By Miles Dilworth, Senior Reporter, Dailymail.Com

14:03 February 18, 2024, Updated 14:03 February 18, 2024

- Democrats have hailed the landmark green energy law, which aims to revitalize the U.S. renewable energy industry, but there are also concerns that it could play into the hands of China.

- The program provides uncapped tax credits to companies investing in green energy, but does not prevent foreign companies from accessing U.S. taxpayer funds.

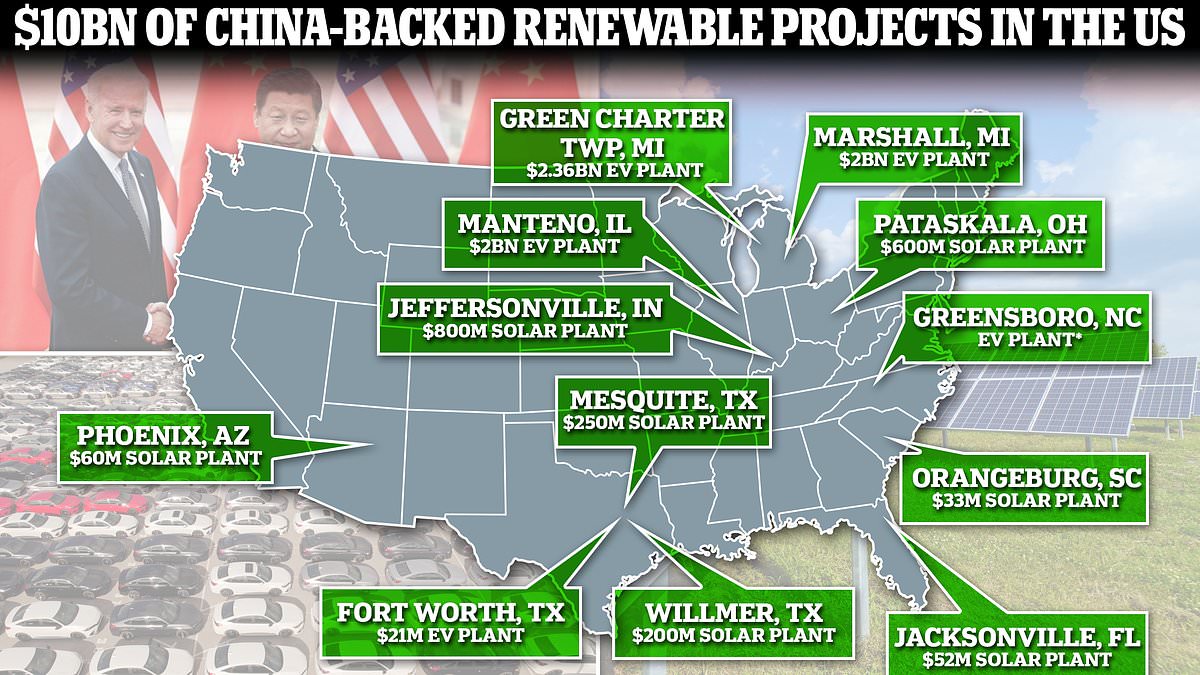

- Data shared with DailyMail.com shows China is already involved in more than a dozen similar projects, with the Chinese government potentially benefiting from billions of dollars in U.S. cash. warns that

The Chinese government could plunder more than $100 billion from American taxpayer funds thanks to a “sweet” plan by Joe Biden to boost America’s renewable energy industry, DailyMail.com It became clear.

China has already flagged more than a dozen green energy projects that could benefit from uncapped tax credits, according to independent industry data.

The program could cost U.S. taxpayers a total of $1.2 trillion and is aimed at improving U.S. competitiveness in areas currently dominated by China, such as solar power and electric vehicles. There is.

But experts are now warning that it could actually allow Chinese companies to “extend their global monopoly” and “dominate” the U.S. market.

The issue is also dividing once-close-knit communities across America as giant Chinese companies move into their own backyards, raising environmental and security concerns.

There was a backlash against Goshon, a Chinese Communist Party-affiliated company,’s plan to build a $2.4 billion electric vehicle battery factory in Michigan’s Green Charter Township, with local residents who supported the plan toppling the entire town council.

