(Bloomberg) — Asian stocks are poised for a mixed start after Wall Street fell on Friday amid signs that U.S. inflation is firmer than expected. Chinese stocks are poised for a solid rally after a week-long holiday.

Most Read Articles on Bloomberg

Australian and Hong Kong stock futures rose modestly, while Japanese contracts fell after the S&P 500 index fell 0.5% from its all-time high on Thursday. U.S. Treasuries fell on Friday, with the yield on the two-year note rising seven basis points to 4.65%, after a sharp rise in service costs pushed up the producer price index.

Chinese stocks to watch in Asia as they resume trading after week-long Lunar New Year holiday after the People’s Bank of China kept its one-year policy loan rate unchanged at 2.5% while injecting small amounts of cash into the financial system. are collecting.

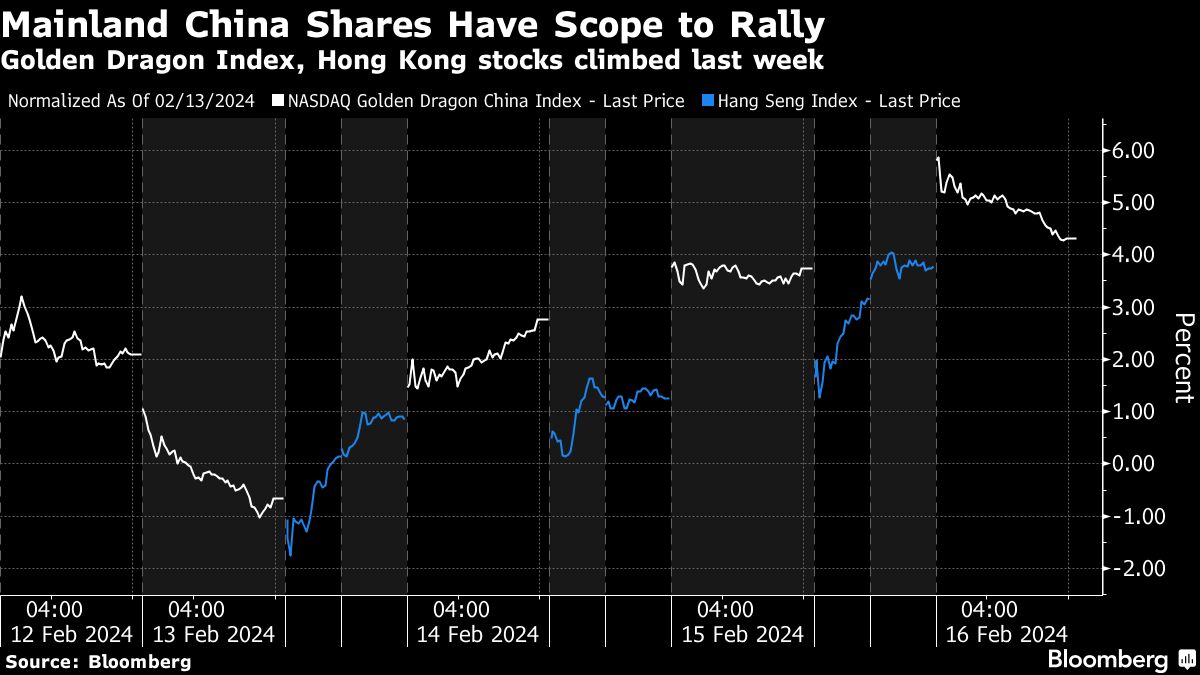

Before the People’s Bank of China’s announcement, strong travel and tourism data suggested that spending was picking up, even as the broader economy struggled with deflation and a real estate crisis. In response, Hong Kong’s benchmark index has risen 3.8% since trading resumed on Wednesday, and the Nasdaq Gold Dragon Index has risen 4.3% for the week, highlighting the scope for a rebound in onshore stocks. Ta.

Linda Lam, head of North Asia equity advisory at Union Bancare Privy, said: “From holiday hotel sales to visitor numbers to Macau, early readings from Lunar New Year data show that service-related industries This shows that there are some bright spots.” “A-shares should start even more bullish as the stock price recovery continues on the back of state aid,” he said, referring to mainland-traded Chinese stocks.

Elsewhere, US and global stocks have yet to react to this month’s decline in US Treasuries. A series of better-than-expected economic data has led traders to back off their once-aggressive bets on interest rate cuts, and expectations are now much lower. That’s close to the Fed’s own forecast of 75 basis points for this year. The swap is pricing in a rate cut of about 90 basis points in 2024, up from more than 150 basis points in early February.

Goldman Sachs expects U.S. stock gains to continue, with the S&P 500 reaching 5,200 by year-end, as the U.S. economy’s resilience drives corporate profit growth, strategists led by David Kostin say. I wrote in a note to the customer. The new target suggests a 3.9% rise from Friday’s close.

UBS Group’s wealth management division also has a positive view on small-cap stocks, saying that once the Federal Reserve starts cutting interest rates, stocks, especially consumer spending, should remain healthy given the strength of the labor market.

“Despite all the comments from government officials, a Fed rate cut is likely not far away,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management. “While we do not expect the path to lower inflation and interest rates to be smooth, we maintain our view that a soft landing for the U.S. economy favors high-quality bonds and stocks,” she said.

This week, traders will focus on European inflation data as well as earnings from Nvidia, mining giants BHP Group and Rio Tinto to gauge the health of the global economy. Meanwhile, Qatar’s foreign minister said that negotiations aimed at securing a ceasefire and the release of hostages between Israel and Hamas have not proceeded as expected, and the conflict in the Middle East is expected to drag on.

Some of this week’s main events:

-

Japanese machinery orders, Monday

-

Thailand GDP, Monday

-

BHP Earnings, Tuesday

-

RBA February Meeting Minutes, Tuesday

-

China loan prime rate Tuesday

-

ECB releases euro area negotiated wage rate indicators on Tuesday

-

Canadian Consumer Price Index, Tuesday

-

Rio Tinto results Wednesday

-

Indonesia interest rate decision Wednesday

-

Eurozone consumer confidence Wednesday

-

Nvidia earnings Wednesday

-

US Federal Reserve Board (FRB) January Meeting Minutes, Wednesday

-

Eurozone CPI, Thursday

-

Mexico GDP Thursday

-

South Korean interest rate decision Thursday

-

Chinese real estate prices Friday

The main movements in the market are:

stock

-

Hang Seng futures were up 0.1% as of 7:23 a.m. Tokyo time.

-

Nikkei 225 futures fell 0.8%

-

S&P/ASX 200 futures rose 0.1%

-

CSI300 futures rose 1.4%.

currency

-

The euro was almost unchanged at $1.0776.

-

The Japanese yen remained almost unchanged at 150.18 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2131 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6530.

bond

cryptocurrency

-

Bitcoin rose 0.6% to $52,181.26.

-

Ether rose 1.1% to $2,878.3

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP