Recognizing the threat of climate change and the importance of sustainable development, Singapore has committed to establishing a strong environmental and climate change legal and regulatory framework. This is an unprecedented initiative in Southeast Asia.

Singapore launched a major environmental strategy in 2021. Singapore Green Plan 2030a comprehensive roadmap that lays out Lion City’s sustainability vision for the next 10 years.

This legal update sets out (i) the key goals and objectives under the Singapore Green Plan 2030; (ii) the key regulations and initiatives that have been or will be implemented to achieve such goals and objectives; and (iii) are briefly outlined. ) Recent carbon market trends in Singapore.

A. Singapore Green Plan 2030

The Singapore Green Plan 2030 is Singapore’s contribution to the international sustainability agenda and global climate goals, and is underpinned by five pillars:

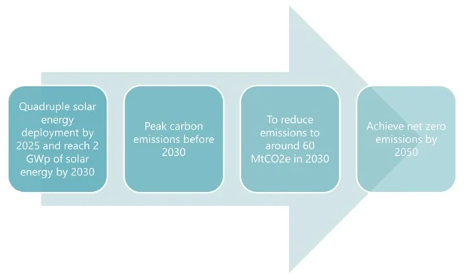

(i) Net zero emissions target

Ultimately, the overarching end goal of the Singapore Green Plan 2030 is for Singapore to eventually achieve its ‘national climate goals’.Net zero emissions by 2050”. To achieve this, the following milestone goals were set:

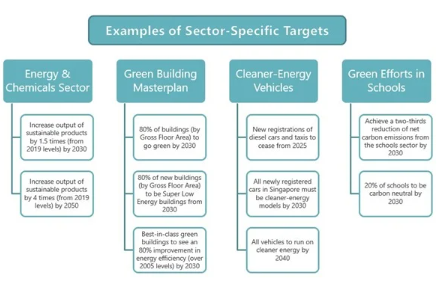

(ii) Sectoral targets

To achieve its goal of achieving net-zero emissions by 2050, the Singapore Green Plan 2030 also sets out more sector-specific targets, including:

B. Key regulations and initiatives

There are two main aspects to regulation regarding climate change and carbon markets. (i) Carbon Tax. (ii) Disclosure of climate information.

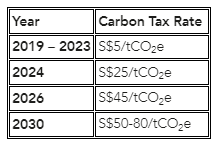

(i) Carbon tax

The imposition of carbon tax under the Singapore Carbon Pricing Act 2018, which came into force in 2019, is the cornerstone of Singapore’s climate regulation. The tax currently applies to facilities that produce more than 25,000 tCO2e equivalent per year, with an initial tax rate of S$5 per tonne. This carbon tax rate will be increased in stages.

The International Carbon Credits (ICC) framework, introduced in November 2022, allows companies subject to a carbon tax to offset up to 5% of their taxable emissions with voluntary carbon credits from 2024 onwards. It is accepted. For more information, please see the ‘Recent carbon market developments in Singapore’ section below.

(ii) Disclosure of climate information

In addition to carbon tax obligations, Singapore’s SGX-listed companies are subject to additional climate disclosure obligations.

- Sustainability Reporting – (a) Mandatory annual sustainability reporting. (b) For most companies, the Task Force on Climate-related Financial Disclosures (TCFD) reports on a “comply-or-explain” basis.and

- Mandatory TCFD Reporting – (a) SGX-listed companies in the financial, agricultural, food and forest products, and energy industries (from 2024). (b) SGX-listed companies in the materials, construction and transportation industries (from 2025).

C. Recent carbon market trends in Singapore

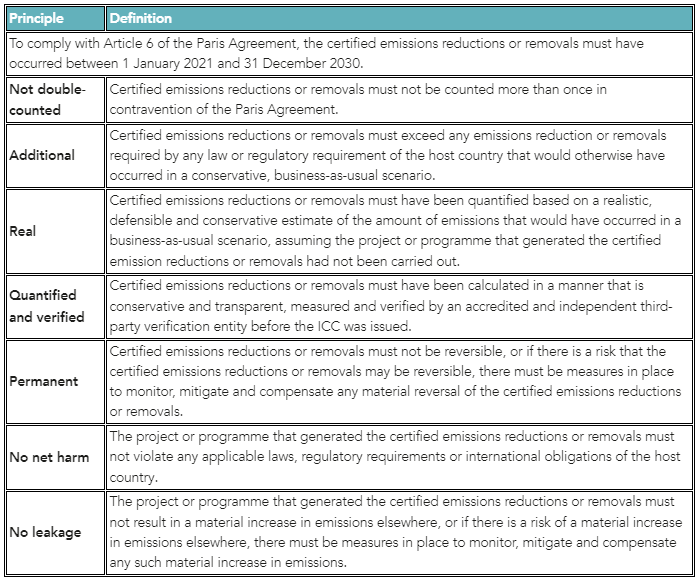

On October 4, 2023, the Ministry of Sustainability and Environment (MSE) and the National Environment Agency (NEA) established eligibility criteria based on the ICC Framework.

Under the ICC framework, companies liable to pay carbon tax can use eligible ICCs to offset up to 5% of their taxable emissions from 1 January 2024. The framework is consistent with Article 6 of the Paris Agreement and allows Singapore to work with other countries to reduce carbon taxes. Supporting Parties’ respective climate goals through international cooperation.

In the eligibility criteria, the ICC states that emissions reductions or removals (occurring within the time period specified in Article 6 of the Paris Agreement) and demonstrate high environmental integrity by meeting the seven principles (listed below with their definitions). is required to do so.

(sauce: National Environment Agency, “Singapore sets eligibility criteria for international carbon credits under carbon tax regime”, Table 1: ICC eligibility criteria (4 October 2023)https://www.nea.gov.sg/media/news/news/index/singapore-sets-out-eligibility-criteria-for-international-carbon-credits-under-the-carbon-tax-regime)

By understanding the impact of key regulations and initiatives, businesses in Singapore (or those planning to enter) can gain a competitive edge while simultaneously contributing to a sustainable future.

This legal update provides a brief introduction to Singapore’s key environmental and climate change regulations (particularly as they relate to carbon markets) in a condensed and attractive manner, and should not be read as legal advice in any form or manner. It is not to be construed.