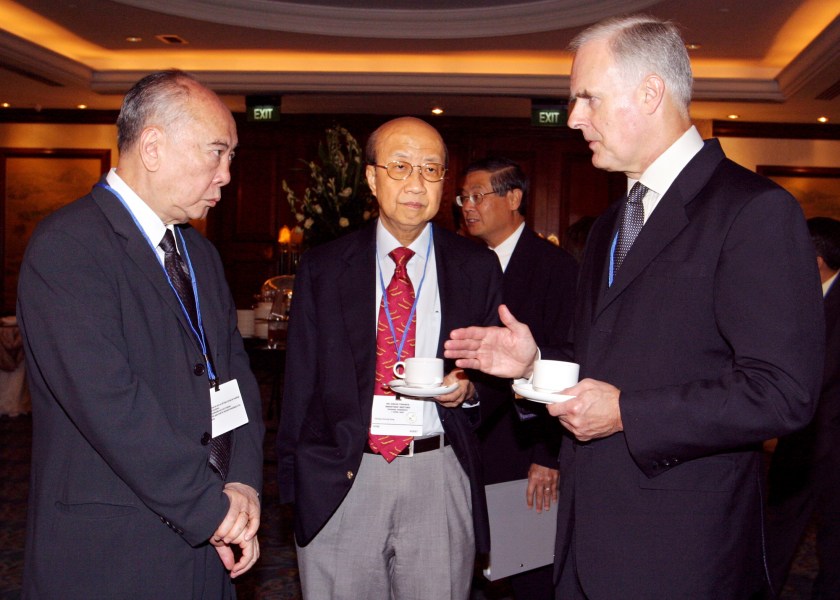

John of the Monetary Authority of Singapore chats with United Overseas Bank Chairman Wee Choo Yeo (left) and Oversea-Chinese Banking Corporation Executive Chairman Chong Chun Kong (centre) before the launch of the Association of Southeast Asian Nations (ASEAN).・Deputy Managing Director Palmer (right). ) Finance Ministers Meeting in Singapore, Wednesday 7 April 2004. Jonathan Drake/Bloomberg via Getty Images

Wee Kyaw Yeo, the billionaire who shaped Singapore’s financial landscape by merging several old family-owned banks, has died. He was 95 years old.

The former chairman of United Overseas Bank passed away on Saturday, according to a United Overseas Bank spokesperson. His funeral will be held on February 7th.

Mr Wee was one of the last generation of bankers born before World War II to come to dominate Singapore’s financial system after the country gained independence from Britain in the 1960s. After his father co-founded his predecessor, his UOB, in 1935, he led the acquisition of banks across Southeast Asia to create his UOB, one of the region’s largest lenders. Did.

As of February 2024, his net worth was $10.4 billion, according to the Bloomberg Billionaires Index.

“My father left an indelible mark on Singapore and the region,” Wee Yee Cheong, UOB’s chief executive since 2007, said in a statement. “My father’s influence and values will remain at UOB: thinking long-term, the importance of deep relationships, doing the right thing and reaching out to those in need.”

The elder Wee was the chairman of UOL Group Ltd, one of Singapore’s largest property developers. Notable parts of his real estate empire include Pan-His Pacific Hotel chain and his SGX Center in Singapore. He played a key role in saving the parent company of the producers of Tiger Balm, an iconic pain-relieving ointment that dates back to the days of the Chinese emperors.

“Dr. Wee was a visionary business leader, pioneering entrepreneur and philanthropist,” UOL said in a statement. Mr. Wee served as Chairman for over 50 years since his 1973. Under his leadership, UOL has grown from a local company with assets of S$70 million ($52.1 million) to a company with total assets of over S$20 billion, with offices in 15 countries. Said.

Get key

Wee was born on Kinmen Island, off the coast of China’s Fujian Province, to businessman Wee Cheng Cheng and Ko Ngok Hsu, a villager from Jincheng Fishing Port. They married when Geok Siew was 18 years old, and she became Khen Chiang’s second wife with his first wife’s blessing. That was common at the time.

Wee Kyaw Yeow lived with his mother until he was seven years old, then moved to Malaysia and then to Singapore in 1939. His early education was interrupted by World War II, as the Japanese military began bombing Singapore two years later.

He resumed his studies at St. Andrew’s, a Church of England secondary school, in 1949, but did not pursue his studies as he was older than most of his classmates and had poorer English skills. Instead, he joined his father’s commodity and spice trading company Ken Leong in Singapore.

Wee gave up his career in 1958 to focus on building his family’s bank. According to the bank’s website, it was incorporated as China Unified Bank and primarily served communities in Fujian province in its early years. The name was changed in 1965.

After going public in 1970, Mr Wee embarked on a series of acquisitions and steered UOB through the consolidation of Singapore’s financial sector, which by the early 2000s had absorbed dozens of banks into the current three largest banks. It was done.

His most famous acquisition came in 2001, when he beat out regional giant DBS Group Holdings to buy Singapore’s Overseas Union Bank.

OUB perceived DBS’s proposal as hostile. The main reason for this is that the government-backed financial institution did not consult the tycoon’s owner, Lian Ying-zhou, before launching the bid. Damaging comments in acquisition documents made matters worse.

Although Mr Wee had no intention of buying OUB, he immediately arranged to meet Mr Lian and his wife at their home and then made a friendly bid of S$10 billion, which ultimately won the bank.

We also diversified into other product areas such as trade finance and foreign exchange.

His involvement with Tiger Balm was circuitous. The parent company, Ho Par Brothers International, went public in 1969, but soon fell into trouble, and the Singapore government intervened in 1975 to save the company. A new board of directors, including Wee, was established to organize the company. He was appointed chairman in 1978 and consolidated the business, according to the company’s website. In 1997, the company was renamed Haw Par Corp.

family inheritance

Mr Wee stepped down as UOB President in 2013, but remained on as Honorary President and Honorary Advisor.

Although the bank’s takeover frenzy waned, it remained one of Singapore’s largest banks, along with DBS and Oversea-Chinese Bank. Mr Wee explained at the 2016 annual general meeting that acquisitions come with risks and UOB needs to be careful.

In early 2022, eldest son Yi Chong led the bank in its first major acquisition in 16 years, agreeing to buy Citigroup’s consumer assets in Indonesia, Malaysia, Thailand and Vietnam for about S$4.9 billion. did.

In his 2014 biography, eldest son Wee expressed pride that at the time, all of his children were running or working in family-related businesses. Another son, Wee Yi Chao, took over the securities firm UOB Kay Hian Holdings Ltd. in 2000.

Mr. Ee Cheong’s son, Mr. Wee Teng Chuen, left the bank in 2020 and joined 32 Real Estate Pte. Ltd. He was appointed as Managing Director and Head of Capital Raising.

“We do not know whether the fourth generation of the Wee Cheng Cheng family will take over the family headship in the future,” Wee said in his 2014 biography. “I just hope they do.”