Since the start of the 2020s, we’ve been comparing the current decade mostly to the 1920s and the 1970s. However, the S&P 500’s

SPX

42.3% melt-up since Oct. 12, 2022, to a new record high last week has us considering whether another period represents a possible analogous scenario, i.e., the second half of the 1990s. We see parallels between conditions then and now that may suggest what’s up ahead for both the stock market and the federal-funds rate, or FFR.

Leading the S&P 500 higher back then was the Nasdaq-100

NDX.

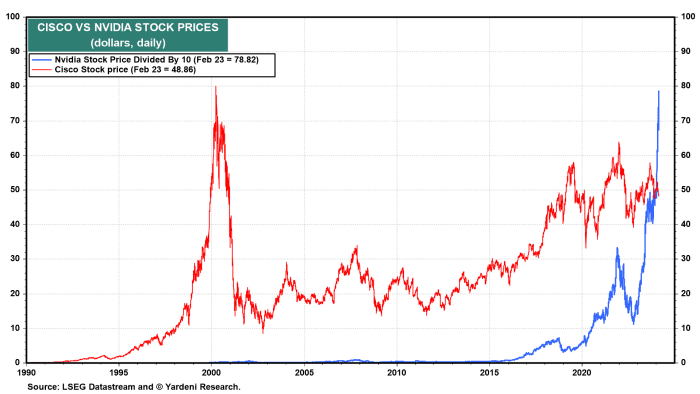

That seems to be happening again since the ratio of the latter to the former bottomed on Jan. 5, 2023. We are especially intrigued by the similarity between the recent vertical ascent of Nvidia’s

NVDA,

stock price and Cisco Systems’

CSCO,

stock price during the late 1990s.

In fact, the second half of the 1990s script might be the most likely scenario for the federal-funds rate over the rest of this decade. Back in the 1990s, stock prices soared. The positive wealth effect boosted economic growth. Inflation was subdued by rapid productivity growth, implying that the inflation-adjusted FFR was in line with the so-called neutral FFR.

Consider the following:

1. Real GDP: The 1990s started with a brief and shallow recession. Real GDP growth rebounded quickly from a low of -1% year-over-year during the first quarter of 1991 to its historical average of 3.1%. During the second half of the 1990s, it fluctuated around 4%-5%.

The current decade started with a brief but severe recession because of the COVID-19 pandemic lockdown in early 2020. It was followed by a very strong recovery. By the fourth quarter of 2023, real GDP was back to the 3.1% historical average growth rate. We expect to see real GDP growing at or above this rate through the end of the decade thanks to solid productivity growth.

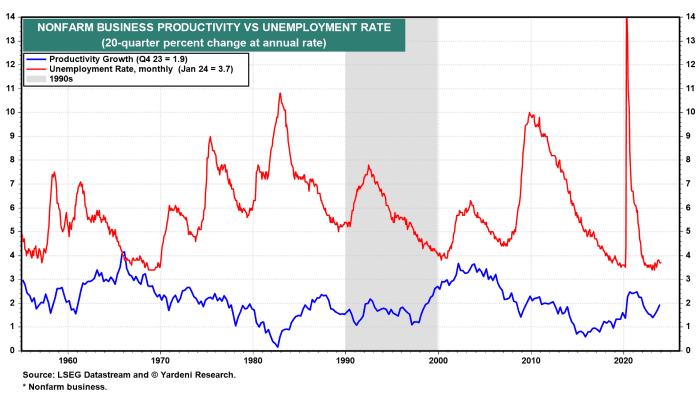

2. Productivity: The growth rate of nonfarm business productivity was extremely volatile during the first half of the 1990s. It soared to 5% year-over-year during the first quarter of 1992. Then it plunged to -0.6% during the fourth quarter of 1993. During the second half of the decade, it was back over its historical average of 2%. It peaked at 4.2% by the end of the 1990s.

During the first half of the current decade, productivity growth has also fluctuated widely, from 6.8% during the third quarter of 2020 to negative 2.4% during the second quarter of 2022. But it was back above its historical average at 2.7% at the end of last year. In our Roaring 2020s scenario, we are expecting a productivity growth boom during the second half of the current decade much like the one during the second half of the 1990s.

3. Inflation: In addition to boosting the growth rate of real GDP, productivity (along with hourly compensation) determines unit labor costs (ULC) — the year-over-year percentage change that is the underlying inflation rate. Both ULC and CPI inflation rates fell significantly during the first half of the 1990s. The former dropped from 5.1% in the fourth quarter of 1990 to negative 0.2% in the second quarter of 1994. Over this same period, the CPI inflation rate declined from 6.3% to 2.3%. Over the remainder of the decade, it fell to a low of 1.4% in March 1998 and ended the decade at 2.7%.

