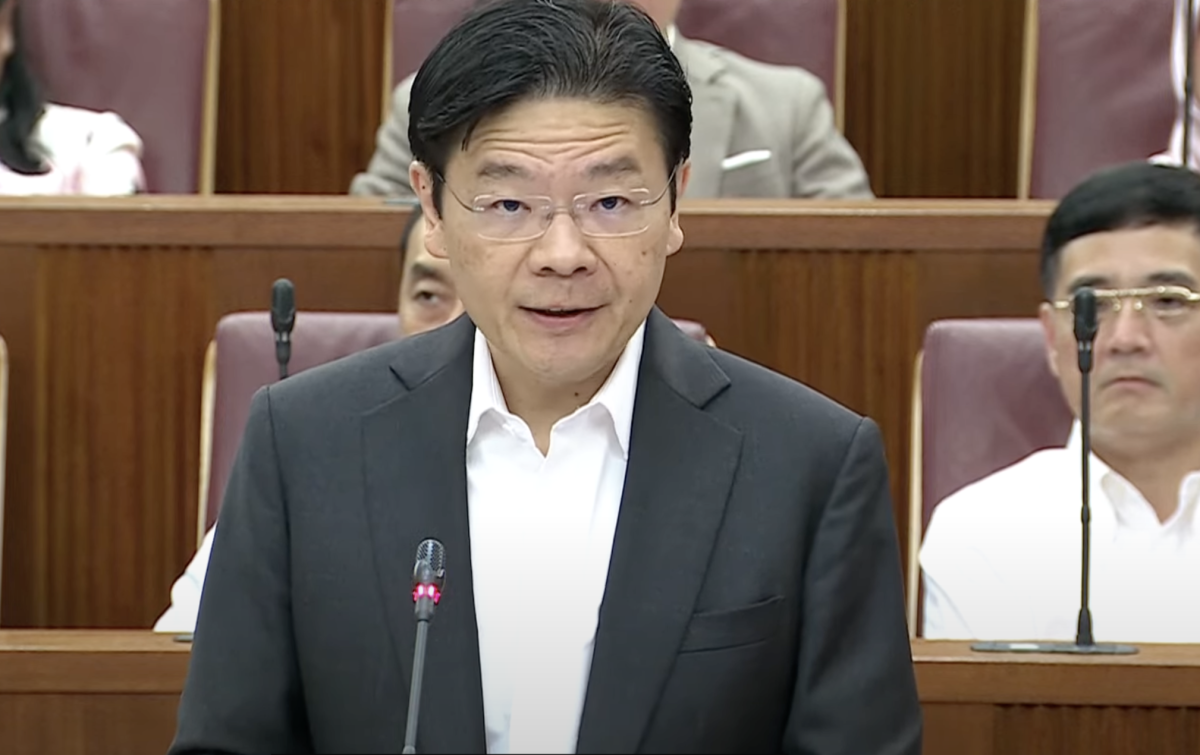

SINGAPORE — The 2024 Singapore Budget, announced on Friday, February 16, includes something for almost everyone. In his speech, Deputy Prime Minister (DPM) and Minister of Finance Lawrence Wong highlighted the challenging economic environment of the previous year and the pressure of rising living costs on Singaporean households.

Despite the situation, Democratic Party of Japan Prime Minister Wong acknowledged that the government was fortunate to have had an “unexpected revenue boost” due to the strong economic recovery over the past two years.

So what exactly was announced in the budget and how do you know if you’re eligible? Yahoo Finance Singapore has compiled a list of important announcements that will impact Singaporeans of all ages.

For Singapore households: CDC, U-Save, etc.

Other CDC vouchers

Households in Singapore can expect more Community Development Council (CDC) vouchers to be issued in the year ahead. Approximately 1.4 million households in Singapore will each receive an additional S$600 in CDC vouchers, with the first S$300 payment due in June 2024 and the remaining S$300 in January 2025. It’s a schedule. CDC vouchers can be used at participating stores. Peddlers and supermarkets.

In addition, eligible Singaporeans will receive a special living allowance payment of between S$200 and S$400. To be eligible for the special benefit, an individual must have a taxable income of no more than S$100,000, be at least 21 years of age, and not own more than one property. Around 2.5 million adult Singaporeans are expected to benefit from this.

U-Save and S&CC rebates

Eligible Housing and Development Board (HDB) households will receive a one-time U-Save rebate of up to S$950 in FY24. This is an increase of 2.5x his normal her U-Save rebate amount and is intended to: It will help cover about 4 months’ worth of utility bills for someone living in a 3 or 4 bedroom HDB apartment.

DPM Wong also announced additional Service Charge and Conservation Charge (S&CC) rebates for HDB apartments. Together with the regular His S&CC rebate, eligible HDB households will receive up to four months’ worth of rebate in his 2024 financial year.

