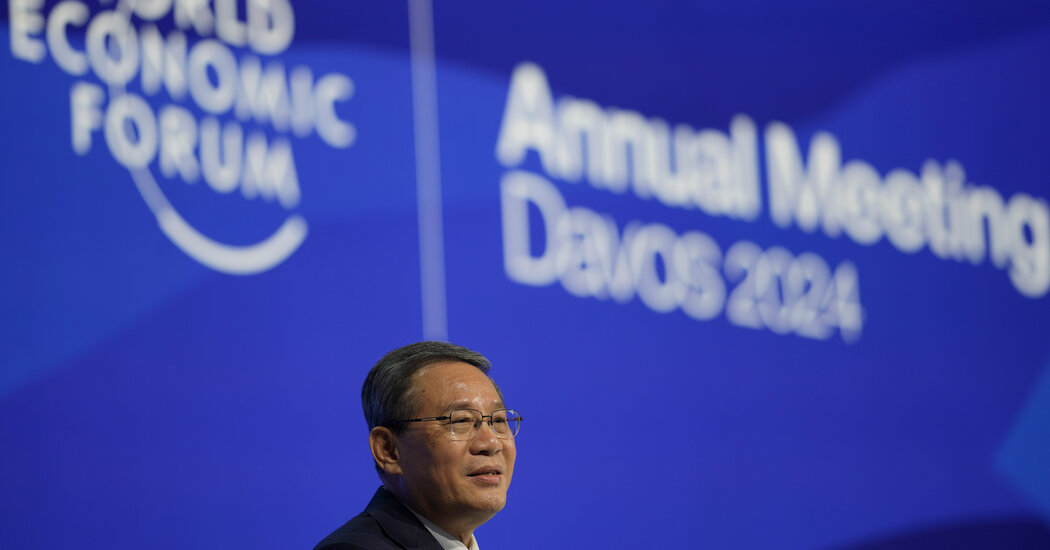

China’s No. 2 leader, Li Qiang, visited Switzerland with a message for the business giants gathered at the World Economic Forum.

“Choosing the Chinese market is not a risk, but an opportunity,” Chinese Premier Li told an audience at Davos on Tuesday.

However, there are different feelings about developments in the Chinese stock market, which are less optimistic. Concerns about China’s economy have been evident in Hong Kong for months, with stock prices falling 14% last year, the fourth straight year of declines.

There is no sense of relief in the new year, with economic data released by China on Wednesday prompting further selling.

In Hong Kong, where many of China’s biggest companies trade, stock prices fell 3.7% on Wednesday. So far this year, the market has lost a tenth of its value. Stock prices in Shanghai, China’s financial capital, fell 2.1%, extending this year’s decline to nearly 5%.

China said its economic growth rate of 5.2% in 2023 is high by most standards, but the economy is undergoing major changes. Chinese leaders are seeking to reduce reliance on borrowed money while also pulling the country out of real estate and construction, long the pillars of growth.

The consumption boom that was expected after China changed its “zero coronavirus” policy at the end of 2022 also did not pan out.

A declining population and an aging workforce are adding to the headwinds. China said Wednesday its population is shrinking by 2 million people and aging rapidly, putting further strain on its already fragile health system and underfunded national pension.

Economists at Capital Economics said in a note that while China’s economy has shown some recent improvement, “the recovery clearly remains fragile.”

Real estate and consumer companies are among those hit hardest by the decline in Hong Kong, which has long been a gateway for foreign investors looking to put money into mainland China. Chinese real estate developer Longfor Group fell 6.8% and Chinese delivery service Meituan fell 7%.

While U.S. stocks have been flat so far this year, Japanese stocks have soared, rising more than 6%.

Many investors are hoping China will jump-start the economy with a massive stimulus package, as it has done in the past during times of economic stress, but policymakers say this time will be different.

Qiang reiterated this negative stance in his speech at the World Economic Forum. “We are firmly committed to avoiding large-scale stimulus, and we have not pursued short-term growth at the expense of long-term risk accumulation,” he said.