(Bloomberg) — Chinese stocks rallied as authorities ramped up relief efforts, and Asia’s It ignored the widespread downturn.

Most Read Articles on Bloomberg

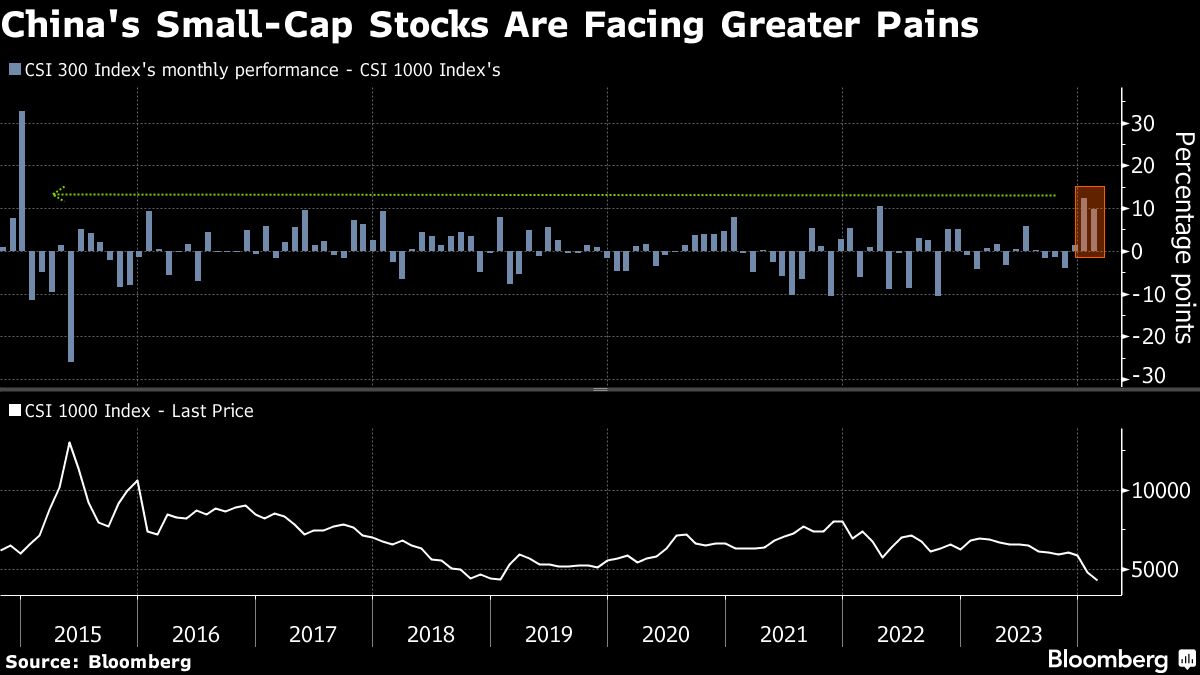

The Hang Seng Index rose 2%, and the mainland index CSI300 rose 1.8%. The rise came after the Chinese government took further steps to stem the decline in stocks, including expanding trading restrictions for investors, including quantitative funds. Investor mood was also boosted by a pledge by the country’s sovereign wealth fund to further increase its holdings in exchange-traded funds (ETFs).

In contrast, stocks in Japan, Australia and South Korea fell, but U.S. stock futures were firm after the S&P 500 index fell 0.3% and the Nasdaq 100 index fell 0.2% on Monday.

“Right now, markets are looking for clearer signals about economic recovery,” Marcella Chow, global market strategist at JPMorgan Asset Management, said on Bloomberg TV regarding China. She said: “Expectations remain extremely low. Markets and investors remain troubled by the weakness of the economic recovery.”

In Asian trading, the 10-year US Treasury yield fell by 3 basis points. This was followed on Monday by another round of heavy selling on strong U.S. economic data, pushing interest rates up 14 basis points, the biggest two-day increase since June 2022.

Monday’s decline in U.S. Treasuries came as prices rose while the Institute for Supply Management’s services index hit a four-month high. The news rattled trading just as investors were already digesting the cautious views of some Fed speakers, including Jerome Powell.

