Milan — 2024 is shaping up to be a busy year for M&A in Italy, while potential investors are buzzing about the prospects for Golden Goose’s initial public offering.

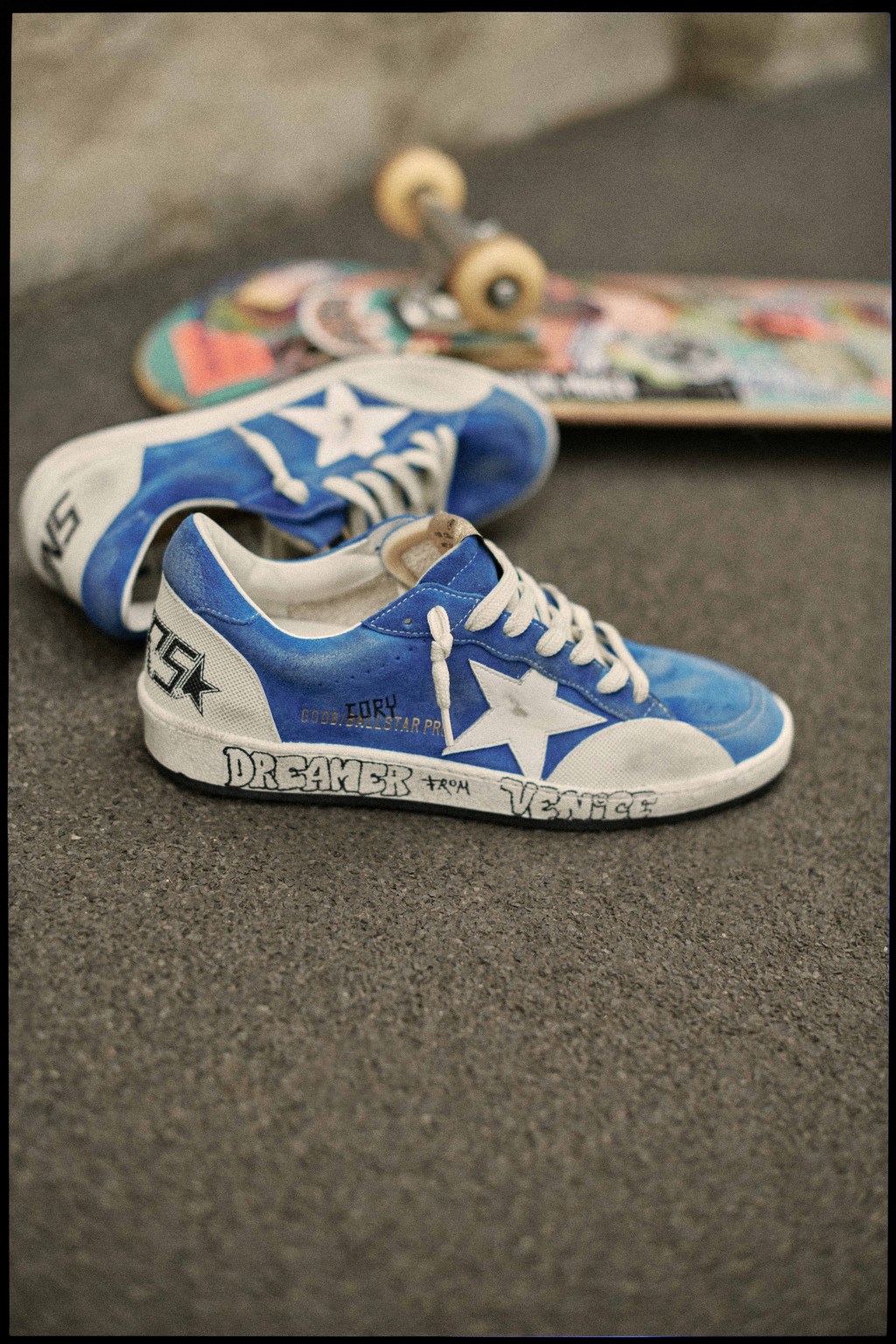

In 2020, private equity fund Permira acquired the Italian brand from the Carlyle Europe Buyout Fund for a fixed price of 1.28 billion euros. Golden His Goose, which has achieved much of its success with superstar sneakers that offer 400 variations a year, is led by CEO Silvio Campala.

