There are several key differences between the tech-stock rally of this year and that of 2021, even as the euphoria has similarities with the last wave, Goldman Sachs’s top stock-market strategist says.

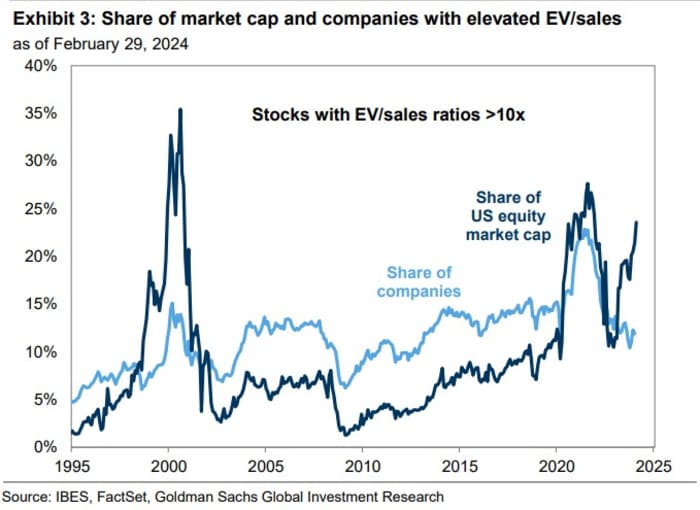

David Kostin, in a note to clients, says companies that have an enterprise value-to-sales ratio of at least 10 account for 24% of the total U.S. stock market cap, versus 28% in 2021 and 35% in the late 90s tech bubble.

But Kostin notes the number of stocks with those elevated valuation ratios has declined very sharply. “Unlike the broad-based ‘growth at any cost’ in 2021, investors are mostly paying high valuations for the largest growth stocks in the index. This dynamic more closely resembles the Tech Bubble than 2021. However, in contrast with the late ’90s, we believe the valuation of the Magnificent 7 is currently supported by their fundamentals,” he says, a reference to the grouping of Microsoft

MSFT,

Apple

AAPL,

Nvidia

NVDA,

Alphabet

GOOGL,

Amazon.com

AMZN,

Meta Platforms

META,

and Tesla

TSLA,

Another big difference between now and 2021 is the cost of capital — the implied weighted average cost of capital of the S&P 500

SPX

fell to 3.8% in 2021, versus 5.7% today, which in turn has focused investors on profitability. The higher cost of capital also has translated into small-cap underperformance, which is another difference from the 2021 experience.

They expect the cost of capital to remain above the average of the past decade, which means the valuations of small and unprofitable growth stocks are unlikely to return to 2021 levels, says Kostin.