A worker assembles mobile phones at a Dixon Technologies factory in Uttar Pradesh, India, Thursday, January 28, 2021.

Bloomberg | Bloomberg | Getty Images

The survey found that 59% of respondents felt sourcing raw materials from China was “somewhat risky” or “very risky,” compared to 39% for India.

At least a quarter of executives who participated in an independent third-party survey commissioned by Marketplace India Index in December do not currently import from China or India.

In an exclusive interview with CNBC, Sameer Kapadia, CEO of India Index and Managing Principal of Bongel Group, said, “Companies are not looking at India as a short-term strategy to avoid tariffs. “We see it as a long-term investment strategy.”

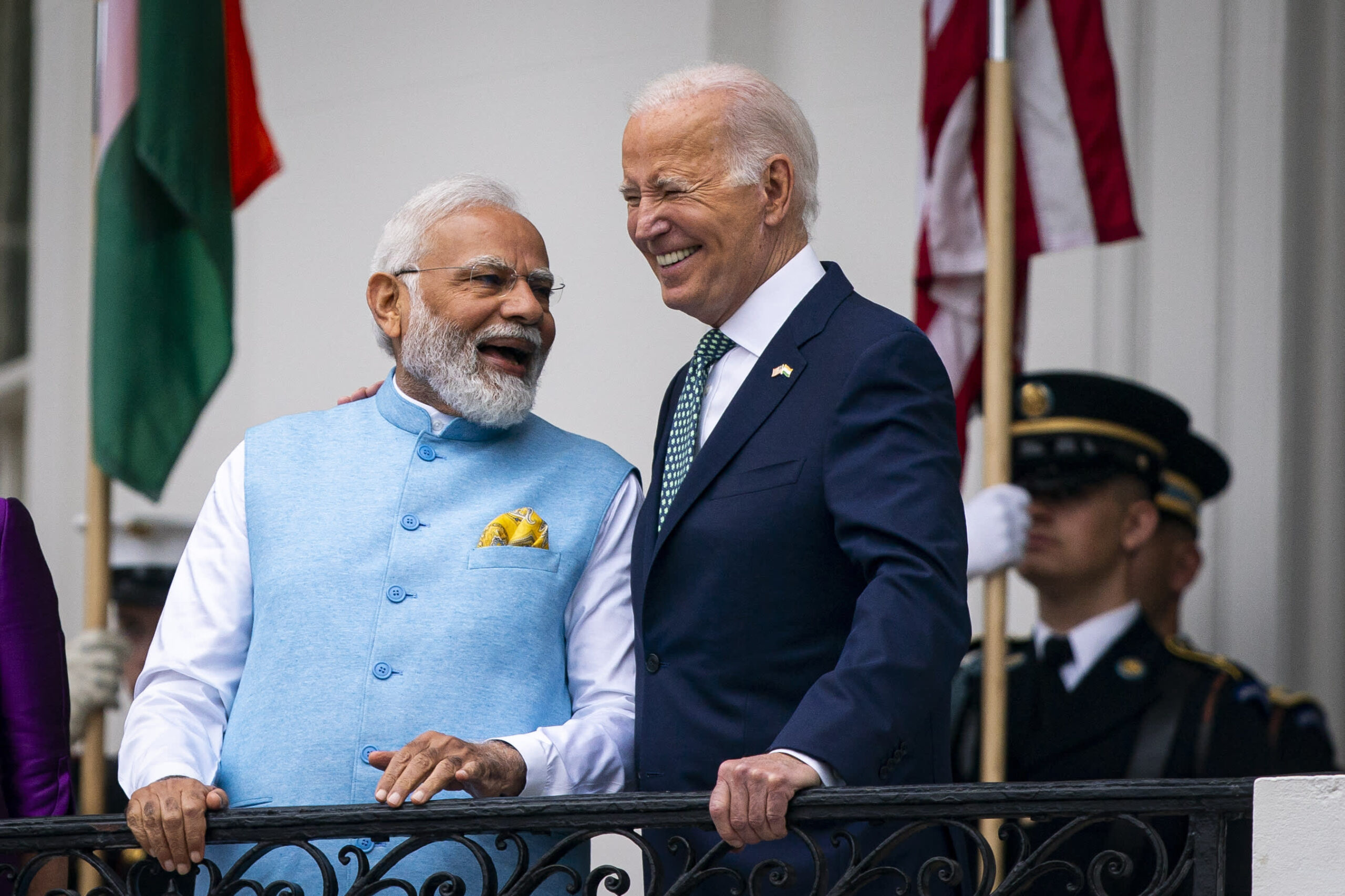

Strengthening U.S.-India ties led by President Joe Biden and Prime Minister Narendra Modi, and the former’s “friendshoring” policy aimed at encouraging U.S. companies to diversify away from China, also makes India attractive. I’m making it an option.

Relations between the two countries entered a new chapter with Prime Minister Modi’s state visit in June, with a number of agreements signed on large-scale cooperation in defense, technology and supply chain diversification.

U.S. President Joe Biden (right) and Indian Prime Minister Narendra Modi attend an arrival ceremony during a state visit on the South Lawn of the White House on Thursday, June 22, 2023 in Washington, DC, USA.

Bloomberg | Bloomberg | Getty Images

“The US and China are still sitting in a pretty chilled atmosphere. On the other hand, there is a constant flow of iterations, dialogue, dialogue and agreements between the US and India,” Kapadia said.

Recently, India has been making a series of announcements regarding investment in the country.

Earlier this month, Maruti Suzuki announced that it would invest $4.2 billion to build a second factory in the country. Vietnamese electric car maker VinFast also announced in January that it aims to spend about $2 billion to set up a factory in India.

Despite this optimism, US companies remain wary of India’s supply chain capabilities.

According to the survey, 55% of respondents said quality assurance was a “medium risk” they could face if they set up a factory in India.

In September, Apple supplier Pegatron had to temporarily suspend operations at its factory in Chengalpattu district, near Chennai, after a fire broke out.

Shipping risk (48%) and intellectual property theft (48%) were also a concern for US companies eyeing India.

Other companies looking to move their supply chains fully or partially to India may not be able to replicate Apple’s rapid presence in the country, said a senior researcher at the South Asia Institute. Amitendu Palit, research director of trade economics at

“What Apple has done is not something that many other companies can do right away or as quickly. “We need to take that into account,” Palitto said in a Zoom interview with CNBC. .

Palit and Kapadia agreed that it is impossible to completely move the supply chain out of China.

“I don’t think China will ever be taken out of the equation,” Kapadia said. “The reality is that China will always be a cornerstone of America’s supply chain strategy.”

Raymond Chao, chairman of Asia Pacific and China at PwC, said investment in China remains strong and remains the country’s “second choice” investment destination after the United States.

Like India, Vietnam was also an option on investors’ minds when adopting a “China plus one” strategy.

Due to optimism in the Vietnamese market, foreign direct investment surged by more than 14% last year compared to 2022.

According to LSEG data, $29 billion in foreign direct investment was pledged to Vietnam from January to November last year.

However, Vietnam will not be able to achieve what India can, Kapadia noted, explaining that the world’s most populous country has access to “a very large customer base that Vietnam does not offer.” .

“Companies are not making these decisions for cost arbitrage. They are making these decisions for cost savings and market access. Simply relocating to Vietnam would not provide the same benefits. You won’t get it,” he added.