Nvidia stock was on track to close at a new all-time high on Monday. The company’s stock price rose despite reports that it was struggling to satisfy Chinese customers and U.S. regulators over chip exports.

If Nvidia can sustain its gains to the close, it would be the highest closing price since Nov. 20, 2023, when the stock closed at $504.09, according to Dow Jones Market Data. It is also the largest single-day increase since August last year.

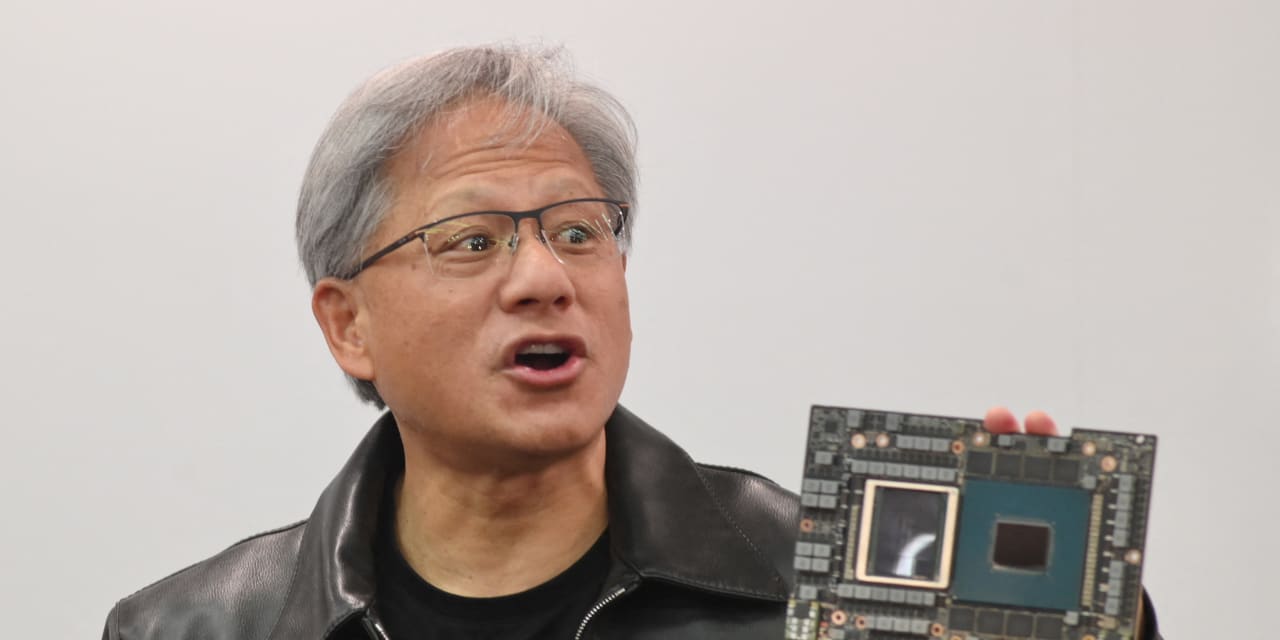

Nvidia’s stock price has hovered just below $500 in recent months after soaring in 2023 based on its dominance in graphics processing units used to train artificial intelligence models. This coincided with tightening US restrictions on exports of AI chips to China.

Nvidia is responding by planning a series of AI chips with limited functionality designed to comply with regulations, but this plan appears to be facing some challenges.

Advertisement – SCROLL TO CONTINUE

Chinese technology giants Alibaba Group and Tencent plan to order significantly fewer Nvidia chips this year than they had originally planned before the export ban went into effect, the Wall Street Journal reported on Sunday, people familiar with the matter said. It was reported as.

This could cast a shadow on Nvidia’s near-term order outlook, but the company has reiterated repeatedly that strong demand in other regions will fully offset the expected hit to sales in China from U.S. restrictions. It’s here.

Faced with possible future U.S. regulation and unwilling to be locked into dependence on Nvidia, Chinese companies may turn to domestic chip suppliers such as Huawei. According to the magazine, Huawei has received orders for at least 5,000 Ascend 910B chips from major Chinese internet companies in 2023.

Advertisement – SCROLL TO CONTINUE

But it is unclear whether Huawei will be able to provide enough advanced chips at scale to meet China’s AI development demands.

Testing could take place later this year, Reuters reported, citing people familiar with the matter, with Nvidia planning to begin mass production of its H20 AI chips for the Chinese market in the second quarter of this year. , the initial production volume is said to be limited.

“We are working with the U.S. government and following the government’s clear guidelines to ensure we deliver compliant product solutions to our customers around the world,” an NVIDIA spokesperson said in an emailed statement. .

Among other chip stocks, Advanced Micro Devices (which has also said it intends to develop chips specifically for the Chinese market) rose 3.6% on Monday. Meanwhile, Intel rose 3.6%.

Advertisement – SCROLL TO CONTINUE

It rose by 2.2%.

Email Adam Clark at adam.clark@barrons.com.