The Indian company also challenged Sony’s claims to the Singapore International Arbitration Center that it had breached its obligations under the merger agreement. Sony had filed suit in a Singapore court seeking a $90 million termination fee for Gee’s failure to fulfill the terms of the merger.

In a regulatory filing, Mr. Gee denied that Sony had the right to terminate the merger agreement and said the request for a termination fee was not legally acceptable. It alleged that Sony has failed in its obligation to give effect to and execute the merger approved by the NCLT. The government had approached NCLT “seeking direction to implement the merger”. “While this action is not surprising, there is no substantive reason for NCLT to rule in favor of Zee and force the merger,” the founder of InGovern Research Services said. Shriram Subramanian he told Reuters.

According to people familiar with the matter, Gee and Sony individually and jointly failed to meet 22 merger conditions. However, the two sides had different opinions on who would run the merged entity. Sony did not want Mr. Geonka to lead the combined company after he became the subject of a regulatory investigation by Mr. Sebi.

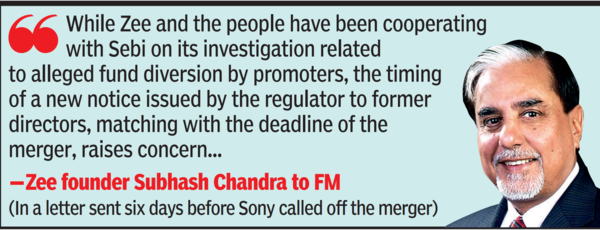

Goenka’s father, Ji Subhash Chandra It accused market regulators of trying to block the merger. In a letter to Finance Minister Nirmala Sitharaman six days before Sony called off the merger, Chandra said, “Zee and the Nation have been cooperating with Sebi in its investigation into the alleged misappropriation of funds by the promoters, but the new notification… The timing is yet to be decided.” Documents issued by the regulator to former directors in time for the merger deadline have raised concerns. ”

He pointed out that the notification did not even contain any new findings. “I am not saying that if Sebi has any suspicions it should not investigate…Issuing a notice at this stage seems to be an act to sensationalize the issue. ” Chandra further said, “If the mentioned parties, especially Mr. Sebi, continue to influence the investigation, it will result in significant financial loss to the minority shareholders of the company.”

Separately, Sony said in an internal email to employees on Wednesday that it will continue to pursue opportunities, including M&A, to strengthen its presence in India.