In our Roaring 2020s scenario, CPI inflation continues to moderate along with ULC inflation as productivity growth continues to improve. ULC inflation was down to 2.3% year-over-year during the fourth quarter of 2023 from 6.3% during the first quarter of 2022. If productivity growth climbs to 3.5%-4.5% over the rest of this decade, as we expect, that would boost the growth rate of real GDP while keeping a tight lid on inflation.

“Businesses will continue to invest in productivity-enhancing technologies.”

4. Unemployment: During the 1990s, the unemployment rate rose from 5.4% during January 1990 to a peak of 7.8% in June 1992. It then trended downward throughout the rest of the 1990s, finishing the decade at 4%.

The jobless rate troughed at 3.5% at the start of the 2020s. It spiked to 14.8% during the pandemic lockdown. It was back under 4% at the end of 2021 and has remained below this level through January of this year.

So the labor market is already tighter than it was during the late 1990s. We’ve previously observed that there is an inverse correlation between the unemployment rate and the trend growth rate of productivity. That makes sense: When labor is hard to find, businesses have an incentive to boost the productivity of their employees.

That describes the current situation, in our opinion, which is why we expect that businesses will continue to invest in productivity-enhancing technologies. Today’s technologies have far more potential to boost both brawn and brain productivity than ever before, and far more businesses than ever before will need that boost given the tight condition of the labor market. And just by happenstance, such brawn and brain technologies are more useful and affordable for almost all sorts of businesses than ever before.

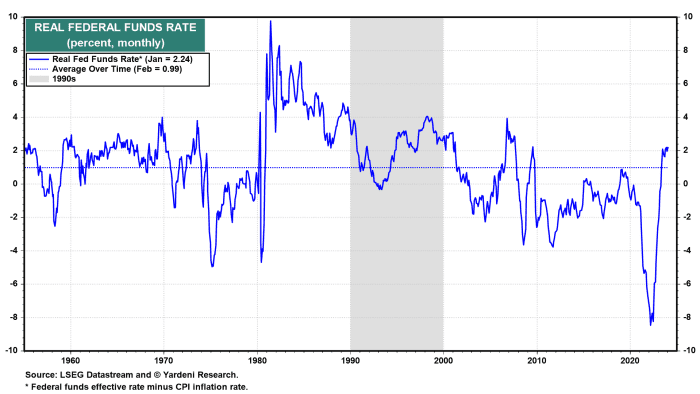

5. Federal-funds rate: The federal-funds rate fell from about 8% at the start of the 1990s to around 3% in 1993. It rose during 1994 and peaked at 6.3% on March 31, 1995. It then ranged mostly between 5% and 6% for the rest of the 1990s.

Back then, the U.S. economy was doing well as productivity growth improved. The unemployment rate was falling, and inflation was subdued. That could very well describe the rest of the 2020s. If so, then perhaps the FFR will indeed stay higher (i.e., 5.25%-5.5%) for much longer (i.e., through the end of the decade).

But what about the real FFR? Isn’t it already too restrictive? If inflation continues to moderate, as we expect, the real FFR will rise and be even more restrictive. To avert a recession from such tightening, won’t the Fed have to lower the FFR?

First, for the record, we question the relevance of a real FFR, which adjusts an overnight bank borrowing rate with a year-over-year inflation rate. The disparate time frames make it a very odd concept, to say the least.

In any event, the FFR is currently 2.24%. The economy had no problems with real FFRs ranging between 2% and 4% during the second half of the 1990s. Perhaps, the same is likely to happen over the remainder of this decade. It’s happened before, so it could happen again, especially since the economic environment seems quite similar.

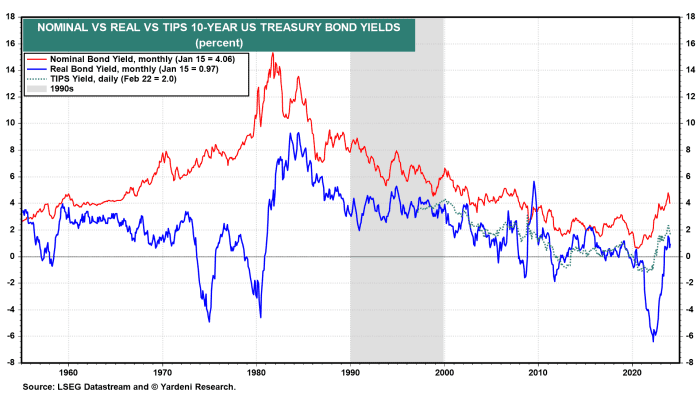

6. Bond yields: While the concept of a real FFR seems odd to us, we have no problem with the real bond yield, i.e., the 10-year U.S. Treasury bond

BX:TMUBMUSD10Y

yield less the CPI inflation rate on a year-over-year basis. It happens to track the 10-year TIPS yield quite well.