Neither Permira nor Golden Goose have publicly commented on a potential listing in Milan in 2024 or a potential sale. The company is on an upward trajectory, recording revenue of 421 million euros in the nine months to September 30, an increase of 19% compared to the same period in 2022. Compared to 2021, sales increased by 60%. Profitability continued to expand, with earnings before interest, taxes, depreciation and amortization rising to 34.8% in the first nine months of 2023.

Observers are keeping a close eye on Golden Goose after Birkenstock’s lackluster debut on the New York Stock Exchange, with the stock falling on its first day. But market sources say the latter’s shareholders aim to emphasize the Italian brand’s luxury image, which also includes a collection of apparel and accessories, compared to the German sandal maker.

There has also been speculation that another sneaker brand, Oatly, could be sold by the Made in Italy Foundation. The fund is managed by Quadrivio and Pambianco and invests 120% from Reno in wine, food, beauty, fashion and furniture. From Rosantica to Dondup to GCDS.

Other brands are also under scrutiny and talk is swirling that they may change hands as well.

Italian investment fund FSI acquired a 41.2% stake in Missoni in 2018, but the founder and family of the same name continued to control 58.8% of the company. Missoni contacted Rothschild last year to explore the possibility of selling the brand, designed by Filippo Grazioli and headed by CEO Livio Proli, the people said. Rumors that OTB was eyeing Missoni quickly died down. Market players speculated that industrial partners may be interested in Missoni’s production and artisanal capabilities. (OTB, which owns Diesel, Jil Sander, Marni, and Maison Margiela, among others, is also aiming for an IPO, but that is likely to happen in 2025.)

A model appears on the runway at the Missoni Fall 2023 ready-to-wear fashion show held at Palazzo Mezzonatto in Milan on February 25, 2023.

Giovanni Giannoni appears on WWD

In 2021, private equity giant L. Catterton acquired a majority stake in Etro in a deal worth €500 million. Etro ended 2022 with sales of 277 million euros, an increase of 17% compared to 2021, but posted a loss of 23.6 million euros, mainly due to amortization and special charges. This led L Catteron to recapitalize at the end of last year, when he injected 15 million euros into the company with the aim of raising further investment funds. However, sources say L. Catterton led the merger between watch and jewelry retailer Nuova Publicex and Etro, putting pressure on profits, and the Etro family, which maintains a minority stake in the brand, It is said that this caused friction. Etro is led by CEO Fabrizio Cardinali and designed by Creative Director Marco De Vincenzo.

Trussardi’s future remains uncertain, as he sought creditor protection last year. There was speculation that potential White Knights, including Miroglio, were interested in backing the storied brand, but a deal fell through. 3X Capital, a Bergamo, Italy-based firm specializing in corporate turnarounds, was called in to consult with Trussardi’s parent company, Italian independent asset management firm Quattro R. Acquired management rights to the brand.

CEO Sebastian Suhl and creative directors Serhat Işık and Benjamin A. Huseby left the brand last year.

Another well-known brand, La Perla, is also going through difficult times, with trade unions Firktem Gil and Ultec in November “following the complete lack of concrete action” by the German businessman. Union members have expressed “deep concern about the fate” of the innerwear brand. Lars Windhorst is the owner of the company through London-based private equity firm Tenor.

Archive images of La Perla.

The union lamented the “total financial contradiction” and declaration of “general and alarming” job cuts at La Perla’s Bologna, Italy-based factory. The ailing brand has failed to make a steady restart in recent years after Tenor, then known as Sapinda, took over the company in 2018. La Perla posted a pre-tax loss of 48.8 million euros on sales of 69.1 million euros in 2018 and remains heavily in debt. 2022, according to the company’s annual report.

The fate of New Guards Group also hangs in the balance after Coupang agreed to rescue parent company Farfetch and inject $500 million in emergency funding into the company as part of a “pre-pack” management process. New Guards Group has 10 international brands including Marcelo Burlon County of Milan, Palm Angels, Unlabelled Projects, Heron Preston, Aranui, Peggy Goo, Ambush and There Was One. It is also a licensee of Off-White and a European partner of Reebok.

As reported, Capri was considering IPOs for Versace and Jimmy Choo before the deal was signed to be acquired by Tapestry, but so far there have been no further signs of a spinoff. Time will tell how Versace fits into the American giant, which will also own Michael Kors, Coach, Stuart Weitzman and Kate Spade once the acquisition is complete.