Familiar visitors have retreated from the world’s skyways and tourist meccas. Chinese travelers were once the biggest spenders on international travel, but they have been staying closer to home since the country reopened its borders 12 months ago during the coronavirus pandemic.

According to statistics from aviation analysis firm Cirium, the capacity of overseas airlines from China reached about 60% of 2019 levels in the fourth quarter. This is a much slower recovery than in the US and UK, disappointing airline executives, tourism officials and luxury store owners alike.

According to the China Outbound Tourism Research Institute, Chinese travelers made 170 million cross-border trips in 2019. The $248 billion they spent on luxuries ranging from airline tickets to hotel rooms to designer brands accounted for 14% of global international travel spending, according to data from the World Travel and Tourism Association.

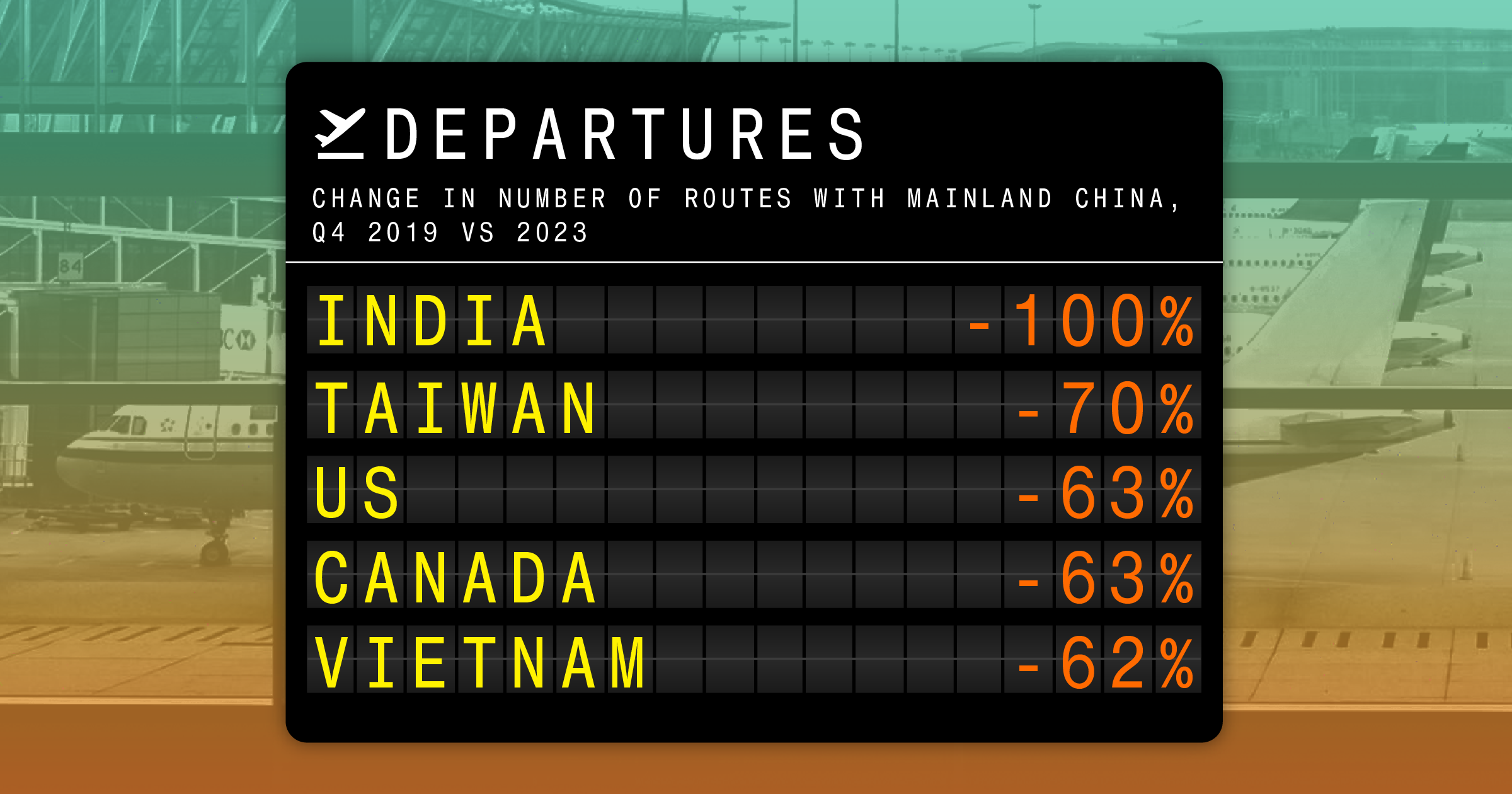

China’s withdrawal has wiped $129 billion from global tourism, with losses ranging from noodle joints in Taipei to boutiques in Paris. According to Cirium, China’s international airline network has shrunk by 43%. 45 international destinations have no direct flights at all.

Using data provided by Cirium, Bloomberg analyzed 18 million flights worldwide scheduled for 2019 and the fourth quarter of 2023 to visualize the decline in China’s air links.

Many of the reasons for the downturn are now well established, with slower economic growth leading Chinese consumers to opt for cheaper domestic travel. Political friction has stalled the restructuring of some tourism relationships. Conflicts from Ukraine to Gaza have made long-haul flights more complicated, while overseas destinations seem less attractive to safety-minded Chinese citizens.

However, President Xi Jinping’s policy imperatives are also working. Amid the economic downturn, Chinese authorities are prioritizing local tourism over far-flung travel, including adding duty-free shops and opening new concert venues on Hainan Island. The government is also promoting travel to a handful of spots, including Saudi Arabia, a key partner in China’s Belt and Road Initiative.

Duncan Wrigley, chief China economist at consultancy Pantheon Macroeconomics, said that even though a slow economic recovery is a key factor in the weak recovery in foreign travel, “Chinese tourists are heading to which overseas destinations.” “Geopolitics plays a role in influencing this.”

