6 Minutes to read

Belgium has stopped developing guidelines for the labeling of plant-based meat due to continuing disagreements among stakeholders, but the increase in value-added tax on alternative dairy products is expected to improve this area, particularly for certain domestically produced meats. It’s hurting the brand.

The plant-based labeling war in Belgium is over for now, with “vegetarian steak” and “vegan burger” now all legally recognized after the country’s lawmakers failed to reach an agreement on the issue. did.

Following political debate dating back to 2022, Economy Minister Pierre-Yves Delmagne announced that the process of developing guidelines for the labeling of meat-free foods had been halted due to widespread disagreement on the topic.

But while that may be good news, Belgium’s stance on plant-based milk taxes is worrying and, in the company’s case, potentially fatal.

Why Belgium has suspended labeling guidance for plant-based meat

In 2020, the EU decided to vote against the proposed ban on the labeling of plant-based meat products, a work made up of Bolenbond, National Butchers, Bacon Butchers, Caterers’ Union, General Farmers Syndicate and Meat Federation. A subcommittee was established. Producers, ProVeg International and others called for the development of “clear guidelines” for plant-based labels. The group used the common argument of consumer confusion to argue that companies cannot use meat-related terms for substitute products.

This sparked years of debate and backlash from plant-based advocacy groups Good Food Institute Europe, the European Vegetarian Union and Provege. They called on the Belgian government to reject these guidelines, saying they disrespect consumers and endanger the EU’s market integrity.

“We were concerned that the very restrictive guidelines regarding allowed vegetarian names would seriously undermine the accessibility and promotion of vegetarian food. This is something that really needs to be addressed in terms of the fight against global warming.” ” said Green MP Barbara Creamers. Touching on the consumer confusion aspect, she added: “What’s the worst that can happen? You thought it contained real chicken, but you came home with a bowl of vegetarian chicken cubes?”

Creamers was told by Damagne, who was responsible for the issue along with Agriculture Minister David Clarimbal and Secretary of State Alexia Bertrand, that there would be no new Belgian guidelines for labeling plant-based meat. “There is still significant dissonance among the various stakeholders regarding the guides, including the guidelines that have been developed,” Darmagne said, according to Nieuwsblad.

The guidelines that were actually formulated were also discussed at the ministerial level. “But there is no political consensus on its publication. I think this is unfortunate,” the economy minister added.

“Although the process for developing the guidelines has not officially changed, we believe it is unlikely that any further changes will be made before the next election.” [in June]” said Fien Louwagie, Communications Manager at ProVeg Belgium. “After the election, we hope the new government will recognize that consumers are not confused by plant-based foods with ‘meaty’ names and abandon the development of guidelines altogether.”

Other European countries, most recently France and Italy, have also succeeded in banning the use of meat-related terms for plant-based products. A similar debate continues in Poland. Meanwhile, Switzerland has ruled against such laws, with the court announcing that such labels do not deceive consumers.

Discriminatory tax reels local alternative milk brands

The suspension of the process is a positive sign for plant-based advocates, but Belgium’s “financial discrimination” against plant-based milk is a major stumbling block. Currently, most beverages are subject to excise and packaging taxes, which are 22 cents for sweetened beverages and 17 cents for unsweetened beverages. However, his three products are excluded from these: cow’s milk, soy milk and rice milk.

However, some companies aiming to develop more climate-friendly alternatives to rice and soy (such as peas and oats) are finding it difficult to understand why they are treated differently. Masu. One of those companies is soy milk maker Top To, which last year was charged with overdue excise duty of 30,000 euros and subsequently fined 10,000 euros.

“I didn’t know that I had to pay sales tax,” Tip Toe founder Arnaud Mouirat told De Tigid. “The bill was a very unpleasant surprise. €40,000 is a lot for a company with a turnover of €200,000.” Will we impose excise tax on sex drinks?” he added.especially since [they focus] What about sustainability? ”

An unexpected bill forced Thip Toh to raise its prices, and its products now cost 3 euros. Considering that the cost of soy and dairy products is around 1.20 euros for the same amount, the company is at a huge disadvantage, given that most milk alternatives cost less than 1 euro. 3. Finance Minister Vincent Van Petegem has confirmed that he is reviewing the milk exemption, but changes are not imminent as they require legislative changes and will be a matter for the next government.

This has left Muirat and Thip Tho in a state of confusion. “I’m worried about the survival of the company,” she said. “Thanks to the €180,000 subordinated loan I recently obtained, I will be able to pay the sales tax, taxes and penalties. But I would rather use that money for innovation and growth. I wanted to hire someone, but I had to cancel my plans.”

The entrepreneur contacted the parliamentary cabinet and spoke to CD&V party leader Samy Mahdi. “They told me they support me, but still nothing happens. I never thought the government would oppose our project,” he said.

Small startups aren’t the only ones looking for change. The same goes for Danone, the parent company of Alpro, Europe’s leading manufacturer of plant-based dairy products. “We need harmony,” said Nathalie Guillaume, Danone’s communications and sustainability director. “Our society is in a transition towards sustainability. A flexitarian diet with dairy and plant-based alternatives is the future. Prices must be affordable. There should be no discrimination in the evaluation of different types of milk drinks.”

