(Bloomberg) — European stocks rose on gains in Asia and Wall Street as investors bet the Federal Reserve would cut interest rates as early as March. Looks like it’s poised to move higher after the holidays.

Most Read Articles on Bloomberg

Euro STOXX futures rose 0.6%. The gains came after the MSCI Asia-Pacific index rose as much as 1.1% to close at a four-month high. Hong Kong stocks led the rally, as the Chinese government softened its stance on the gaming industry, with Chinese tech companies rebounding after falling stocks due to proposed regulations.

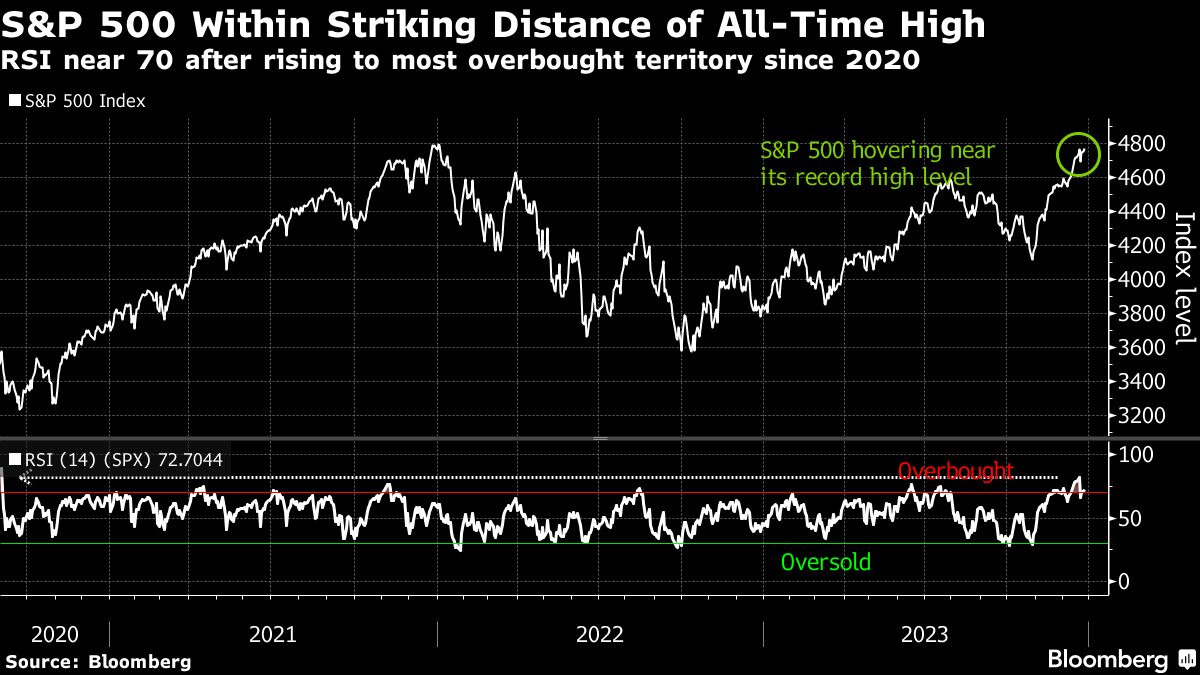

U.S. futures were nearly flat after the S&P 500 index closed Tuesday, coming within 0.5% of the record high reached early last year when interest rates remained at pandemic lows. . Meanwhile, 10-year U.S. Treasury yields fell 2 basis points in Asian trading after Tuesday’s auction attracted buyers as market prices moved toward the Fed’s aggressive easing path in 2024. The dollar is stable against most major currencies.

“Recent trends in Asia are likely to continue. U.S. markets should rebound for the rest of the week,” said Redmond Wong, a strategist at Saxo Capital Markets in Hong Kong. “However, China and Hong Kong are likely to continue to lag, and Hong Kong’s gains may be short-lived.”

Australia’s S&P/ASX 200 index rose to its highest since April 2022 as miners’ profits rose on higher iron ore prices as markets reopened after a long weekend. Mainland stocks rebounded from early losses after data showed the country’s industrial profits are growing faster, supported by favorable base effects.

Japan’s Nikkei 225 index rose more than 1% and remains just below its previous high in July after Bank of Japan board members discussed the potential timing of ending negative interest rate policy at a meeting last week. Several members expressed the view that there was no need to rush the policy. After the summary was announced, the yen depreciated and government bond yields fell.

“Japanese stocks don’t have any special blind spots, so bullish views are predominant among investors heading into the end of the year,” said Masanari Takada, derivatives strategist at JPMorgan Securities. While it was a risk for top-down traders, today’s Bank of Japan summary results provided reassurance. ”

In Hong Kong, major tech stocks partially recovered from Friday’s $80 billion plunge after authorities said they intend to ease controversial new gaming regulations. Tencent rose as much as 6.2%, while smaller rival NetEase rose more than 14%.

U.S. stocks are up 4.5% so far this month, and are now up 24% since the beginning of the year. MSCI’s national indexes are down 4.5% from their November 2021 record, while the US and Australian indexes are near record highs and India’s index has been hovering near record highs since the beginning of this month. Asia is a laggard, with the MSCI Asia-Pacific index still 25% off its February 2021 high.

Elsewhere, oil prices rose on rising tensions in the Middle East, reversing gains as new attacks on ships in the Red Sea prompted ships to avoid key shipping lanes. Gold falls, Bitcoin falls as traders assess how crypto markets will react if regulators meet expectations by approving the first U.S. exchange-traded fund to invest directly in cryptocurrencies It later rose slightly.

In the corporate world, SoftBank Group Corp. announced it would receive $7.6 billion in T-Mobile US stock at no additional cost, marking its biggest intraday gain since June 13.

This week’s main events:

-

Japan’s industrial production, retail sales, Thursday

-

U.S. wholesale inventories, new unemployment claims, Thursday

-

House prices across the UK, Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 6:47 a.m. London time.

-

Nasdaq 100 futures little changed

-

Japan’s TOPIX rose 1.1%

-

Hong Kong’s Hang Seng rose 1.8%

-

The Shanghai Composite rose 0.5%.

-

Euro Stoxx50 futures rose 0.6%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.1043.

-

The Japanese yen fell 0.2% to 142.64 yen to the dollar.

-

The offshore yuan was little changed at 7.1487 yuan to the dollar.

-

The Australian dollar rose 0.1% to $0.6832.

-

The British pound was almost unchanged at $1.2730.

cryptocurrency

-

Bitcoin rose 0.3% to $42,483.22

-

Ether rose 0.2% to $2,228.65

bond

-

The 10-year Treasury yield fell 2 basis points to 3.87%.

-

Japan’s 10-year bond yield fell 3.5 basis points to 0.595%.

-

The Australian 10-year bond yield fell 4 basis points to 3.97%.

merchandise

-

West Texas Intermediate crude oil is little changed.

-

Spot gold fell 0.1% to $2,065.30 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Akemi Terukina and Joanna Osinger.

Most Read Articles on Bloomberg Businessweek

©2023 Bloomberg LP