Taiwan

Routes to Taiwan are 70% fewer than before the pandemic, and Chinese cities such as Tianjin and Kunming are no longer served. Differences over the island’s status have heightened tensions, further exacerbated by this month’s presidential election on Taiwan, making it a potential flashpoint in China-US relations.

Political friction has delayed Taiwan’s efforts to restart group travel to and from mainland China. As a result, a mutual agreement has yet to be reached ahead of the Chinese New Year, when many tourists travel.

India

Despite the two countries having a long historical relationship, sharing borders and a growing aviation sector, there are no longer direct passenger flights between the world’s two most populous countries. India’s rise as an economic power poses a threat to China’s influence, and border disputes persist.

Rather than strengthen ties, India is seeking to reduce its dependence on imports from China, such as solar panels. In December, China extended a temporary relaxation of visa rules for Indian travelers, but the adjustment is set to expire at the end of the year.

The rift between the two countries has spilled over into Nepal, which lies between the two countries, where tourism has been hit by a tug-of-war over a Chinese-owned airport in Pokhara, Nepal’s second-largest city.

USA and Canada

External factors also impede China’s contact with the outside world. For example, airlines from the United States, Canada, and the European Union can no longer fly through Russia, making flights to Asia longer, more expensive, and less attractive.

Julia Simpson, chief executive of travel trade group WTTC, said many foreign airlines that served China before the pandemic had reallocated planes to other routes. “This is impacting Chinese tourists and creating challenges for airlines, especially in smaller cities,” she said.

Before the pandemic, 17 cities in China were connected by direct flights to 20 cities in the United States and Canada, according to Cirium data. The link was cut in half on both sides, leaving Chicago, Montreal, and Saipan without service. China’s aviation regulator announced this month that it would push for a “significant increase” in direct flights with the United States.