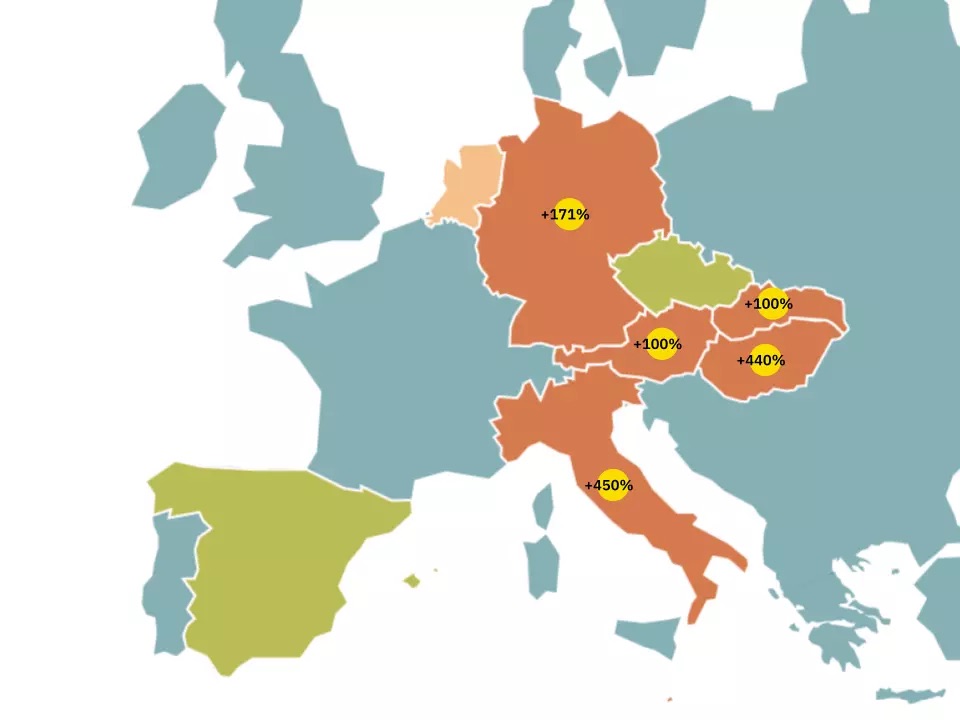

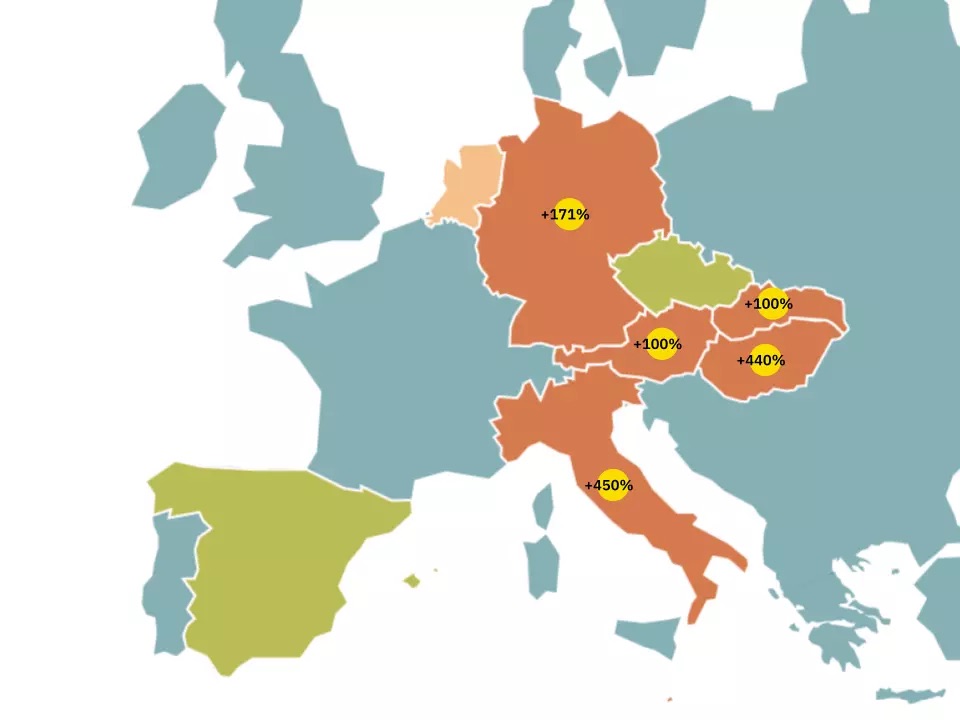

Belgium is not alone in imposing disproportionate taxes on plant-based dairy products. In Germany, vegan alternatives are subject to a 19% tax, compared to 7% on dairy products (despite calls for equality), and in Hungary, plant-based dairy products are subject to a 22% tax, while conventional dairy products are subject to a 22% tax. Italy imposes a similar tax of 22% and 4%. %, Each. The Netherlands, on the other hand, is going backwards. Previously, the same value-added tax rate of 9% applied, but the new rules will result in a 196% increase in alternative milk taxes (excluding soybeans).

However, Belgium could follow the lead of the Czech Republic, which has narrowed the gap between taxes on milk and plant-based alternatives. Currently, both are taxed at 10%. Greece also reduced the value added tax on plant-based milk from her 24% to the equivalent of cow’s milk (13%). Much remains to be seen regarding Belgium’s upcoming elections.