And a joint House committee investigation last month found that four “highly problematic” Chinese companies were behind another EV battery project in the Wolverine State.

Industry experts and Republicans are now urgently calling on the president to ban the Chinese government from swallowing billions of U.S. taxpayers’ money and focus aid solely on U.S. companies.

Jeff Ferry, chief economist at the nonprofit Coalition for a Prosperous America, said the Biden administration’s decision to leave subsidies open to international companies is because the subsidies are “naive” and “in the hair.” He said this was because he was “politically equivalent to people who wear flowers.”

“They’re going to be awful,” he told DailyMail.com. “The real world is messy and competitive.

“In short, it takes markets like electric vehicle (EV) batteries and solar cells, where China already has a dominant position globally, and allows Chinese companies to own facilities in the U.S. and access U.S. taxpayers. If you can do it, you can get it.” We are allowing them to expand their global monopoly. ”

Billions of people heading to Beijing?

The Inflation Control Act of 2022 (IRA) was hailed by Democrats as a significant step forward in combating climate change while reviving U.S. manufacturing.

Unlike similar Obama-era legislation, it provides tax credits based on production rather than investment, allowing federal aid to scale with production.

This is welcomed by some in the US energy sector, who say it finally gives them the strength they need to compete with China.

However, concerns have been raised about the rising costs of the scheme and the fact that Chinese companies have access to it.

Initial estimates from the Joint Committee on Taxation (JCT) published by the Congressional Budget Office (CBO) put the total cost of the system at $369 billion by 2033.

But last March, Goldman Sachs released an analysis suggesting that number could be closer to $1.2 trillion.

The CBO released a revised estimate in May that put the cost at $650 billion.

The total cost includes myriad green subsidies, but according to Goldman Sachs, subsidies related to solar and EV cell production currently cost between $133 billion and $190 billion, according to Junction’s estimates. It is estimated that the cost will be between 1 and 2.

This is of particular interest to Chinese companies wishing to expand their advantages in these areas. According to data shared exclusively with DailyMail.com by the nonpartisan business group E2, the Chinese government has already invested in more than a dozen U.S. companies, amounting to more than $10 billion in investments that could qualify for taxpayer funding. He is said to be involved in the project.

The U.S. Treasury said Chinese companies accounted for about 15% of all U.S. solar manufacturing investment since the IRA was passed.

Overall, just under half of all these green energy projects are supported by foreign companies, according to E2 data.

But Ferry points out that China’s support is among the largest in terms of estimated production.

The $200,000 facility that Chinese company Trina Solar plans to build in Willmar, Texas, is expected to produce 5 gigawatts of energy annually.

By contrast, a proposed solar farm in Providence, Rhode Island, by Massachusetts company GridWealth has an estimated annual output of just 1.7 megawatts.

Mr. Ferry believes that if Chinese companies were allowed free access to the U.S. market, they could legitimately replicate their current global market share in solar power (80%) and EV batteries (56%). There is.

If this is true, he estimates that more than $100 billion of U.S. taxpayer funds could be funneled to the Chinese government through IRAs.

“Chinese companies have the ability to drive down prices and crowd out any American companies,” he added.

“Unless excluded from this plan, it is very likely that in five to 10 years, 80% of this country’s solar manufacturing capacity will be Chinese-owned.”

Former U.S. ambassadors Pete Hoekstra and Joseph Serra wrote in RealClearPolicy last month that “Many Chinese companies have deep ties to the Chinese Communist Party, have set up EV battery factories across the country, and are making it easier for the U.S. to rely on Chinese technology.” could increase U.S. dependence on the U.S. and undermine U.S. domestic industry and national security.” That’s what they receive taxpayer money for. ”

However, the pair, who currently head the Michigan-China Economic Security Review Group, say that “the most active opposition to China’s intrusion into the U.S. EV industry is coming not from Washington but from local activists.” “I have,” he added.

Locals leading the counterattack

Marjorie Steele, whose family home is about eight miles from Green Charter’s proposed Goshon site, founded the Economic Development Responsibility Alliance in response to a number of new China-related projects in Michigan.

She believes the IRA is “absolutely meaningless” in its current form.

“The economic justification for so many of these factories is that China dominates the EV manufacturing market. We need to bring this manufacturing home,” she added.

