-

Michael Hartnett, Bank of America’s chief investment strategist, said in a new note that Nvidia is now worth as much as the entire Chinese stock market.

-

The company has a market capitalization of $1.7 trillion, the same as all Chinese companies listed on the Hong Kong Stock Exchange.

-

Nvidia stock has soared 239% in 2023 and 41% in 2024 through Thursday.

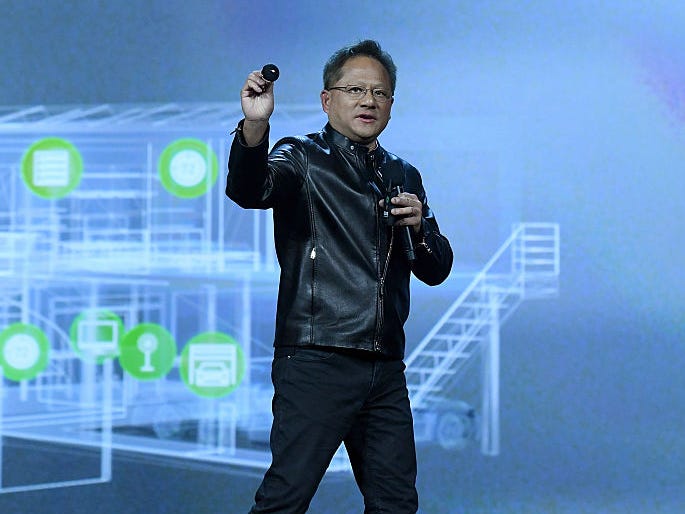

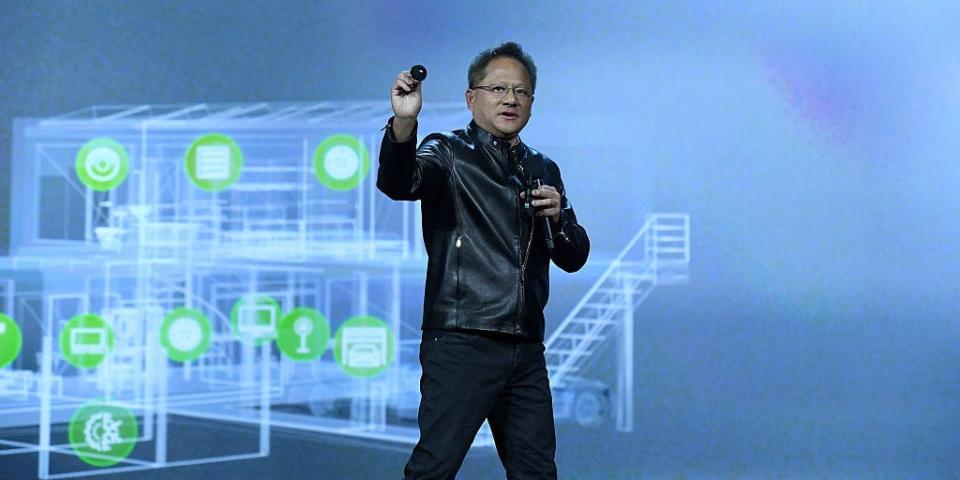

Nvidia has grown at an astonishing pace, reaching a valuation comparable to the entire Chinese stock market.

In a new Bank of America research note, chief investment strategist Michael Harnett says Nvidia’s $600 billion jump in value over the past two months has pushed its market cap to $1.7 trillion. It pointed out that this boost has brought it on par with all Chinese companies listed on Hong Kong stock exchanges. Combined exchange.

The semiconductor giant’s market capitalization has nearly quadrupled since the beginning of last year. The company’s stock price soared 239% in 2023 and is up 41% this year alone through Thursday. Only four publicly traded U.S. companies are worth more.

Meanwhile, stock prices have plummeted due to the slump in the Chinese economy. Slowing economic growth and a prolonged real estate crash are weighing on the market. The country has also been dealing with deflation. The Hang Seng Index, a benchmark for Chinese stocks listed in Hong Kong, has fallen 26% over the past year and 8% since the beginning of the year.

But Hartnett said there could be opportunities for investors who can identify Chinese stocks with strong management teams, balance sheets and strong earnings. He points to the precedent of the collapse of Japan’s Nikkei stock average in the early 1990s, after which a select group of 15 companies with these characteristics came together in a 400% bull market.

Read the original article on Business Insider