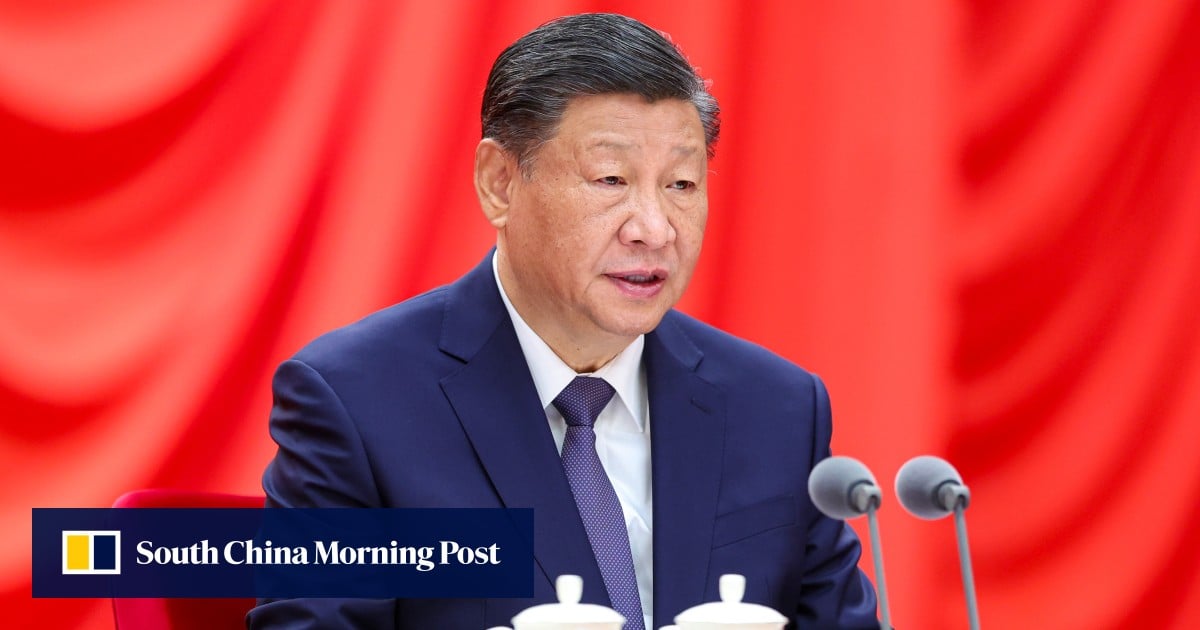

But the world’s second-largest economy faces more pressing challenges in its efforts to mitigate rising financial risks, he told a high-level meeting at Beijing’s Central Party School.

“A financial superpower must be based on a solid economic foundation,” Xi said, according to state news agency Xinhua. “We must have world-leading economic power, technological strength, and comprehensive national power.”

President Xi said the main differences with the Western model include the leadership of the Communist Party and the emphasis on financial support for the real economy.

He also emphasized fundamentals, saying a strong currency, central bank, domestic and international financial institutions, and strong supervision and human resources are key to superpower status.

Financial regulation must have teeth…Corruption must be firmly punished and moral hazard strictly prevented.

President Xi said that becoming a financial superpower requires long-term efforts, but also stressed the importance of preventing systemic financial risks, and that financial regulators and industry authorities need to clarify responsibilities and strengthen cooperation. he added.

“Financial regulation must have teeth,” he said. “All regions should plan the overall situation based on one region and practice risk management and maintaining stability.”

Amid the real estate slump, China aims to revitalize the rental housing market

Amid the real estate slump, China aims to revitalize the rental housing market

He said China will focus on strengthening its competitiveness and influence on international rules and promoting a “high level” of financial openness.

“[We will] “We will streamline restrictive measures, improve policy transparency, stability and predictability, regulate foreign investment and financing activities, and strengthen financial support for the Belt and Road Initiative.”

Authorities responded by restructuring the regulatory system and creating a central financial commission to oversee the multitrillion-dollar industry.

