President Xi spoke to the guests on behalf of his “old friends” who had entertained him when he visited Iowa on an exchange visit some 40 years ago when he was a low-level Communist Party official. The talks were positive, and the Chinese government said: He continued to work on strengthening trade with the United States.

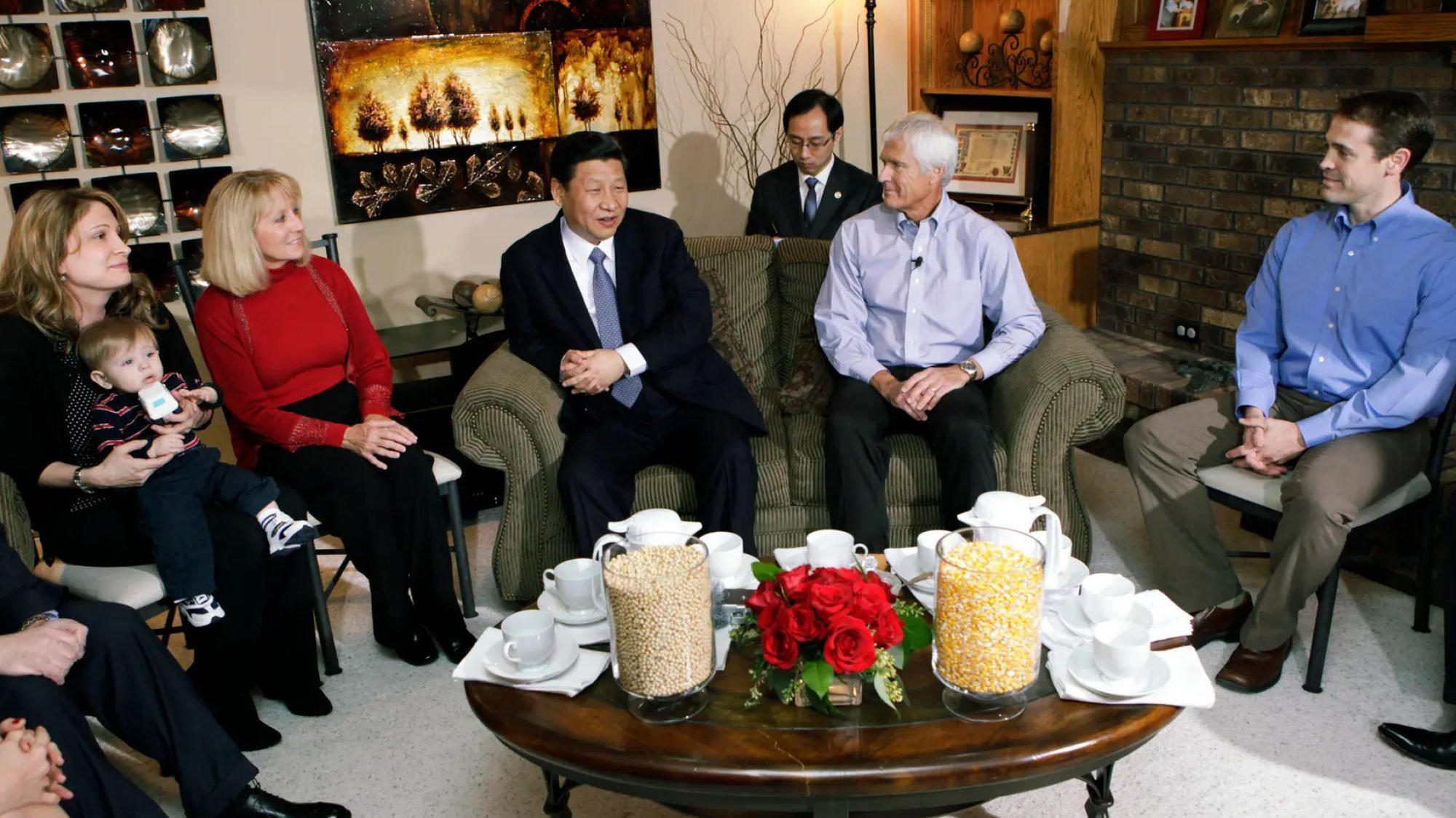

For Kimberly, it was personal. When Xi returned to Iowa as vice president in 2012, his family welcomed the Chinese leader to their farm. Mr. Xi also drove one of the tractors. Recalling those days, Kimberly described Xi as “normal and human.”

