On April 9, the board of trustees of the Science Based Targets initiative (SBTi) announced forthcoming updates to its net zero standard, proposing to allow the use of some environmental attribute certificates (EACs), including carbon credits, towards Scope 3 abatement. Since then, climate watchdogs both within and beyond SBTi have hotly debated whether the new flexibility will maintain best practices in corporate climate action. At the heart of the debate is the role of carbon credits in corporate net zero plans, and whether they accelerate or delay global decarbonization.

The announcement comes as companies are falling 1.4 gigatons of carbon dioxide (GtCO2) short of their current annual Scope 3 emission reduction targets under the existing SBTi net zero guidelines. That gap threatens to grow to over 7 GtCO2 of unabated Scope 3 emissions by 2030, according to a recent analysis from MSCI Carbon Markets, one of the most influential carbon market analysis firms.

SBTi’s announcement included no details regarding what types of credits will count, what portion of Scope 3 emissions will qualify for EAC abatement, the timeline during which companies can use the flexibility, nor what requirements companies will need to meet before engaging with the more flexible standard. That makes it impossible to say exactly how the update will affect corporate climate strategy and carbon markets; but here are four plausible outcomes of increasing flexibility in Scope 3 abatement rules, based on recent carbon market models and announcements.

A rise in corporate climate target-setting

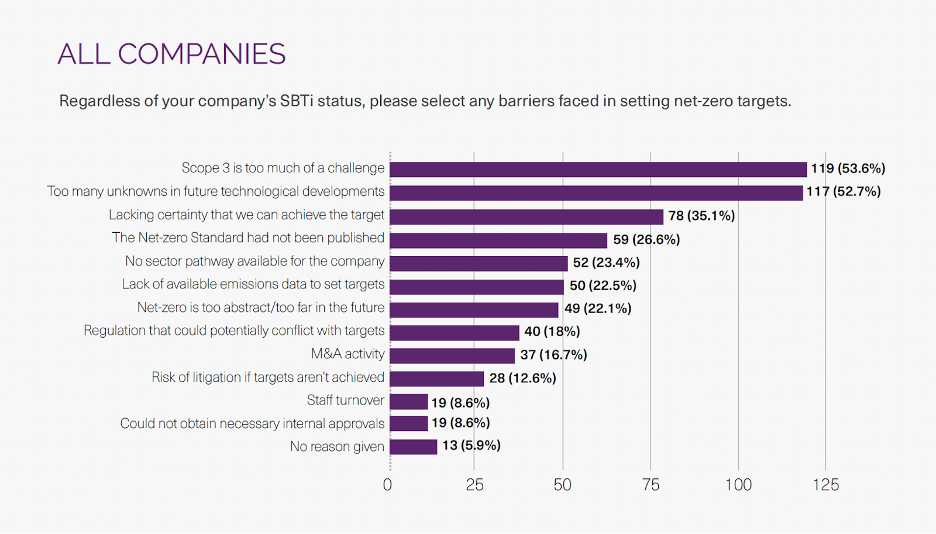

Meeting Scope 3 decarbonization goals has been the biggest barrier to companies looking to set SBTi net zero targets, according to research from SBTi.

The new framework provides additional paths to corporate climate action under the SBTi standard. This could “eventually lead to a new wave of firms making commitments” as the new rules “provide a more realistic way for (firms) to keep track of their Scope 3 emissions targets,” according to Guy Turner, head of MSCI Carbon Markets.

Greater flexibility on Scope 3 abatement would expand in SBTi’s roster of companies with validated targets growing by as much as 20 percent, according to one model from MSCI, although the real impact will depend on the specifics of the finalized rules.

More than $19 billion in new investment into carbon markets

Including carbon credits as an additional tool for Scope 3 abatement could drive billions of dollars towards climate projects on the voluntary carbon market that restore nature, reduce emissions and capture carbon, helping to close the climate finance gap.

That additional finance would reach as high as $19 billion in the near term, and north of $65 billion by 2030, according to MSCI.

The model assumed that only companies on track to meet their Scope 1 and 2 targets would qualify for the Scope 3 flexibility, and that those companies could use carbon credits to meet 100 percent of their Scope 3 reduction shortfalls. The actual capital flows will depend on the details in the new guidelines.

More diverse carbon project types

SBTi’s announcement noted that the forthcoming rule updates will allow the use of “environmental attribute certificates” (EACs) to abate some Scope 3 emissions. According to previous statements from SBTi, EACs include carbon credits based on emission reductions. The current net zero standard permits only limited use of carbon credits that remove carbon from the atmosphere and does not permit companies to use any reduction-based carbon credits to meet near-term or net zero targets.

Carbon projects that reduce emissions include those that improve fuel efficiency, reduce methane leaks from waste processing and provide low-emission cookstoves. It’s unclear whether SBTi’s EAC definition will also encompass credits from carbon projects that avoid emissions, such as REDD+ projects, which help to protect standing forests.

Inclusion of emission reduction and avoidance credits for interim targets on the path to net zero would align with the Voluntary Carbon Market Integrity Initiative’s (VCMI) beta Scope 3 flexibility claim, published in November. VCMI, a non-profit established in 2021 to provide guidance on Paris Agreement-aligned carbon credit use, endorsed SBTi’s proposal to permit greater flexibility on Scope 3 abatement.

Other standards-setters will validate carbon credit quality

The SBTi board’s announcement emphasized the importance of high quality standards for any carbon credits used for Scope 3 abatement, but stated that the organization would not itself validate credit quality. Instead, it noted that “other entities” are better positioned to do so.

Based on SBTi’s commitment at COP28 to collaborate more closely with other standard-setters, it’s likely that it will look to the Integrity Council for the Voluntary Carbon Market for those standards. ICVCM, a non-profit established in 2021 to provide carbon credit quality guidelines, also welcomed SBTi’s announcement last week.

The ICVCM published its Core Carbon Principles in 2023, detailing 10 elements of a high-quality carbon project. It has not yet approved specific carbon project methodologies that align with these principles, but plans to announce the first approved methodologies later this year.

The question at the heart of the net zero debate

The ramifications of SBTi’s net zero update rest entirely on the details of the forthcoming rules and the appetite of companies to work with the standard. It will be months until either factor is clear. While the updated rules draft is due in July, there’s no official timeline for when SBTi will finalize the updates.

At the core of last week’s flurry of announcements and debate regarding the forthcoming rule updates lies a fundamental question about how to advance global decarbonization: Does broadening the tent for what “counts” accelerate action, or allow us to kid ourselves about real progress?

Evidence from studies last year suggested the former — that companies using carbon credits decarbonize their own supply chains more quickly than their non-carbon buying counterparts. If that research bears out, the rule updates will likely precipitate a new wave of climate ambition while unlocking billions in climate finance.