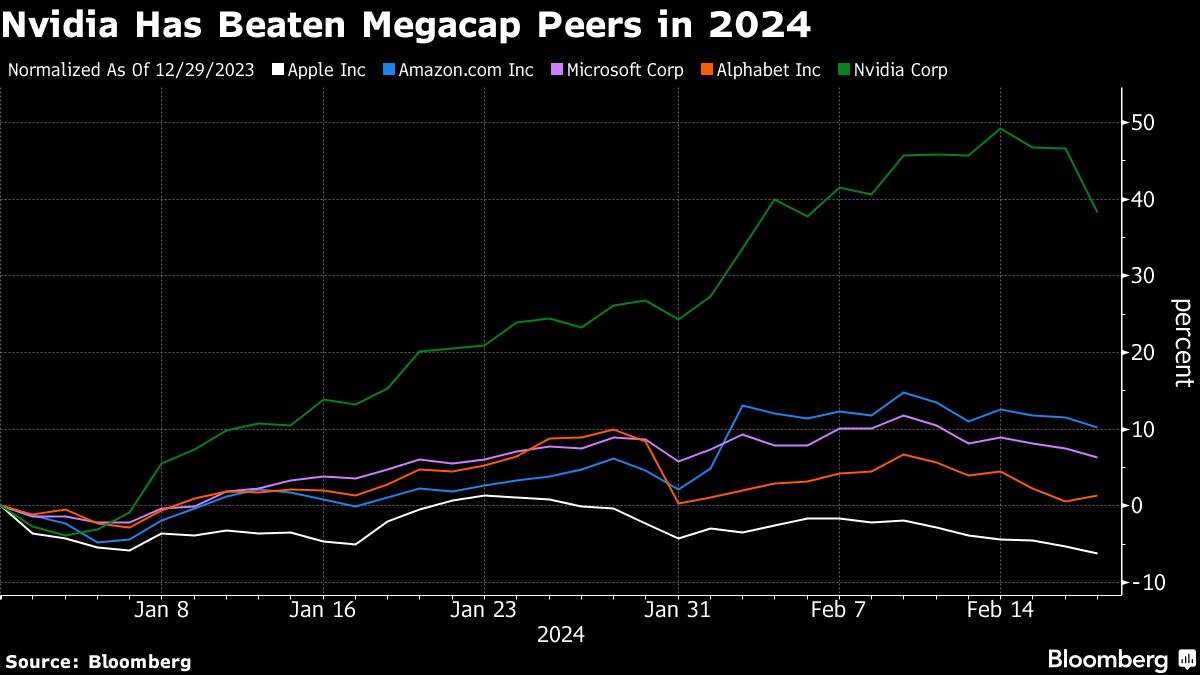

The focus is also on Nvidia’s financial results, which will be released later Wednesday. The company fell more than 4% heading into its earnings report late Wednesday, but traders will be looking for confirmation whether the company can live up to the lofty expectations brought on by the artificial intelligence boom.

“The company’s performance was the largest of the reporting period and serves as a macroeconomic barometer and the proverbial canary in the coal mine for the artificial intelligence boom,” said Kyle Rodda, senior market analyst at Capital.com. said. Nvidia. With valuations at eye-watering levels, “the bar for upside surprise is set high,” he said.

The dollar was steady in Asian trading, with the yield on the 10-year U.S. Treasury little changed, but iron ore fell to a three-month low on persistent weakness over the outlook for Chinese steel demand.

In Japan, the Nikkei stock average has lost momentum recently, moving further away from its 1989 closing all-time high of $38,915.87. Still, macro and equity hedge funds are betting on Japan this year, expecting the central bank to change policy in eight days. Negative interest rates will continue for years. As exports increased more than expected in January, the yen remained at around 150 yen to the dollar.

In commodity markets, oil held firm as investors juggled signs of tight supply amid rising tensions in the Middle East and a still-unstable demand outlook. Elsewhere, gold was little changed after four sessions of gains.

Nvidia Neuro

Although the timing of earnings for the “Magnificent Seven” mega-cap stocks varies, the ongoing earnings season reaffirms the view that American companies are doing well so far. Among other highlights of the U.S. session, Walmart rose after reporting strong earnings, while Palo Alto Networks fell in late trading after lowering its full-year revenue forecast.

Faced with Nvidia’s numbers, some traders decided to lock in their profits. The market is also weighing reports that Microsoft Corp. is developing network cards as an alternative to cards supplied by chipmakers.

The artificial intelligence craze is driving stocks related to the technology higher, and Nvidia is one of the few companies to demonstrate significant revenue growth from AI.

The Fed’s January meeting minutes are also expected to be released on Wednesday, giving traders further clues as to where policymakers stand on the rate cut schedule. Last week’s higher-than-expected inflation rate raised concerns that the Fed would not start cutting interest rates as quickly or as quickly as market participants expected this year.

This week’s main events:

-

Eurozone consumer confidence Wednesday

-

Nvidia, HSBC profits Wednesday

-

The US Federal Reserve releases minutes of its January meeting on Wednesday.

-

Atlanta Fed President Rafael Bostic speaks Wednesday

-

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, CPI, Thursday

-

U.S. new unemployment insurance claims, U.S. existing home sales, Thursday

-

ECB releases January Governing Council report on Thursday

-

Fed President Lisa Cook and Minneapolis Fed President Neel Kashkari meet on Thursday

-

Chinese real estate prices Friday

-

Germany IFO Business Environment, GDP, Friday

-

ECB releases one-year and three-year inflation expectations survey on Friday

The main movements in the market are:

stock

-

S&P 500 futures were down 0.2% as of 10:30 a.m. Tokyo time.

-

Japan’s TOPIX fell 0.1%

-

Australia’s S&P/ASX 200 falls 0.7%

-

Hong Kong’s Hang Seng fell 0.6%.

-

The Shanghai Composite fell 0.6%.

-

Euro Stoxx50 futures little changed

-

Nasdaq 100 futures fell 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0807.

-

The Japanese yen remained almost unchanged at 150.07 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2063 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6551.

cryptocurrency

-

Bitcoin rose 0.2% to $52,156.9

-

Ether rose 0.2% to $2,995.76

bond

-

The 10-year government bond yield was almost unchanged at 4.28%.

-

Japan’s 10-year bond yield remains unchanged at 0.725%

-

Australian 10-year bond yield unchanged at 4.18%

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP