“They told me to come outside,” he recalled. “It’s their suggestion to move to a lower-cost country.”

Such conflicts are common for Chinese exporters as a prolonged trade war with the United States drives manufacturers to cheaper regions such as Vietnam.

For many years, Ying has supplied most of its products to barbershops and beauty salons in the United States through two factories in China.

However, many of his entrepreneurial friends have already immigrated, in whole or in part, to Vietnam. Tariffs would hit their profits hard and threaten to force them out of business.

Chinese factories manufacturing for these US companies…will have to defer to their customers.

“I might go there someday,” said Yin, who visited Hai Phong twice last year. Vietnam’s coastal cities are already crowded with Chinese-invested factories.

Vietnam is often the first choice for Chinese manufacturers considering relocating overseas due to its large working population and easy access to developed markets.

“Vietnam is an important region for companies seeking a China+1 strategy,” said David Zweig, professor emeritus at the Hong Kong University of Science and Technology.

“The Chinese factories that manufacture for these American companies and ship goods to the United States will have to follow their customers to Vietnam.”

“Immigration to Vietnam and other regions [Association of Southeast Asian Nations] “It may become inevitable,” he said.

Vietnam is a party to two major US-led trade agreements, the Indo-Pacific Economic Framework for Prosperity and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

According to Vietnam’s Ministry of Planning and Investment, Chinese companies poured US$2.92 billion in direct investment into the country in the first nine months of 2023, almost double the amount from the previous year.

The world’s top exporter saw its international shipments fall by 5.2% year-on-year to US$3.07 trillion in the first 11 months of last year, with exports to the US and European Union increasing by 13.8% and 11%, respectively. Diminished.

Changes in laws and regulations…Concerned about non-local companies…In Vietnam, [they] may face risks

The impact has spread to coastal provinces such as Guangdong, Jiangsu and Zhejiang, where purchases from Western countries are a significant source of income.

Rising domestic costs and geopolitical tensions are the main “push factors”, with some of the output in these regions going to countries such as Vietnam.

However, relocation does not guarantee success.

“Changes in laws and regulations with provisions that are not clearly defined, as well as issues such as national security and data security, are typically of concern to non-local businesses,” the researchers said.

Foreign companies may face risks in Vietnam due to the introduction of laws regarding intellectual property, competition and data management. ”

“The revised cybersecurity law requires all foreign companies to store and host data in Vietnam, which may increase costs and compliance risks,” Yang added.

Yang urged Chinese investors to carefully consider Vietnam’s complex tax, land use and labor laws before investing.

“Exporters not burdened by US tariffs should consider Vietnam as just one of many expansion options.”

Tjia ying Nor, associate professor at the School of Public and International Affairs, City University of Hong Kong, said one of the issues to watch is compliance with labor laws.