The net effect is a stronger economy and a longer period of central bank interest rate cuts. The Fed swap has all but eliminated the possibility of a March rate cut, and also reduced the possibility of a May rate cut.

Jose Torres of Interactive Brokers said the “one-two punch” prevented market participants from achieving further upside. “Barring a significant shock, the easing this year is likely to be slower than the market was pricing in,” said Marko Kolanovic, a strategist at JPMorgan Chase & Co.

Yields in Australia and New Zealand were slightly higher. The Australian dollar rose after the Reserve Bank of Australia left its policy rate unchanged on Tuesday as expected and said it could not rule out further rate rises.

The dollar held steady after hitting its highest since November, amid a slow start to trading in foreign exchange markets. The yen remained almost unchanged at just over 148 yen to the dollar.

Japan’s annual wage negotiations have begun in earnest. Japan’s central bank is looking for evidence of a virtuous cycle in wages and prices that could allow it to emerge from the world’s last negative interest rate system.

In the United States, Minneapolis Fed President Neel Kashkari said officials had time to assess future data before easing, and Chicago President Austan Goolsby reiterated that he wanted more confirmation of favorable inflation statistics.

The OECD said it was too early to tell whether the sharp rise in interest rates had curbed underlying price pressures and the world’s major central banks should not let their guard down in the fight against inflation. Meanwhile, the latest Bloomberg Markets Live Pulse survey showed U.S. shoppers aren’t deterred by rising credit card bills or the ripples from recent layoffs. More than half of the 463 respondents said they expect spending to remain strong or even stronger in 2024.

HSBC’s Dominic Banning said: “The continued strength of the US economy relative to most G10 countries is the main reason why we have maintained a unanimously bullish view on the US dollar since September 2023. That’s one of the reasons.”

Elsewhere, gold edged higher, trading around $2,027 an ounce. West Texas Intermediate was slightly higher. Bitcoin rose slightly above $42,500.

This week’s main events:

-

Reserve Bank of Australia interest rate decision Tuesday

-

Eurozone retail sales Tuesday

-

Order from German factory, Tuesday

-

UBS profits Tuesday

-

Bank of Canada Governor Tiff Macklem speaks on Tuesday

-

Fed’s Loretta Mester and Patrick Harker speak on Tuesday

-

German industrial production Wednesday

-

Walt Disney earnings Wednesday

-

Fed’s Adriana Kugler and Tom Barkin speak on Wednesday

-

China PPI, CPI, Thursday

-

U.S. wholesale inventories, new unemployment claims, Thursday

-

Treasury Secretary Janet Yellen speaks Thursday at the Senate Banking Committee’s hearing on the Financial Stability Oversight Council Annual Report.

-

Pharmaceutical CEOs speak Thursday before the Senate Committee on Prescription Drug Pricing

-

ECB chief economist Philip Lane speaks on Thursday

-

ECB releases economic news on Thursday

-

US CPI revisions Friday

-

German Consumer Price Index, Friday

-

President Joe Biden hosts German Chancellor Olaf Scholz at the White House on Friday.

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 12:39 p.m. Tokyo time.

-

Nasdaq 100 futures rose 0.2%

-

Japan’s TOPIX fell 0.9%

-

Australia’s S&P/ASX 200 falls 0.7%

-

Hong Kong’s Hang Seng rose 2.1%.

-

The Shanghai Composite rose 0.8%.

-

Euro Stoxx50 futures rise 0.5%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0747.

-

The Japanese yen remained almost unchanged at 148.62 yen to the dollar.

-

The offshore yuan rose 0.1% to 7.2116 yuan to the dollar.

cryptocurrency

-

Bitcoin rises 1.1% to $42,816.93

-

Ether rose 1.3% to $2,315.89

bond

-

The 10-year Treasury yield fell 2 basis points to 4.13%.

-

Japan’s 10-year bond yield rose 1 basis point to 0.725%.

-

The Australian 10-year bond yield rose 6 basis points to 4.16%.

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP