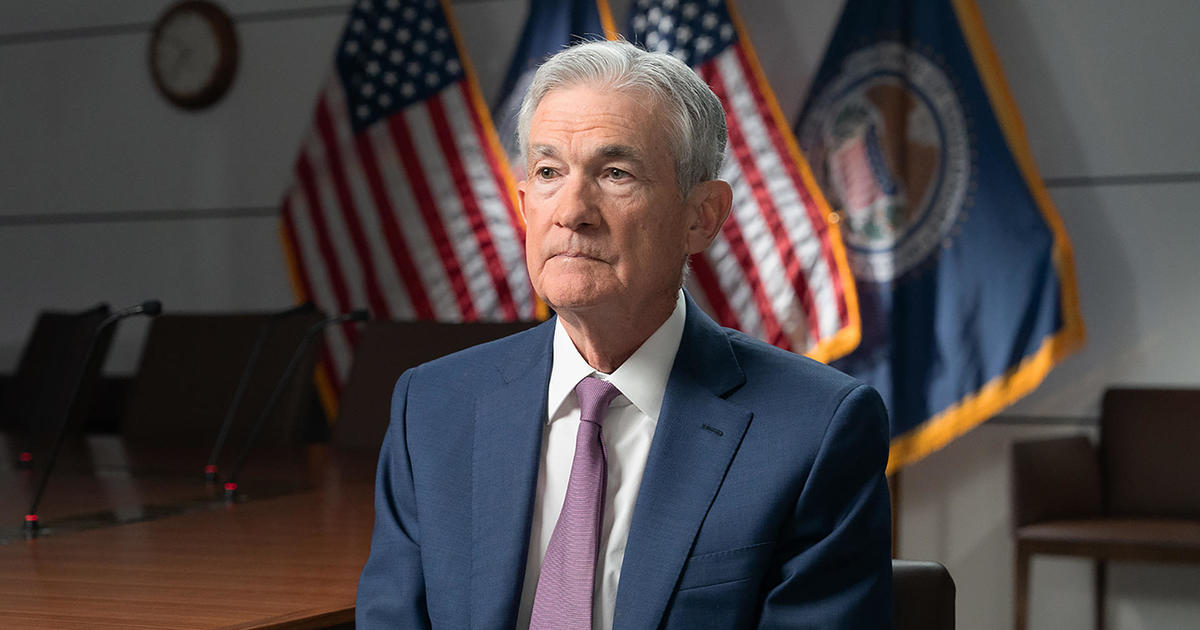

This week on 60 Minutes, Scott Perry spoke with the Federal Reserve Chairman: Jerome Powelland discussed the state of the U.S. economy after record inflation rates in 40 years caused the Federal Reserve to raise interest rates 11 times and cool the economy.

Over the past 11 months, inflation has fallen steadily and employment is nearing a 50-year high. Despite these trends, Chairman Powell announced last week that the Fed would keep the federal interest rate unchanged at 5.25% to 5.50% for the foreseeable future. But Chairman Powell told 60 Minutes that he expects to cut rates by the end of the year.

“Our confidence is rising,” he told 60 Minutes correspondent Scott Pelley in the Federal Reserve Boardroom. “Nearly all of the 19 participants around this table believe it is most likely appropriate to lower the federal funds rate this year.”

Powell also discussed the Federal Reserve’s study of the impact of artificial intelligence on the economy, new regulations to prevent failures like those of Silicon Valley banks, and the failure of Bank C.Hina Evergrandea Chinese real estate company with a large amount of debt.

cyber security

Scott Pelley asked Powell about the threat of cyberattacks on the U.S. banking system. Powell said that adequate defense requires constant vigilance and funding to counter the latest threats, and that the Fed has a role to play in helping banks achieve that goal.

“Offensive players are always improving their game, and defensive players have to constantly improve their game,” he explained. “You have to keep investing and keep catching up or keep moving forward. It never stops.”

Silicon Valley bank failure

In March 2023, silicon valley bank It suddenly closed after customers withdrew billions of dollars in a matter of hours. It was a classic bank run, but social media and mobile banking helped.

Powell said the Fed needs to do a better job of supervising banks and is working on proposed regulations in hopes of preventing another SVB scenario from happening again.

“We have spent a lot of time thinking about how to adapt the regulations to the modern situation, where installations can happen much faster than they did 20 years ago,” the chairman explained.

China Evergrande and the Chinese economy

This month, a Hong Kong court ordered China Evergrande, once China’s most dominant real estate company, into liquidation for failing to restructure $300 billion in debt owed to banks and bondholders. Of this debt, $25.4 billion was owed to foreign creditors. Many other real estate developers in China also have large amounts of debt.

“The Chinese economy clearly faces some challenges right now,” Powell told Perry. “It’s still too tied to things like real estate investing.”

Powell said that although the United States buys manufactured goods from China, it is not financially connected to the Chinese economy to the extent that it would be a shock at this point.

“Unless what’s happening in China leads to a major disruption, you might feel it a little bit, but it shouldn’t be a huge disruption,” he said.

war and the world economy

Mr. Perry asked Mr. Powell what he thought was the biggest threat to the global economy. He said “geopolitical risks” such as wars in Ukraine and the Middle East were the biggest risk to stability.

Powell said the United States, at least for now, is not feeling the effects of the war in Ukraine or the diversion of ships in the Red Sea by Houthi missiles fired from Yemen. These conflicts could worsen and impact the U.S. economy.

“The question will be, ‘Will those risks actually develop into significant economic problems?’ That hasn’t happened yet,” he said.

“It could be oil prices. It could just be an escalation of conflict and the blow that shakes public confidence. But we don’t see that yet. That’s a risk. It’s a real risk and one that we’re working on.” I understand that there is a risk. ”

Immigration and the job market

Powell said the U.S. economy created a desperate labor shortage when millions of Americans left the workforce during the pandemic. He said the Fed expected many of them to return to work in 2022, but that didn’t happen.

However, in 2023, immigration will increase to pre-pandemic levels and labor supply will increase significantly due to an increase in the number of workers in their prime years, he said. Powell told Perry that these are important factors that help stabilize the labor market.

Powell stressed that the Fed does not make decisions or comment on immigration policy, but was nonetheless keen to point out the positive role immigrants have played in this case.

“The American economy has benefited from immigration,” Powell said. “And frankly, just in the last year, a big part of the story of the labor market coming back to better balance is that immigration has returned to typical pre-pandemic levels. ”

Artificial intelligence research

In December, 60 Minutes cameras tracked Mr. Powell to Spelman College in Atlanta, Georgia, where he spoke to students and answered questions about his work at the Federal Reserve. He also hosted a technology roundtable with minority entrepreneurs.

Perry then asked Powell what kind of research the Fed is doing on artificial intelligence to understand its impact on the U.S. economy.

“In the short term, the question is: ‘Will artificial intelligence… enable jobs, encourage jobs, make workers more productive and earn higher wages, or will it replace workers? Or are we going to do a part of each?’” he explained.

He also said the Fed wants to better understand how artificial intelligence will affect the economy over the long term.

“What is the impact on productivity, employment, the distribution of wealth and income? That’s what we’re thinking about.”

The video above was edited by Will Croxton.