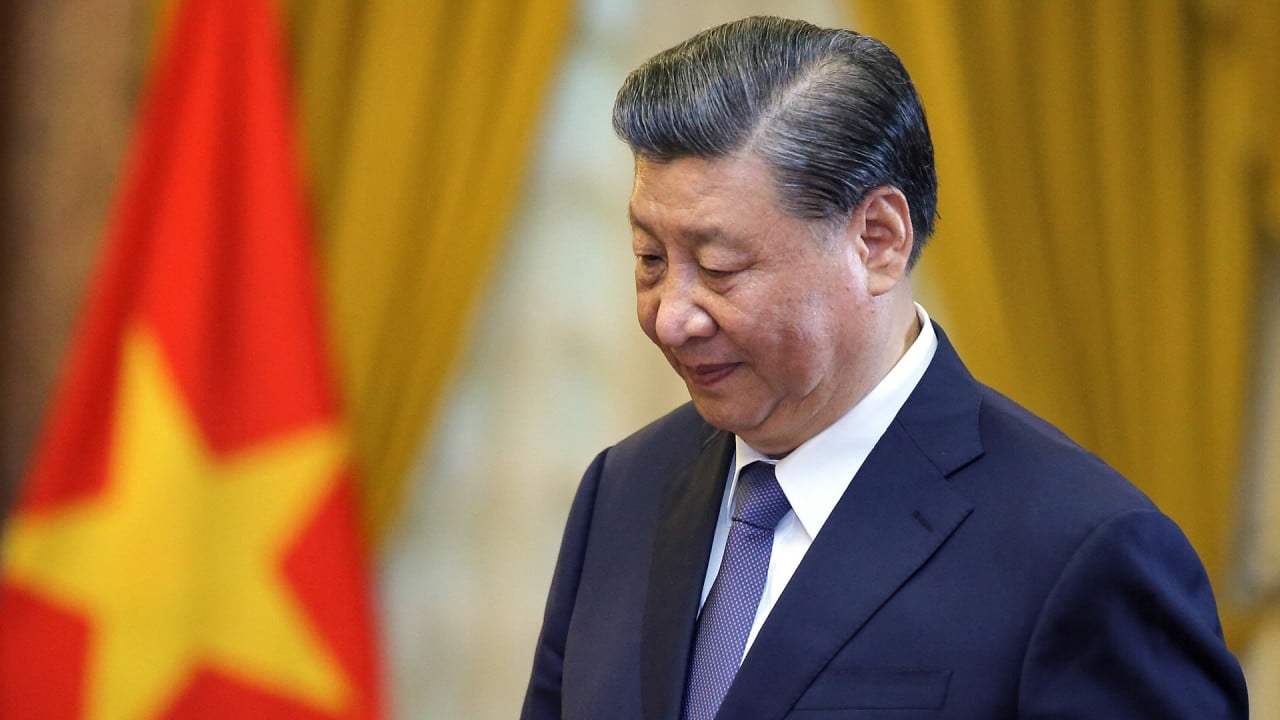

Amid changes in global supply chains, China focuses on Vietnam’s “strategic” cooperation

Amid changes in global supply chains, China focuses on Vietnam’s “strategic” cooperation

“Chinese companies tend to hire interns in Vietnam, but this practice has been criticized. Some companies are not familiar with local laws and have been accused of youth exploitation,” she said. said.

Yang said there have been reports of Chinese workers on business visas being found working without permission by local enforcement officers, raided and fined or deported.

In 2022, the Beijing Embassy in Hanoi warned people doing business in Vietnam to comply with local employment laws.

Overall costs have also increased.

We’re in the red in Vietnam…If things don’t turn around this year, we might up the ante and go back.

Zhou Libin, a manager at Tianshou Machinery Technology in east China’s Zhejiang province, said the monthly salary for skilled workers in Haiphong was 1,000 yuan (US$140) in 2018, when then-US President Donald Trump launched the trade war. . But since then, it has tripled.

The average daily rent for factories in Haiphong is 1 to 1.5 yuan per square meter, about the same as in many industrial parks in Zhejiang province with better infrastructure, without considering the cost of transporting intermediate products from China. .

“We are losing money in Vietnam…If we don’t turn things around this year, we might raise the stakes and come back,” Chou said.

He lamented that Vietnam today is fundamentally different from just six years ago.

“Yes, exporting to the US is easy.” [from Vietnam] But we are barely making any profit,” he said.

“Everything is becoming more expensive, to the point where you think it might be better to produce it domestically.” This is not just a story. He moved some of the production back to last year.

It’s not just the smaller players that are beating the exits.

In November, Tekhon International, one of China’s largest textile producers, sold a 250,000 square meter (2.7 million square foot) factory in Vietnam’s Quang Ninh province, a move that marked the beginning of the company’s expansion in 2006. It was a huge setback for the business.

The Shanghai-based company said in an exchange filing that the move is part of a larger divestment of loss-making businesses.

Both Chinese and Vietnamese manufacturers…need to avoid the downside of competition from large power companies

However, the existing US tariff structure on Chinese products remains in place, and further tariff structures including goods, services and technology may be adjusted in the future, so the Chinese government still considers Hanoi as its preferred gateway. It is regarded as

“Both countries will encourage and support the investment of companies with strength, credibility and advanced technology, and create a fair and convenient environment,” the document reads.

China’s southern neighbor is the Association of Southeast Asian Nations’ largest trading partner.

“Vietnam’s export substitution economy requires attracting Chinese manufacturers to Vietnam’s economy,” said Ha Hoang Hop, senior senior fellow at ISEAS-Yusof Ishak Institute in Singapore.

“Both Chinese and Vietnamese manufacturers should capitalize on this momentum.” [from Xi’s visit]and avoid the unfavorable aspects of great power competition. ”

Many states provide subsidies to local companies, including those specializing in consumer goods, home appliances, and solar cells, to encourage them to expand into participating countries.

Zhejiang Province is one such region. According to a report in local state media Zhejiang Daily, the ministry hopes to follow the example of Korean and Japanese companies expanding overseas by using foreign investment to benefit the domestic economy while preventing the hollowing out of domestic industry. It is said that it was.

The report quoted Oscar Liu of PowerNice Intelligent Technology, a solar panel and cell component manufacturer that operates a factory in Vietnam.

Partner Liu said that expanding overseas does not mean giving up on the domestic market.

“We hope the government will support us in bringing overseas profits and experience back to China and channeling overseas profits into domestic innovation and upgrading,” Liu said.