(Bloomberg) — Italy’s government is considering selling up to a 10% stake in financial company Banca Monte dei Paschi di Siena SpA in a bid to reduce debt and promote consolidation in the banking sector.

The state, which owns about 39% of the bailed-out bank’s shares, is evaluating the move by accelerating bookbuilding and putting the shares on the market, similar to previous sales, according to people familiar with the discussions. That’s what it means. The sale could take place as early as April, the people said, but a final decision has not yet been made.

Prime Minister Giorgia Meloni is expected to announce the government’s latest economic goals and budget framework in early April, and the new sale of Paschi shares will underpin these goals and encourage European Union member states to improve their fiscal health. could help improve Italy’s position within the country. Although Italy’s budget deficit is decreasing, debt remains at 140% of economic output.

An Italian government spokesperson declined to comment.

Mr. Meloni is considering a new sale after the government’s previous lock-up period for a previous sale of the lender’s stake has expired, the people said, adding that no final decision has yet been made. . Italian newspaper MF earlier reported that the state was considering selling an additional 10% by May 20.

Roma continues to work on merging Paschi, the world’s oldest bank, with similar banks, and selling a relatively small stake now would make the remaining holdings cheaper for potential buyers. The person was deaf and spoke on condition of anonymity. It’s confidential.

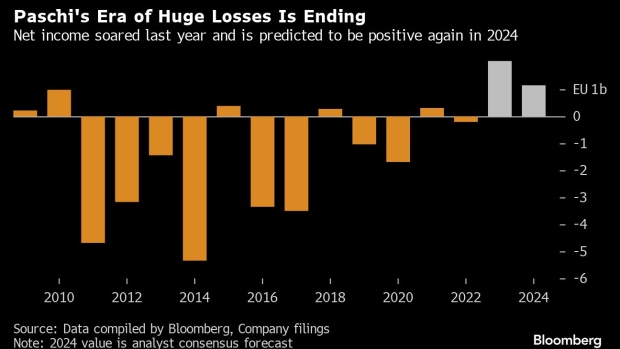

The final decision will depend on market opportunities, the people said, adding that Paschi’s recent strong performance could ease the sale process. The government has announced that it plans to sell all of its holdings by the end of this year, in line with its agreement with the EU.

Italy has been searching for an exit strategy for years, including selling about 25% of its financial institution for about 920 million euros ($1 billion) last year and a failed merger bid with UniCredit.

Paschi, founded in 1472, was first bailed out by the state 15 years ago after a deterioration in loans and derivatives trading took a toll. For the next ten years, he struggled to achieve stable profits as there was limited room for strategy under the conditions set by the EU.

CEO Luigi Rovaglio signaled significant progress in making Paschi even more attractive to investors after a restructuring and years of reorganization. The bank announced earlier this month that it would pay its first dividend in 13 years.

–With assistance from Jeff Black.

©2024 Bloomberg LP