During the 1990s, the real bond yield fluctuated in a flat range between a low of 2% (December 1990) and a high of 5.3% (November 1994). It is currently 1%. If inflation continues to fall to the Fed-targeted 2%, while the nominal bond yield remains around 4% (because the Fed keeps the FFR higher for much longer than expected), then the real bond yield would double to 2%. That would still be below the real bond yields of the 1990s, when the economy performed perfectly well.

“The stock market is having a significantly positive wealth effect on the economy.”

7. Stock market: If this is the 1990s all over again, are we in 1994 or are we closer to 1999? We aren’t sure. However, we are sure that, as occurred during the second half of the 1990s, the stock market is having a significantly positive wealth effect on the economy now that the major stock-market indexes are at record highs. That’s another reason to believe that the economy will remain resilient and another reason the Fed might hesitate to lower the FFR for a while — maybe a long while.

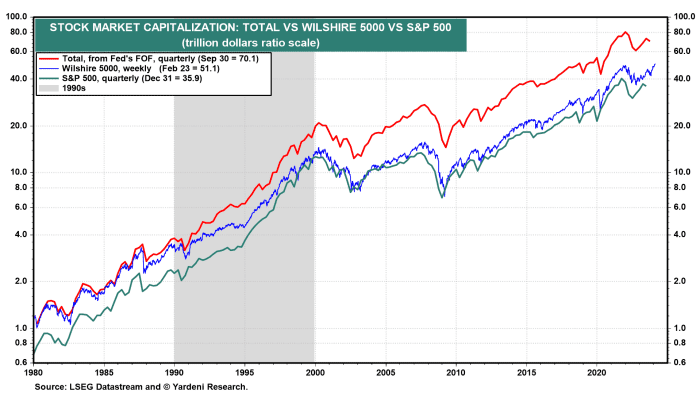

The value of all stocks traded in the U.S. rose fivefold during the 1990s from $4 trillion to $20 trillion. It is currently up fourfold above that level to about $80 trillion.

8. Bottom line: The Roaring 2020s have lots of similarities to the Roaring 1990s. Both the 1920s and the 1990s ended with stock-market melt-ups that were followed by meltdowns.

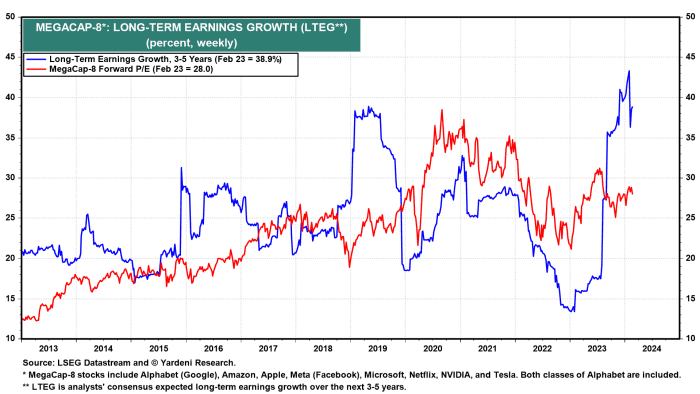

So we continue to monitor melt-up indicators. That includes analysts’ consensus expectations for S&P 500 long-term earnings growth (LTEG). It is up sharply from last year’s low of 9% during the April 11 week to 14.7% currently.

That’s a big jump reflecting upward revisions in the long-term prospects for the growth rate of the MegaCap-8 companies (i.e., Alphabet

GOOG,

GOOGL,

Amazon.com

AMZN,

Apple

AAPL,

Meta Platforms

META,

Microsoft

MSFT,

Netflix

NFLX,

Nvidia and Tesla

TSLA,

) following great earnings reports by some of them recently.

The LTEG of the MegaCap-8 is up from 13.4% during the Jan. 31, 2023, week to 38.9% during the Feb. 23, 2024, week. Nevertheless, the overall LTEG is still well below previous melt-up peaks.

Ed Yardeni is president of Yardeni Research Inc., a provider of global investment strategy and asset-allocation analyses and recommendations. This article is excerpted from Yardeni Research’s “Morning Briefing” for Feb. 26, 2024. Individual investors can read Yardeni’s research here. Follow him on LinkedIn and his blog.

Read on: