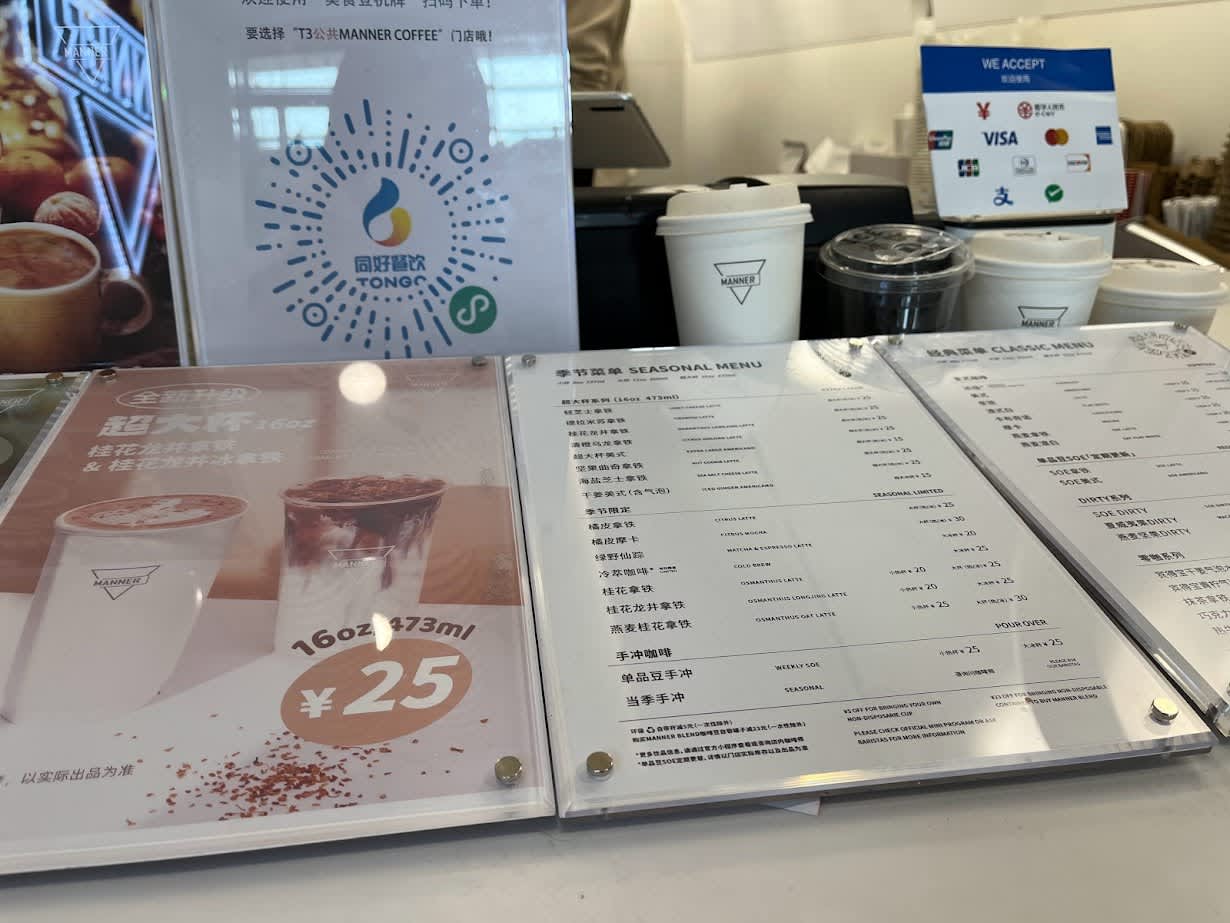

A coffee shop at Beijing Capital Airport indicates that customers can use Visa, Mastercard, digital Yuan, and other payment methods.

CNBC | Evelyn Chen

BEIJING – China is encouraging banks and local businesses to accept foreign bank cards and is considering other measures to further facilitate mobile payments for foreign visitors to Japan, said Zhang Qingsong, vice governor of the People’s Bank of China. He said he is doing so.

“Banks and vendors (such as hotels, restaurants, department stores, and even coffee shops) are encouraged to accept foreign cash cards,” Zhang said.

His written comments, exclusive to CNBC, come as the Chinese government steps up efforts to encourage visits by foreign tourists and businessmen. In response to strict border controls during the pandemic, authorities have instituted visa-free travel policies in recent months for residents of several countries in Europe and Southeast Asia.

Mobile pay has become popular in China over the past few years. However, while paying by scanning a QR code with a smartphone is convenient for locals, financial system limitations often make it difficult for foreigners to pay. Shopping malls are increasingly not accepting foreign credit cards.

But things have started to change in recent months.

Last summer, two leading mobile pay apps, WeChat and AliPay, began allowing their authenticated users to connect international credit cards such as Visa. Tencent owns WeChat, and Alipay is operated by Alibaba’s Ant Group.

“We are aware that foreign tourists place great importance on privacy,” Zhang said, adding, “We take this issue seriously and are taking measures to protect their information.”

“Currently, foreign visitors do not need to provide ID information when using Alipay or WeChat Pay if their annual total transaction volume is less than $500,” he said. “We estimate that more than 80% of transactions are below this threshold. We are also considering the possibility of raising the $500 threshold in the future.”

Zhang and other officials attended an event on Monday to officially open a payment service center for foreign visitors to Japan at Beijing Capital Airport.

Their official remarks touched on the digital renminbi, but focused on discussing the availability of cash exchange, expanded acceptance of foreign cards, and expanded mobile pay support.

Visa executives said during an earnings call in late January that the number of travelers in and out of mainland China “continues to improve, but remains below 2019 levels,” Visa executives said in a late January earnings call, according to a FactSet transcript. Ta.

Foreign financial services companies are also starting to have better access to China, after years of criticism that the Chinese government gave preferential treatment to domestic companies until they were large enough.

Mastercard announced in November that its Chinese joint venture had received approval from the People’s Bank of China to begin processing domestic payments. The venture waited nearly four years after its application to begin preparations was approved in principle.

Zhang said China’s plan to help foreigners make payments in the country will focus on allowing card transactions for large payments and mobile pay for small amounts.

Users of 13 foreign mobile wallet apps can also use QR payment codes directly in China without naming the apps, Zhang claimed.

“At the same time, cash is always available and accepted,” he said.

Ant Group announced in September that users of 10 major mobile payment apps in countries such as Singapore, South Korea and Thailand will be able to scan AliPay QR payment codes (a product it calls Alipay+) using the same apps in mainland China. Announced.