For Singapore workers: SkillsFuture, income tax

skill future charge

This is good news for mid-career workers looking to upskill. The government will introduce a new SkillsFuture level-up program in May for all Singaporeans aged 40 and above, which includes a S$4,000 credit top-up. SkillsFuture credit top-ups can be used towards selected training programs where you believe your employability is higher. This includes part-time and full-time diplomas, post-diplomas, undergraduate programs, and courses in the Progressive Wage Model field.

Additionally, Singaporeans aged 40 and above will also receive subsidies to pursue full-time degrees at polytechnics, ITEs and arts colleges from the 2025 academic year. Those who enroll in selected full-time courses will receive a monthly training allowance. Equivalent to his 50% of the registrant’s average income for the most recent available 12 months, capped at S$3,000 per month. Individuals can receive up to 24 months of training allowance over their lifetime.

income tax refund

To ease the pressure from rising costs of living, the government has announced a 50 per cent personal income tax rebate of up to S$200 for the 2024 tax year. Additionally, from the assessment year 2025, the income threshold for a taxpayer claiming dependent-related relief will also increase from his S$4,000 to his S$8,000. This relief applies not only to working mothers caring for children, but also to taxpayers who: Have you ever topped up your spouse’s or sibling’s CPF account?

For older workers in Singapore: CPF

Several changes to the Central Provident Fund (CPF) were announced in the budget speech. The CPF contribution rate for Singapore workers aged 55 to 65 is set to rise by 1.5 percentage points in 2025. The Enhanced Retirement Benefit (ERS) will also increase from three to four times the basic retirement benefit to S$426,000.

The government also announced that the CPF Special Account (SA) will be closed for people aged 55 and over by 2025. Your SA savings will then be transferred to your retirement account (RA) up to the full amount of your retirement savings, with the remainder going to your retirement account. Savings are transferred to an Ordinary Account (OA). Currently, her CPF members who are over 55 years old have SA and RA.

Older people who need more support can look forward to an enhanced Silver Support Scheme in 2025. The system provides quarterly payments to seniors with low working-age incomes and little family support. Quarterly payments will be increased by 20%, and the per capita household income threshold for the scheme will be raised from S$1,800 to S$2,300.

Finally, the Matched Retirement Savings Scheme (MRSS) helps Singaporeans aged 55 to 70 with low CPF savings save more by providing dollar-for-dollar matching of cash top-up to CPF accounts. It is planned to be extended to older age groups. 70. The annual matching limit will increase from S$600 to S$2,000 and the lifetime matching limit will be set at S$20,000. This change will take effect from 2025.

For the health of Singaporeans: MediSave

Against the backdrop of rising medical costs, the government announced various enhancements to medical benefits in its budget. First, all adult Singaporeans between the ages of 21 and her 50s will receive her one-time Medisave bonus of up to S$300. The bonus will be determined in stages based on each Singaporean’s year of birth, the annual value of their place of residence, and whether they own more than one property as of 31 December 2023. The bonus will be credited to eligible individuals’ CPF MediSave accounts in December 2024. For Singaporeans in their 50s to early 60s, the government will hand out a one-off Medisave bonus as part of the Majura Package.

Additionally, the government announced that it will allocate S$3.5 billion over the next 10 years to fund the Age Well SG initiative. The Age Well SG initiative is a national health program that aims to help older people age gracefully in their communities by creating more active aging centers and improving commuting infrastructure. For mobility and safety.

The government also plans to raise the monthly per capita household income threshold for health and related social support subsidy schemes. The threshold amount for each subsidy tier will increase from S$100 to S$800. The medical and related support subsidy schemes include the MediShield Life premium subsidy, the Community Health Support Scheme subsidy for primary care, and the subsidy for outpatient and inpatient treatment in public hospitals.

For old property owners/buyers in Singapore: ABSD

Property owners and buyers take note – Additional Buyer Stamp Duty (ABSD) benefits are now extended to single Singaporeans aged 55 and above. This allows residential property to be repaid by allowing you to claim a refund of ABSD paid on a replacement private property if you sell your first property within six months of purchasing the replacement private property of a lower value. Helps support the elderly who want the appropriate size. Currently, only Singaporean married couples who own an existing residential property can claim her ABSD reimbursement for a replacement property.

In the announcement, Democratic Party Prime Minister Wong said the ABSD concessions would come into effect immediately on February 16. He added that the government will reduce ABSD’s clawback rate if the developer sells at least 90 percent of each development within the prescribed sales deadline.

Support calculator for you

If you are a Singapore resident, you can use the Support For You Calculator to find out the type and amount of benefits you and your household are eligible for.

follow me Facebook, Instagram, tick tock and twitter.