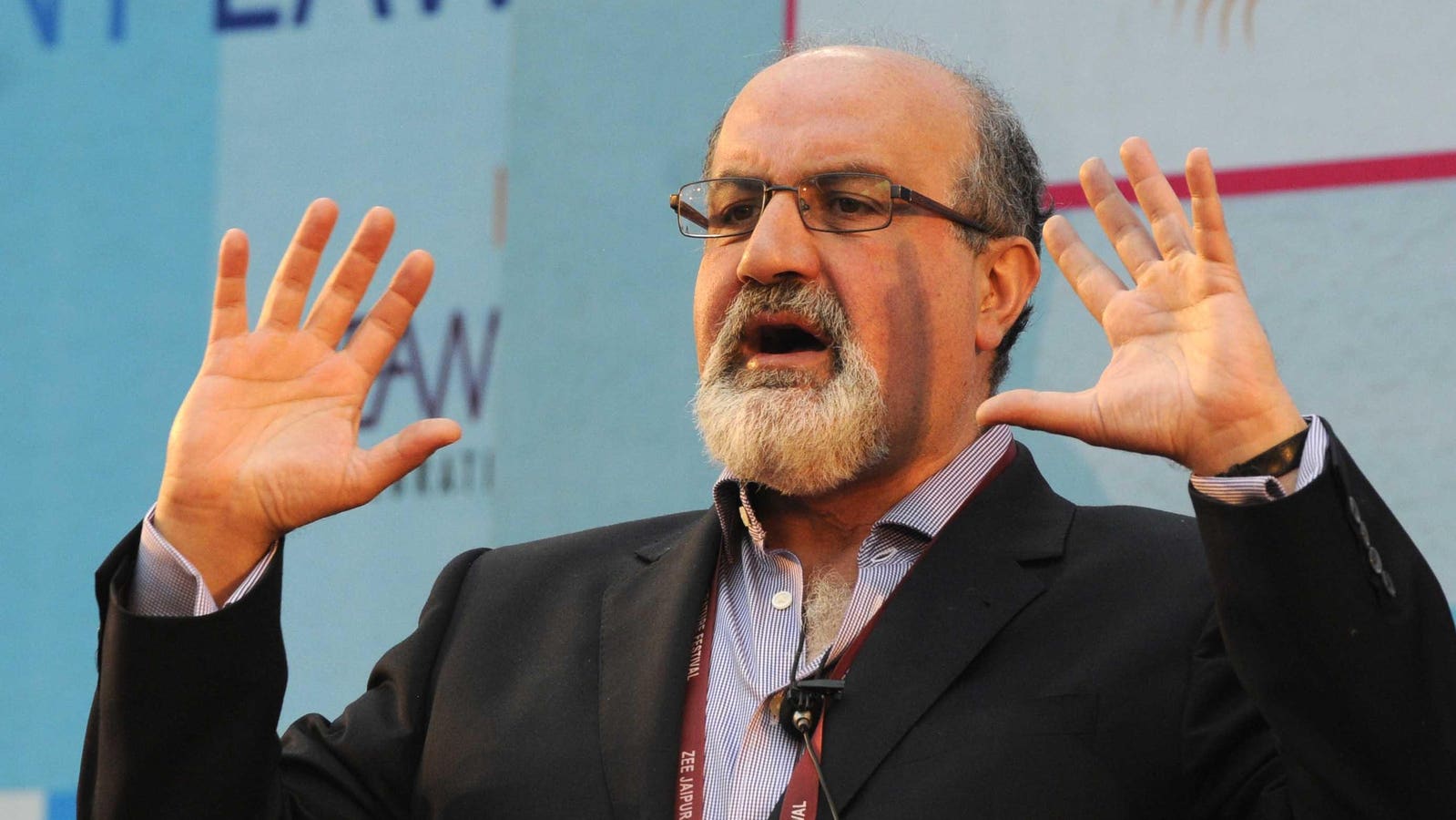

“The risks are right in front of us,” says Nassim Nicholas Taleb, author of the 2007 bestseller “Black Swan: The Consequences of the Highly Improbable.”

Mohd Zakir/Hindustan Times via Getty Images

Of all the fears Asian investors had about 2024, Federal Reserve officials keeping their foot on the financial brakes weren’t among them.

This week’s news that U.S. consumer prices remain above 3% likely significantly changes the Fed’s rate cut narrative. Although inflation has cooled from 3.4% y/y in December to 3.1% y/y in January, this trajectory suggests a daunting level of tenacity.

