Silvera, a leading carbon data provider, is working with the Singapore government to promote high-quality carbon credits to meet its commitments under the Paris Agreement. In parallel with this initiative, the company has opened an office in Singapore to strengthen its presence in Singapore’s vibrant carbon trading ecosystem.

The London-based company builds software to independently and accurately assess carbon projects aimed at capturing, removing and preventing emissions. This technology helps organizations make effective investments towards achieving net-zero emissions.

The company’s suite of data and tools gives businesses and governments alike the confidence to invest, measure, realize and report on true climate impact.

Empowering climate action

Although the Paris Agreement began in 2015, many signatories are currently falling short of their climate goals. Purchasing carbon credits stands out as an established and scalable approach to directing funds towards outcomes that impact climate change. These credits support projects around the world, including protecting rainforests from deforestation and clean energy initiatives.

Article 6.2 of the Paris Agreement lays the foundation for countries to exchange carbon credits through market mechanisms. This approach will help countries meet their climate goals after emissions reduction efforts.

Singapore, which is leading Southeast Asia in implementing a carbon pricing system, is actively seeking partnerships for carbon credit projects. These initiatives bring a range of benefits to host countries, including investment, job creation and progress towards the Sustainable Development Goals.

Benedict Cheah, Director-General of Climate Change at Singapore’s National Climate Change Secretariat, highlighted the country’s commitment to fostering a high-integrity carbon market. To achieve that, officials specifically noted:

“…we need to leverage data and innovative technology to monitor emissions reductions and removals in carbon credit projects. To provide solutions on this front, we are inviting Singapore to use Silvera’s regional We welcome you to open your office.”

Silvera will assist Singapore in identifying first-class carbon credits (referred to as ITMOs in Article 6.2) from other countries. The collaboration aims to rapidly allocate climate finance to regions with visible climate impacts and use these credits in line with Singapore’s Paris Agreement goals.

In October, the Asian country set standards to ensure international carbon credits are of high quality.

Combining cutting-edge technology and the best carbon measurement methodologies, Silvera provides ratings that evaluate climate investments such as carbon credits. This will enable organizations and pioneering countries like Singapore to confidently implement climate change strategies and move towards achieving net zero.

Singapore raises the bar on high-reliability carbon credits

Singapore has set ambitious targets and recognizes the benefits that carbon markets can bring in achieving net zero targets. It is important for world leaders to harness the benefits of high-quality credit to make significant progress in tackling climate change.

Because of this, governments are increasingly emphasizing the need for independent guarantees to ensure that the credits they purchase “promote real climate action and society’s net-zero progress,” Silvera said. said Samuel Gill, co-founder and president of the company.

Last July, the carbon rating firm raised $57 million to encourage companies to invest in carbon credits with confidence.

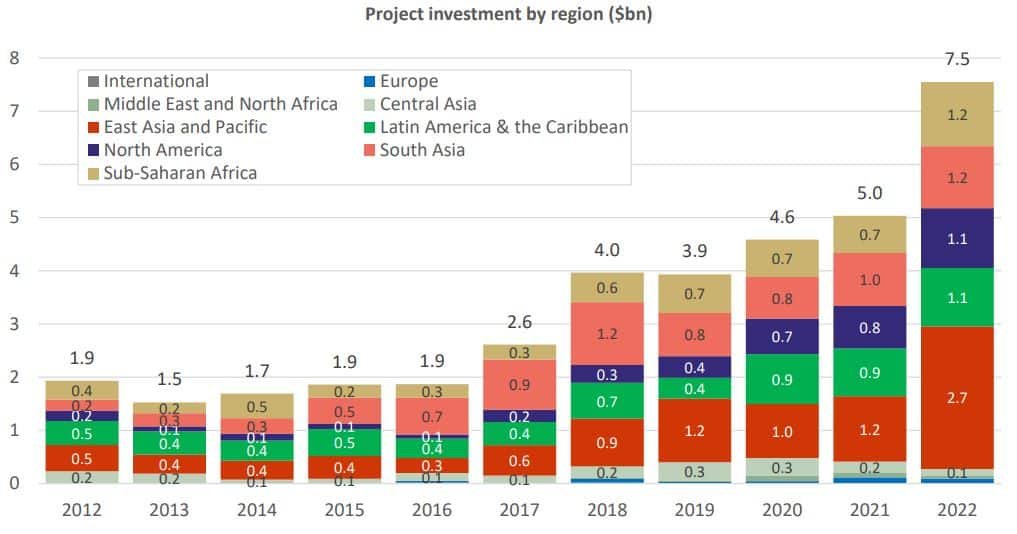

According to Trove Research, total $36 billion invested in voluntary carbon credits Projects within 10 years from 2012 to 2022. Of this, $7.5 billion was raised in 2022 alone.

In terms of share, East Asia and the Pacific region made the largest investments, amounting to $2.7 billion.

Still, global efforts are still about $90 billion short of meeting 2030 carbon reduction targets.

Silvera’s advanced software will help strengthen Singapore’s position as a leading emissions trading hub in Asia. Through this cooperation, the country may be able to set standards for environmental health and set an example for the international community.

The announcement comes at the same time as Silvera expands into the region and establishes local subsidiaries and offices in the country. The development is supported by the Singapore Economic Development Board (EDB).

Silvera’s new office will serve clients in Singapore as well as the broader Asia Pacific region.

Investment in the development of carbon credit projects is an important market signal of a company’s level of climate action. Silvera’s collaboration with the Singapore government represents an important step towards securing high-quality carbon credits to meet climate commitments.