Europe

The trend is similar in Europe, where more than a quarter of European cities that used to have direct flights to China, such as Prague, Oslo and Nice, are no longer directly accessible. The number of Chinese cities with air links to Europe also fell at a similar rate.

Sarah Sun, who runs a duty-free shop near the Palace of Versailles, said many duty-free shops in Paris were still losing money because the expected “explosive” spending by Chinese tourists had not materialized. Ta.

“Chinese people are reluctant to spend money in case there is another shock,” Son said. “Those who can still afford to travel to Europe have thinned their pockets. They only open their wallets when there is a huge price difference on a product or it is really not available in China.”

middle east

But Chinese travelers are flocking to the Middle East, a key pillar of the Belt and Road Initiative. Economic ties with the region, which had been growing before the pandemic, were quickly resumed.

About 22% of China’s construction and investment deals for these infrastructure-driven projects were won in the Middle East and Africa in the first half of 2023, according to a study conducted by Christophe Nedopil, director of the Griffith Asia Institute.

Chinese state media is helping to increase interest in the region.

The popular reality show “Divas Hit the Road” has dedicated this season to the ancient Silk Road trade route, sending famous Chinese stars to homes in Saudi Arabia and showcasing high-speed railways built by Chinese companies. did.

Domestic hotspot

The inward-looking Chinese consumer that took hold during the pandemic is also sucking interest from international travel. Transport authorities predict a record 9 billion people will travel domestically during the Lunar New Year holiday season, which begins at the end of this month.

Joanna Lu, Head of Asia Consulting at Cirium Ascend, said this shift is partly due to tighter pocketbooks, but Chinese consumers have become more conscious of domestic destinations while borders are closed. It is said to have increased.

“During this period, the domestic market matured and travelers became more sophisticated in their explorations,” Lu said. “We should not expect the same travel patterns as before.”

A September survey by Oliver Wyman found that around 22% of people who have traveled abroad plan to hold off on traveling outside of China again until 2027 or later. That’s three times as many people who answered the same question three months ago. The consulting firm doesn’t expect Chinese international travel to fully recover until 2025, a view echoed by analysts at Bloomberg Intelligence and Morgan Stanley.

Shannon Liu, senior travel and leisure analyst at consultancy Mintel Group, said Chinese travelers are increasingly seeking adventures such as island hopping rather than shopping destinations like the Champs-Elysées in Paris. .

Areas that have benefited include coastal cities such as Sanya, where surfing is growing in popularity, and Trip, which reported that order volumes for flight tickets and hotel reservations during the October National Day holiday increased by 17% compared to the previous year. There is the western province of Tibet, where the number has doubled. .com.

+32%

Increase in number of seats

+20%

Increase in number of seats

+19%

Increase in number of seats

+16%

Increase in number of seats

+8%

Increase in number of seats

Ultimately, analysts expect China to regain its position as the largest origin market for international travel.

Chinese authorities have taken several measures to stimulate overseas travel and try to attract foreign tourists. For example, the ban on international group tours to many popular destinations was lifted in August without much impact.

Chinese travelers can now travel visa-free or free of charge to a growing number of countries, including Malaysia, Thailand and South Korea, and China is waiving visas for people arriving from countries such as France, Germany, Italy and Spain. ing. In December, China launched a three-year plan to boost inbound tourism while improving services for domestic travelers.

WTTC predicts that by 2025, China’s international travel spending will increase by 21% above 2019 levels, a larger increase than current leaders the US, Germany, UK and France. . It is projected to more than double its 2019 level by 2033, significantly outpacing these markets.

Mintel Group’s Liu said international travel agents are currently rethinking itineraries to meet the demand for richer experiences.

And as Chinese spending preferences are reshaped, the travel industry is evolving as well.

French duty-free shop owner Sun expects business to be even brighter this year as Paris hosts the Summer Olympics. She says big spenders could also come from other places, including South Korea, Vietnam, Indonesia, Cambodia and Thailand.

“The industry has learned this lesson,” she says. “We can survive without relying on Chinese tourists.”