Chinese customers accounted for more than 25% of ASML’s revenue in 2023, making China a key market for the world’s top lithography tool manufacturer. Export restrictions imposed by the governments of the Netherlands and the United States, which already limit sales of advanced deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography equipment to customers in China, have a significant impact on the company’s balance sheet. not given.

However, the company said further restrictions could have a serious negative impact on ASML.

In its recently released 2023 Annual Report, ASML said: “Geopolitical tensions have resulted in export control restrictions, trade sanctions, tariffs and, more generally, international trade regulations, which may affect the performance of our systems, technologies and services. “This could impact our ability to provide services.”

“Our ability to offer our technology in certain countries, such as China, continues to be affected by our ability to obtain the necessary licenses and approvals. […] The list of Chinese companies affected by export control regulations is growing from 2022 onwards. […] These and further developments in multilateral and bilateral treaties, national regulations, trade, national security, and investment policies and practices have affected, and may further impact, our operations and those of our suppliers and customers. may give. ”

Chinese fabs accounted for 26.3% of ASML’s revenue in 2023, and China was the second largest purchaser of ASML tools on a country/region basis after Taiwan (accounting for 29.3%). In fact, Chinese customers accelerated fab tooling procurement in the second half of 2023 in response to increased sanctions on China’s semiconductor industry. The latest export rules for the US, Netherlands and Japan are for the sale of tools and technology that can manufacture logic chips with non-planar transistors on nodes below 14nm/16nm, 3D NAND with 128 layers or more, and DRAM memory ICs with half 18nm. was restricted. – Below pitch.

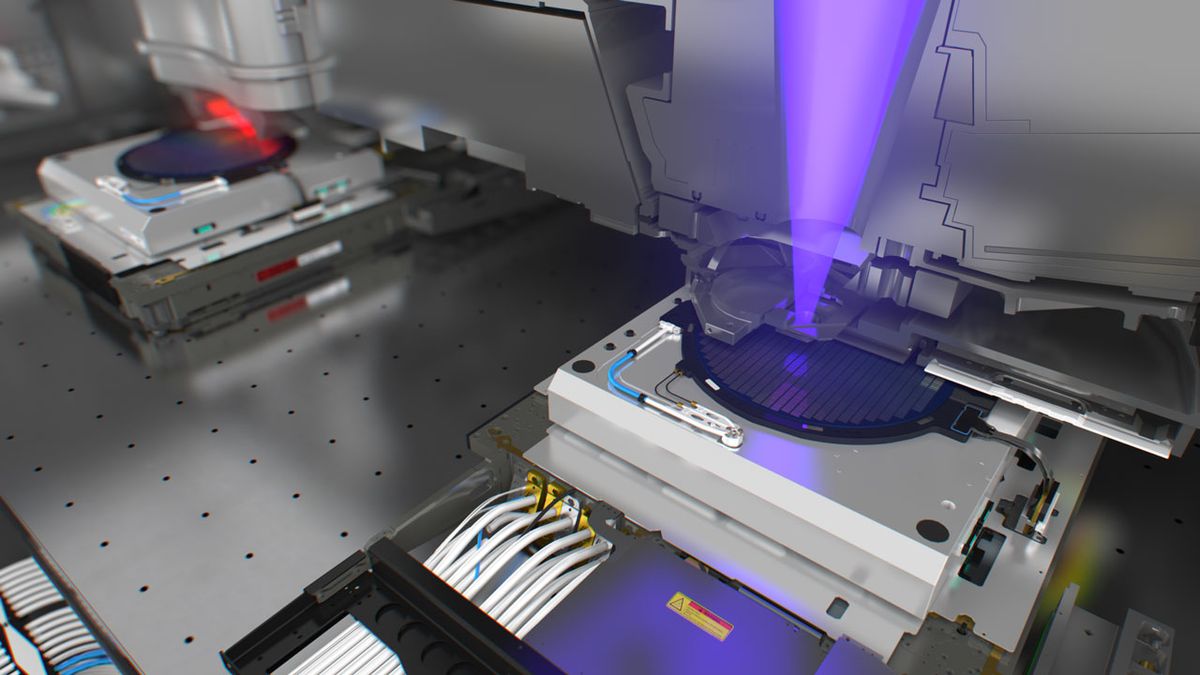

The majority of Chinese logic chip manufacturers (with the exception of SMIC and HuaHong) specialize in mature process technologies and have little interest in equipment that can be used for production at FinFET-based 14nm/16nm production nodes. Their interest is in obtaining sufficient tools to manufacture chips in 28nm class process technology, and ASML is active in providing previous generation fab tools to these customers. is. As of October 2022, ASML’s order backlog in China exceeded $38 billion.

If the US and other governments decide to further rein in China’s semiconductor sector in general, they could ban the sale of 28nm-enabled tools or restrict the export of Chinese chips to their countries. In either case, ASML would be severely affected, as selling wafer fabrication tools for mature processes to China-based chipmakers brings in significant profits.

At present, ASML has established a leading position in the lithography equipment market and its business in China is flourishing. But another potential threat to the company’s business could be that China is pouring billions into developing new factories as well as wafer-fabrication equipment.

“We also face competition from new competitors with significant financial resources, as well as competitors driven by ambitions of self-sufficiency in a geopolitical context,” ASML said. It pointed out. “Additionally, we face competition from alternative technology solutions and semiconductor manufacturing processes.”