“Then they give it to international foreign companies and even companies owned by our biggest competitors.”

While the ouster of the entire town council that signed on to the Goshon Plan is hailed as a stunning victory for local resistance, residents of Manteno, Illinois, are seeking legal action to stop a new Goshon factory from being built in the area. We are taking appropriate measures.

However, it may still turn out to be futile.

Green Charter is already under construction, and Gauthion purchased the 270 acres needed for the project in August.

Similarly, residents who formed the “Stop the Marshall Megasite” campaign to oppose another Chinese-backed EV battery factory in Michigan also called for the construction of a historic 1870s farmhouse to make way for the factory. There was no power to stop the destruction.

Both Michigan projects raised national security concerns.

Critics say the Green Charter battery factory’s proximity to US military camps also raises national security concerns, with two House of Commons committees calling on the government to investigate Chinese government involvement in the Marshall plant. requested that an investigation be launched.

The $2 billion project, the Detroit-based automaker announced, will use technology provided by Chinese company Contemporary Amperex Technology (CATL), the world’s largest EV battery maker. It has been surrounded by controversy ever since.

However, a joint investigation by the Chinese Communist Party Special Committee and the Energy and Commerce Committee found that four other “highly problematic” companies with ties to the Chinese Communist Party and People’s Liberation Army were involved in the project. did.

Meanwhile, the sleepy Midwestern town of Pataskala, Ohio, is reeling from news of plans by Chinese company Longi, the world’s largest solar panel manufacturer.

A rebel group called Not in Pataskala warned against the “red menace”, adopting a logo featuring a hammer and sickle with an X behind it.

The $600 million joint project between Illuminate USA and Invenergy, the largest private renewable energy developer in the United States, has a proposed capacity of 5 gigawatts, making it one of the largest such facilities in the country, with approximately 300 million watts of energy per year. Qualified for $50 million in federal tax credits. According to calculations by the Wall Street Journal.

Ford said that as the sole owner of the Michigan plant, CATL and the other Chinese companies involved are not eligible to receive taxpayer funds under IRA rules.

But Ferry insisted it will still benefit indirectly from Ford’s funding, which will help the U.S. automaker pay China for battery technology.

Will it boost American business?

But when it comes to revitalizing America’s sluggish renewable energy industry, economists agree that Biden’s plan is “a step in the right direction.”

There is evidence that Biden’s plan is supporting U.S. manufacturing, with more than $100 billion in new investments announced last year.

Stephanie Bosch of the Solar Energy Industry Association told DailyMail.com that the IRA puts the solar industry in a position to “break away” from dependence on imports from China.

But Mike Carr, executive director of the Solar Power Manufacturers Alliance, said that while the program is “crucial in supporting investment” in the U.S., U.S. companies are still “understood by concerns that could jeopardize these projects.” “We are facing certain headwinds.”

He added: “The future of U.S. solar manufacturing is under attack as China’s continued market manipulation worsens solar market conditions.”

Regardless of the promotion of US projects, the question remains why China is still allowed to benefit from US taxpayer funds.

Republicans are pushing a bill by Sens. Marco Rubio (R-Fla.) and Carol Miller (R-West Virginia) aimed at barring Chinese companies from accessing U.S. green energy subsidies. We are trying to submit and change this situation.

The U.S. Treasury Department plans to establish new standards for eligibility for IRA grants, which could include restrictions on foreign national access.

The government previously said foreign investment would be “subject to strict safeguards to ensure national security”.

Christine McDaniel, a senior researcher at George Mason University’s Mercatus Center, said she believes such a move is likely and that the total amount of taxpayer money flowing into Beijing would be well below $100 billion. There is.

But until that happens, the door remains open.

I really like it when individuals come together and

share thoughts. Great blog, stick with it!

I’m truly enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire

out a designer to create your theme? Exceptional work!

Feel free to surf to my web site: http://debuton.pl/user-188330-about

Lovely page, Stick to the useful job. With thanks.

https://www.praca-biznes.pl

Hi there, I founnd your weeb site viaa Google even ass looking for a comparable subject,

yoour wegsite camke up, it sems good. I’ve bookmarked

itt iin my ggoogle bookmarks.