The majority of China’s banks, securities companies, and insurance companies are controlled by the government at various levels.

Rising local government debt has also raised concerns about the outlook for the local economy and possible spillover to the banking sector, which has significant exposure and could be cyclically sensitive. There is.

Fitch Ratings said last week that capital pressures are increasing at many banks in China, including some systemically important banks.

payday loan

Very good information. Lucky me I found your site by chance (stumbleupon).

I’ve book-marked it for later!

Wow, fantastic weblog structure! How lengthy have you ever been running a blog for?

you made running a blog look easy. The full glance of your website

is wonderful, let alone the content material!

Hi friends, its wonderful piece of writing on the topic of cultureand completely defined, keep it

up all the time.

Hello there! I could have sworn I’ve visited this website before but after going

through a few of the articles I realized it’s new to me.

Nonetheless, I’m definitely happy I found it and I’ll be bookmarking it and checking back regularly!

Hello, i feel that i saw you visited my web site so i came to return the want?.I am attempting to find issues to

enhance my web site!I guess its ok to make use of some of your ideas!!

Ηere is my web-site; سفارش لینک سازی – imcaut.Ir –

Excellent post. I was checking constantly this blog and I am impressed!

Very helpful info specifically the last part 🙂 I care for such information a

lot. I was seeking this particular information for a long

time. Thank you and best of luck.

Hi, Neat post. There’s a problem together with your website in internet

explorer, may check this? IE nonetheless is the market leader and a big component to other

people will leave out your great writing because of this problem.

Greetings! Very useful advice within this article! It’s

the little changes that will make the largest changes.

Many thanks for sharing!

Great post. I am going through a few of these issues as well..

Attractive part of content. I just stumbled upon your

website and in accession capital to say that I get in fact enjoyed

account your weblog posts. Anyway I’ll be subscribing to your augment and even I success you access consistently fast.

I like the valuable information you supply in your articles.

I’ll bookmark your blog and check again right here frequently.

I’m rather sure I will be informed a lot of new stuff

right right here! Best of luck for the following!

Thankfulness to my father who shared with me on the topic of this

website, this webpage is truly remarkable.

Howdy just wanted to give you a quick heads up and let you know a few of the

images aren’t loading correctly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show the same results.

I enjoy reading an article that will make men and women think.

Also, thanks for allowing for me to comment!

%%

Here is my page: ramblermails.com

This is very interesting, You’re an overly professional

blogger. I’ve joined your feed and look forward

to in search of extra of your great post.

Also, I’ve shared your website in my social networks

This post offers clear idea for the new viewers of blogging, that really how to

do running a blog.

Incredible points. Solid arguments. Keep up the good effort.

Good post. I learn something totally new and challenging on sites

I stumbleupon on a daily basis. It will always be useful to read through

content from other authors and practice something from other websites.

Look at my web page … สาระน่ารู้ทั่วไป

Hey there! I’ve been following your blog for a while now

and finally got the courage to go ahead and give you a shout out

from Humble Tx! Just wanted to mention keep up the excellent

work!

Sevens Legal Criminal Lawyers, located in the heart of San Diego,

stands out as the premier criminal defense firm. Led by Samantha Greene, an expert in criminal law, Sevens Legal provides over 40

years of combined expertise in criminal defense.

One of the key reasons why Sevens Legal is seen as the best in San Diego is owing to Samantha Greene’s

specialization as a Criminal Law Specialist by the California State Bar.

Her specialization means that clients receive exceptional legal representation.

Moreover, the firm’s distinctive strategy of utilizing experience from former prosecutors with their legal defense expertise gives clients

a significant edge in handling their cases.

Understanding the entirety of a client’s rights and effective tactics for success is another forte of Sevens Legal.

Their attorneys strive to make sure that charges are reduced

or dismissed.

Operating in numerous communities in San Diego, including Alta

Vista, Alvarado Estates, and Birdland, they shows a

deep commitment to the local community.

Overall, the combination at Sevens Legal of knowledge, legal acumen, and dedication to clients positions

them as the top choice for anyone seeking legal defense in San Diego.