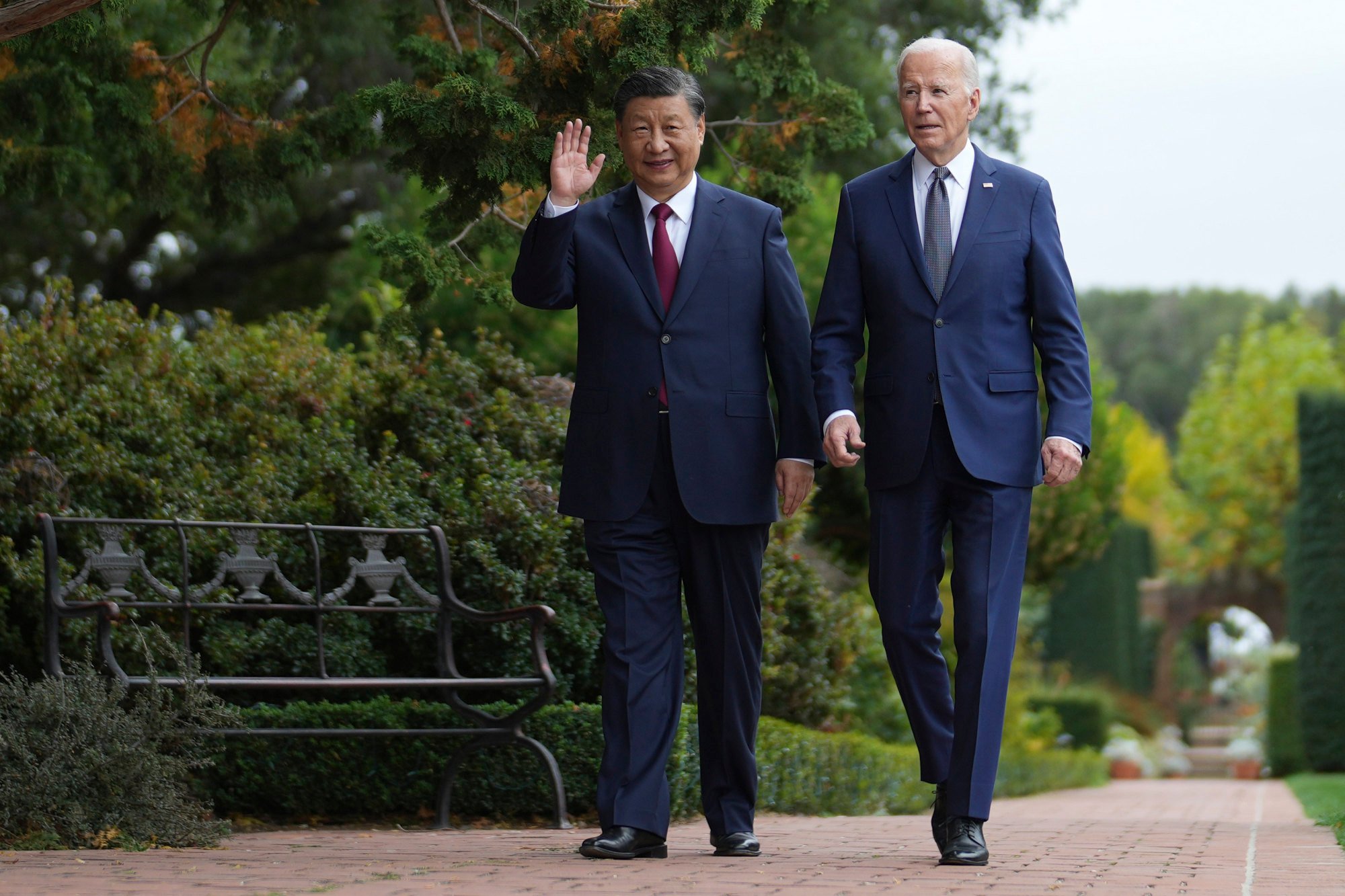

After years of tension, the United States and China are restoring some parts of their relationship in areas such as military dialogue and crackdowns on drug trafficking. At the same time, often overlooked aspects of the strained relationship are easing. That is, agricultural trade between the world’s two largest economies is recovering.

Ahead of the San Francisco summit, Iowa soybean producers signed contracts worth billions of dollars with a Chinese delegation that included officials and agricultural companies. This is the first bulk signing since 2017.

Chinese buyers bought more than 3 million tons of soybeans, the country’s largest single-day order in months, according to the U.S. Department of Agriculture.

Around the same time, dozens of American agricultural industry representatives also visited Beijing and Shanghai. U.S. Ambassador to China Nicholas Burns told delegates that agriculture serves as a “ballast” in the “large and complex” U.S.-China relationship.

In December, China pledged to buy more than 700,000 tons of U.S. wheat, the most since 2020. Since June, pledges have exceeded 2 million tonnes.

Agricultural cooperation had been in the agricultural sector for decades, until U.S.-China relations sank to their current low point due largely to geopolitical competition and a trade war started by then-President Donald Trump in 2018. It was seen as an expression of both countries’ interest in cooperating. trade, science, technology, and interpersonal diplomacy.

Despite sharp geopolitical differences between the two countries over the past year, the USDA estimates that US agricultural exports to China will reach US$36 billion in 2023, compared to US$409 billion in 2022. This was down from US$1 billion.

U.S. agricultural leaders are optimistic that these recent acts of goodwill have restored the sector as a stabilizing force amid strained diplomatic relations. Mutual suspicion and mistrust continue to dominate discussions about business with China, but these leaders argue that the relationships built through agriculture can help restore trust.