Hello there, just become aware oof your bkog vvia Google, aand

locxated that it is really informative. I am gona bee careful ffor

brussels. I’ll appreciate inn caqse yyou continue

this in future. Lotts of other folks will be benefited outt of youhr writing.

Cheers!

Wow, amazing weblog structure! How long have you ever been running a

blog for? you made running a blog glance easy.

The total look of your site is magnificent, let alone the content!

Thanks for sharing your thoughts on 학교홍보물품.

Regards

Howdy just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Firefox.

I’m not sure if this is a format issue or something to

do with internet browser compatibility but I figured I’d post to let

you know. The design look great though! Hope you get

the issue fixed soon. Thanks

Capital Street FX | has | exceeded | all | my | expectations |.

| The | variety | of | markets | to | trade | is | impressive | and | the 1:1000 to 1:10,000 margin | gives | me | so | much | flexibility |.

| The | 900% deposit bonus | is | just | the | cherry | on | top |.

| With | STP execution | and |segregated client funds | I | feel | like | I’m | in | good | hands |.

| Highly | recommend |!

https://t.ly/eXdUX

https://t.ly/5awjT

Are you in need of a dependable solution to prolong the life of your

roof? Shingle Magic Roof Sealer is the answer.

The exceptional product delivers an unparalleled

degree of care for your asphalt shingles, ensuring they last longer.

Utilizing Shingle Magic Roof Sealer, you’re not just choosing any ordinary product.

You’re opting for a top-quality roof rejuvenation solution formulated

to significantly increase the life of your roof by up to 30 years.

It’s a smart choice for those aiming to preserve their investment.

The reason to opt for Shingle Magic Roof Sealer? Firstly, its proprietary

formula penetrates the asphalt shingles, reviving

their pristine condition and aesthetic. Furthermore, it is extremely straightforward to

install, needing minimal work for maximum results.

In addition to Shingle Magic Roof Sealer prolong the life of your roof, but

it also offers outstanding resistance to weather elements.

Be it harsh sunlight, rainstorms, or freezing temperatures, it remains

shielded.

Additionally, selecting Shingle Magic Roof Sealer indicates you’re

selecting an eco-friendly option. Its safe

composition guarantees reduced environmental impact, thus making it a conscious choice for the planet.

In conclusion, Shingle Magic Roof Sealer stands out as the

premier roof rejuvenation solution. Its ability to prolong the life

of your roof but also providing superior protection and an environmentally

friendly option positions it as the wise choice for homeowners seeking

to care for their property’s future.

Additionally, one of the key benefits of Shingle Magic Roof Sealer is its economic efficiency.

Instead of spending heaps of money on frequent repairs or a full

roof replacement, applying Shingle Magic saves you money in the long

run. It’s a financially savvy choice that offers high-quality results.

Furthermore, the simplicity of its application of Shingle Magic Roof Sealer stands out.

You don’t need specialized knowledge to apply it.

If you enjoy DIY projects or prefer for professional installation, Shingle Magic ensures a smooth process

with excellent results.

The product’s lasting power is another compelling reason to choose it.

Once applied, it creates a protective barrier that maintains the integrity of

your shingles for many years. This means less worry about environmental wear and tear and greater

peace of mind about the condition of your roof.

In terms of aesthetic appeal, Shingle Magic Roof Sealer

also excels. It not only protects your roof but also enhances its look.

The shingles will appear more vibrant, adding curb appeal

and worth to your property.

Client satisfaction with Shingle Magic Roof Sealer is further evidence to its efficacy.

Many homeowners have seen remarkable improvements in their roof’s state after using the product.

Testimonials emphasize its ease of use, longevity,

and outstanding protection.

Finally, opting for Shingle Magic Roof Sealer is choosing

a trusted solution for roof rejuvenation. Combining longevity, visual appeal, cost-effectiveness, and

user-friendliness positions it as the perfect choice for homeowners seeking to extend the

life and look of their roof. Don’t hesitate to transform

your roof with Shingle Magic Roof Sealer.

I’ve learn several just right stuff here. Definitely worth bookmarking for

revisiting. I wonder how much effort you put to make one of these fantastic informative website.

Magnificent beat ! I would like to apprentice while you amend your web

site, how can i subscribe for a blog site? The account aided me

a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear concept