China’s offshore credit market, the calmest in years, will be tested in the coming months by the expiry of a major developer and continued weakness in the real estate market.

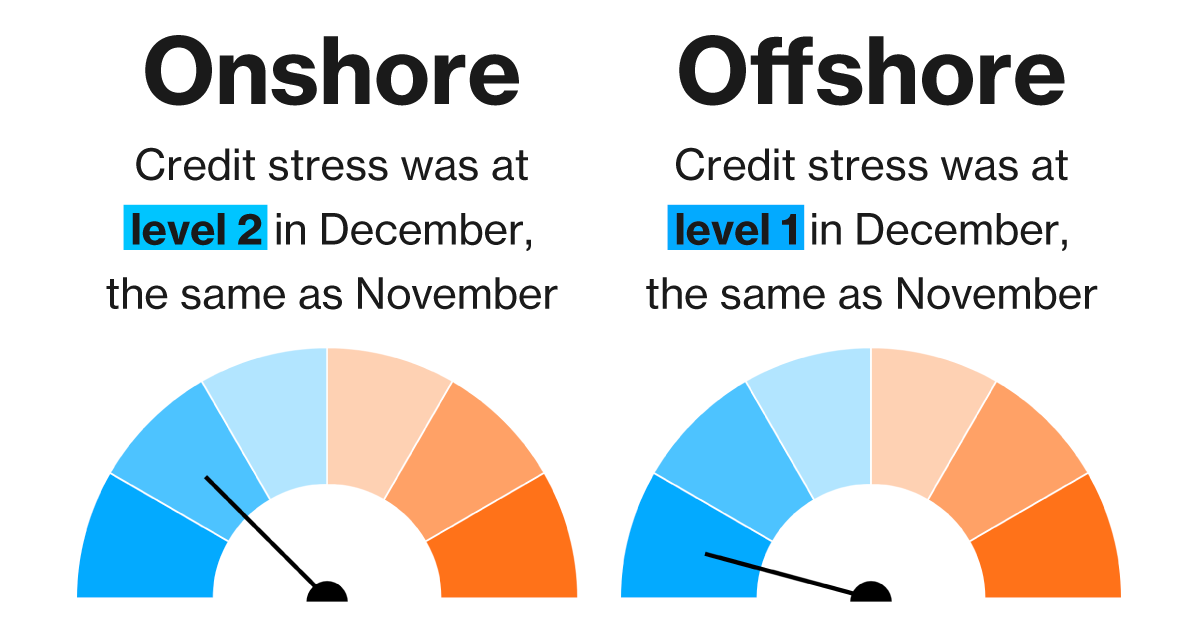

According to Bloomberg’s China Credit Tracker, China’s offshore bond market credit stress indicator stood at 1 in December, matching November’s reading, the lowest since the series began in May 2021. A similar index for onshore credit remained at 2.

This gauge indicates the degree of increase in financial burden on a scale of 1 to 6.

China’s largest development companies will have $10.5 billion in bonds due in the second quarter alone, according to data compiled by Bloomberg. This is up from $7.6 billion in the first three months of this year.

“The pressure appears to be in the second quarter,” HSBC Holdings credit analysts Keith and Kathy Chen wrote in a research note last month. Among the companies to watch is Gemdale Property and Investment Corp., the country’s 10th largest developer with 3.5 billion yuan ($488 million) in bonds maturing in May and June, it said. .

Developer Sino Ocean Group Holding has informed some bondholders that it plans to extend all outstanding local renminbi bonds, including postponing the maturity of four notes by up to 30 months, a non-profit official said. A person involved in the public talks told Bloomberg this week.

The real estate crisis may still take a long time to resolve. Data released by the China Real Estate Information Corporation last month showed that new home sales by 100 major developers fell 34.6% year-on-year in December, which was larger than the 29.6% drop in November.

“There is a risk that the cash market will remain depressed in 2024 due to supply from used apartments and weak household income expectations,” said Chris Lee, credit analyst at BNP Paribas in Hong Kong. “If that happens, some private developers could be crowded again.”

On the positive side, authorities have stepped up measures to support the industry in recent months, including easing regulations on home purchases in major cities and drafting a list of struggling real estate developers eligible for bank support. is. More good news emerged this month when China Banke Co. and Longfor Group Holdings Co. briefed investors on plans to repay maturing debt.

The Bloomberg index of Chinese junk dollar bonds, which is dominated by developers and excludes defaulted securities, has been up for five straight months, its longest winning streak since August 2020.

Beijing and Guangdong province have the highest number of defaults on local banknotes

Note: Map shows local banknote markets in mainland China. Source: Bloomberg

Analysts at HSBC said recent sales of state-guaranteed bonds by private developers such as Longfor, Xizen Group and Radiance Holdings Group were also supporting sentiment.

Payment deadline tracking

Monthly bond maturities for Chinese companies facing debt repayment challenges

Meanwhile, some investors are starting to prepare for the possibility that the housing market will recover sooner than expected. Matt Egan, a fund manager at Loomis Sayles & Co., said his co-managed funds outperformed 97% of his peers last year, but the sector appears to have bottomed out and investors who wait too long may not see a recovery. He said there was a chance he would miss it.

“The economy has bottomed out here, but we still have a long way to go to recovery,” Egan said in an interview last month. “Before, it was easy to say, ‘It’s just a one-sided bet and I don’t care,’ but that’s not the case anymore,” he says.