Other analysts cautiously agreed, saying agriculture remains a highly interdependent sector and could help the two countries identify a path to rebuilding their relationship, as long as food is not used as a political tool. Pointed out.

But analysts do not expect relations to improve dramatically, given the wave of anti-China rhetoric in the United States this election year.

Still, after the meeting between Mr. Xi and Mr. Biden, openings appeared again.

U.S. Agriculture Secretary Tom Vilsack met with Chinese Agriculture Secretary Tang Renjian last month, the first meeting between leaders of the two departments since 2015. This forum was established in 2003 under the Joint Committee on Agricultural Cooperation to coordinate bilateral exchanges and cooperation in the agricultural field.

The US Department of Agriculture said the two countries addressed “unresolved market access issues” and also discussed approaches to “addressing climate and food security challenges.”

Since joining the World Trade Organization in 2001, China has become the United States’ most important trading partner in the agricultural sector. China’s share of U.S. agricultural exports increased from 2% in 2000 to more than 17% in 2020, according to a 2021 report from the U.S. Heartland China Institute and the Carter Center.

The increase in 2020 is due to the Trump administration’s Phase 1 trade deal, which imposed tariffs on US$300 billion worth of Chinese imports in 2018 to address the bilateral trade deficit. Under the agreement, China agreed to expand its purchases of certain U.S. products for two years starting January 1, 2020.

Beijing failed to meet its promised $200 billion goal, and President Biden’s new administration continued Trump-era tariffs. However, data showed that agriculture remained an area where the Chinese government sought to implement the terms of the agreement.

We rely heavily on the Chinese market.And I look forward to it normalizing and coming back

The Chinese government more than doubled its soybean purchases in 2020-21 from the previous year. In 2020, about 55% of U.S. soybean exports went to China.

China also imported a record 707,600 tons of U.S. pork and 43,700 tons of U.S. beef in 2020, well above 2017 levels.