It also raises concerns that have been at the forefront of Asian policymakers’ minds for some time. It’s the return of so-called “bond vigilantes” at perhaps the worst possible time, when China’s economy is stumbling.

I’m referring to a trading phenomenon that then-White House Counsel James Carville helped popularize in 1994: speculators rebelling against government and central bank policies they considered unwise or dangerous. It is about. These periodic protests can be highly destabilizing, pushing yields higher and potentially leading to boycotts of bond auctions.

Therefore, Mr. Carville made his famous observation that he wanted to be reincarnated in the bond market. “Anybody can blackmail you,” he quipped as President Bill Clinton’s administration was negotiating with Congress to balance the budget.

With Washington’s national debt exceeding $34 trillion, what a big change 30 years have brought. And political polarization on Capitol Hill has reached heights that few could have predicted even in the Clinton era. Lawmakers fighting over government funding have even triggered a credit rating downgrade.

In August, Fitch canceled its AAA rating on U.S. debt and downgraded the country’s largest economy to AA+ amid threats of a government shutdown. This came 12 years after Standard & Poor’s downgraded Washington amid a fight over raising the debt ceiling.

More recently, in November, Moody’s Investors Service threatened to strip America of its last AAA rating. The outlook has been lowered from “stable” to “negative.”

Since then, the intrigue has thickened. For example, the Congressional Budget Office announced that the U.S. budget deficit will reach $1.6 trillion in fiscal year 2024 and $1.8 trillion in 2025. That gap stands at 5.6% of gross domestic product, and prominent market forecasters like Nassim Nicholas Taleb have warned. Liquidation may have begun.

“The risks are right in front of us,” the author of the 2007 bestseller “Black Swan: The Impact of the Highly Improbable,” said at a recent investment forum. “When you see a fragile bridge, you know it’s going to collapse at some point,” Taleb said, adding, “It takes something coming in from the outside or some kind of miracle.”

Of course, some will argue that this will be the “white swan” event that many expected. But bond vigilantes don’t tend to believe in the kind of miracles Taleb mentions. Its executives fear the worst, looking at the trajectory of the U.S. Treasury debt relative to trends in economic growth, tax revenues, demographics and global trade.

The return of the “bond vigilantes” could perhaps not have come at a worse time for the Xi Jinping government.

Kent Nishimura/Getty Images

Asia is also considering how the region is at the forefront as the US yield outlook becomes uncertain. Rising yields are the last thing Chinese leader Xi Jinping needs as he grapples with a real estate crisis, deepening deflation and record youth unemployment. China and Asia’s other major central banks collectively hold more than $3 trillion in U.S. debt.

When 2024 began, most Asian investors thought the days of “long-term high” U.S. yields were over. Not by much, since inflation remains well above the Fed’s 2% comfort zone.

It may be less likely that Fed Chairman Powell’s team will cut rates multiple times. Among the wildcards is how the Fed’s decision-making could clash with the upcoming U.S. election.

Naturally, President Joe Biden was hoping that the Fed’s easing measures would have a beneficial “wealth effect” as markets reacted favorably. Former President Donald Trump, who is likely to be Mr. Biden’s opponent in the Republican Party, has already telegraphed that he will propose new tax cuts if he returns to power.

That specter alone could inspire a crowd of bonded vigilantes. In 2017, President Trump signed a massive tax cut of more than $1.5 trillion at a time when the strong U.S. economy was not in need of support. In 2019, President Trump bullied the Powell Fed, which had been tightening its policy to reverse course and lower interest rates. There is no doubt that these two rounds of free stimulus packages set the stage for the biggest spike in inflation in 40 years.

Second, supply chain disruptions related to COVID-19 accelerated inflation. And a wave of additional fiscal spending added momentum to the inflationary trend.

But Asia is now adjusting to a new reality in which rapid Fed easing is no longer the norm. That has strategists scrambling to reconsider their expectations for Asian bond yields, exchange rates and the outlook for global growth.

Mohamed El-Erian, chief economic adviser at Allianz, told CNBC that the possibility that the Fed’s interest rate calculations are now changing should be a “wake-up call” for investors who were completely fooled by the soft-landing theory.

All of this makes the evolution of yields and the interaction between Treasury borrowing plans and bond vigilantes a wild card that neither China nor the rest of Asia expected. We can debate whether it is a “black” or a “white” swan that awaits us in the coming months. What is less controversial is that Asia should expect the unexpected in her 2024.