Despite the prolonged trade war, China remains one of the largest markets for U.S. feed grains such as soybeans and poultry products such as chicken feet.

China lifted a flu-related ban on U.S. poultry imports for more than four years in 2019, and demand soared. From 2019 to 2022, U.S. poultry exports to China surged by more than 10,000 percent. In fact, in 2022, chicken feet accounted for more than 85% of all U.S. poultry exports to China.

But last year, China reimposed a ban on poultry imports from 40 U.S. states starting in 2023 due to the flu outbreak. During President Xi’s visit to the US in November, the Chinese government removed seven US states from the banned list, but 33 states remain.

Wendon Chan, a food and agricultural economist at Cornell University, said “agriculture remains one of the areas where both sides can have some agreement,” creating the potential for further cooperation.

He said that in addition to focusing on China’s needs for primary products such as soybeans, the United States will expand its portfolio by developing the Chinese market for dairy products, fruits and vegetables, and even consumer products such as wine and spirits. He said it could also be “balanced and diversified”.

“This will also help make the United States more resilient in the event of tariffs or retaliatory tariffs,” Zhang said.

Climate-smart agriculture is another area where both government and commercial levels can cooperate, he said, noting that traditional agriculture is one of the main sources of greenhouse gases.

“There are a lot of potential mutual learning opportunities,” Zhang said.

Zhang noted that Mexico overtook China last year to become the United States’ largest trading partner, and said the political difficulties in U.S.-China relations are “real and probably won’t improve much.” Ta.

Mexico’s rise ends China’s 17-year position as the largest importer to the US

Mexico’s rise ends China’s 17-year position as the largest importer to the US

Just last month, U.S. Sen. Rick Scott (R-Florida) introduced a bill that would ban Chinese garlic because it is “grown in human sewage, bleached, and harvested in abhorrent conditions, often involving slave labor.” did. Chinese state media responded to the accusations by calling them “anti-intellectual content”, citing scientific research on the benefits of organic fertilizers.

China is the United States’ largest supplier of garlic, but imports have been declining since 2018, according to U.S. data. According to the Department of Agriculture, total imports of fresh and dried garlic in the same year were 115 million pounds lower than in 2016.

The United States has accused China of dumping garlic by lowering market prices and has imposed heavy tariffs on Chinese imports since the mid-1990s. These taxes were increased during the Trump administration. Still, from 2019 to 2023, China accounted for more than 80% of dried garlic imports and more than 40% of fresh garlic imports from the United States.

No action has been taken against the Scott bill, but its claims have made companies that sell to China uncomfortable.

Greg Tyler, CEO of the U.S. Poultry and Egg Export Council, which aims to normalize trade relations, said: “It’s important to keep politics out of trade because we both have concerns about what we can’t produce.” Because there is a need for things.”

Can China and ASEAN benefit from further agricultural cooperation?

Can China and ASEAN benefit from further agricultural cooperation?

“We rely heavily on the Chinese market. And we hope that things will normalize and come back so that we can get this product to market,” he continued, adding that China will take the remaining 33 states to the flu. He added that he hoped to be exempted from the ban.

While American farmers may agree with Mr. Tyler, some people in the Midwest are less comfortable mixing business and politics. Zhang and his colleagues surveyed farmers in Iowa, Minnesota, and Illinois in 2019 and found that a majority supported Trump, even if they did not like the trade war.

“They have the mindset of ‘feeling pain in the short term, but gaining in the long term,'” Zhang said, predicting that Trump will receive similar support this year as he seeks re-election. Zhang pointed out that compared to independent small-scale farmers, leaders of agricultural groups are much more likely to have positive views of China.

Zhang said U.S. farmers’ main concern with China is China’s “erratic” purchasing behavior. “They come to the market every once in a while and buy in bulk,” but the next year demand declines.

Kimberly of the Soybean Association said sales have slowed after increasing around President Xi Jinping’s visit. “Purchasing is happening, but it’s not the huge increase we’ve seen in the past,” he said, adding that he expects orders to continue and perhaps grow even larger as the year progresses. he added.