by Fintechnews Switzerland

February 2, 2024

The Spanish banking sector is poised to make great strides in the field of digital banking. This growth will be driven by increased innovation in the business banking sector, the introduction of the “Lei Claire y Crese” law, and the emergence of foreign digital banking. New analysis by research focused on French fintech reveals market leader.

This report, published on January 9, 2024, examines the growth of Spain’s digital banking scene, delves into the sector’s leading companies and their growth strategies, and shares predictions about the future of the sector.

According to the report, Spain has experienced significant growth in the digital banking sector, which currently has 28 digital outlets, including established banks, domestic pure players, and digital outlets launched by global digital banking leaders. The player belongs to it. These players have garnered a notable user base of more than 15 million by offering intuitive and user-friendly app experiences, streamlined services, and continuous innovation in app functionality.

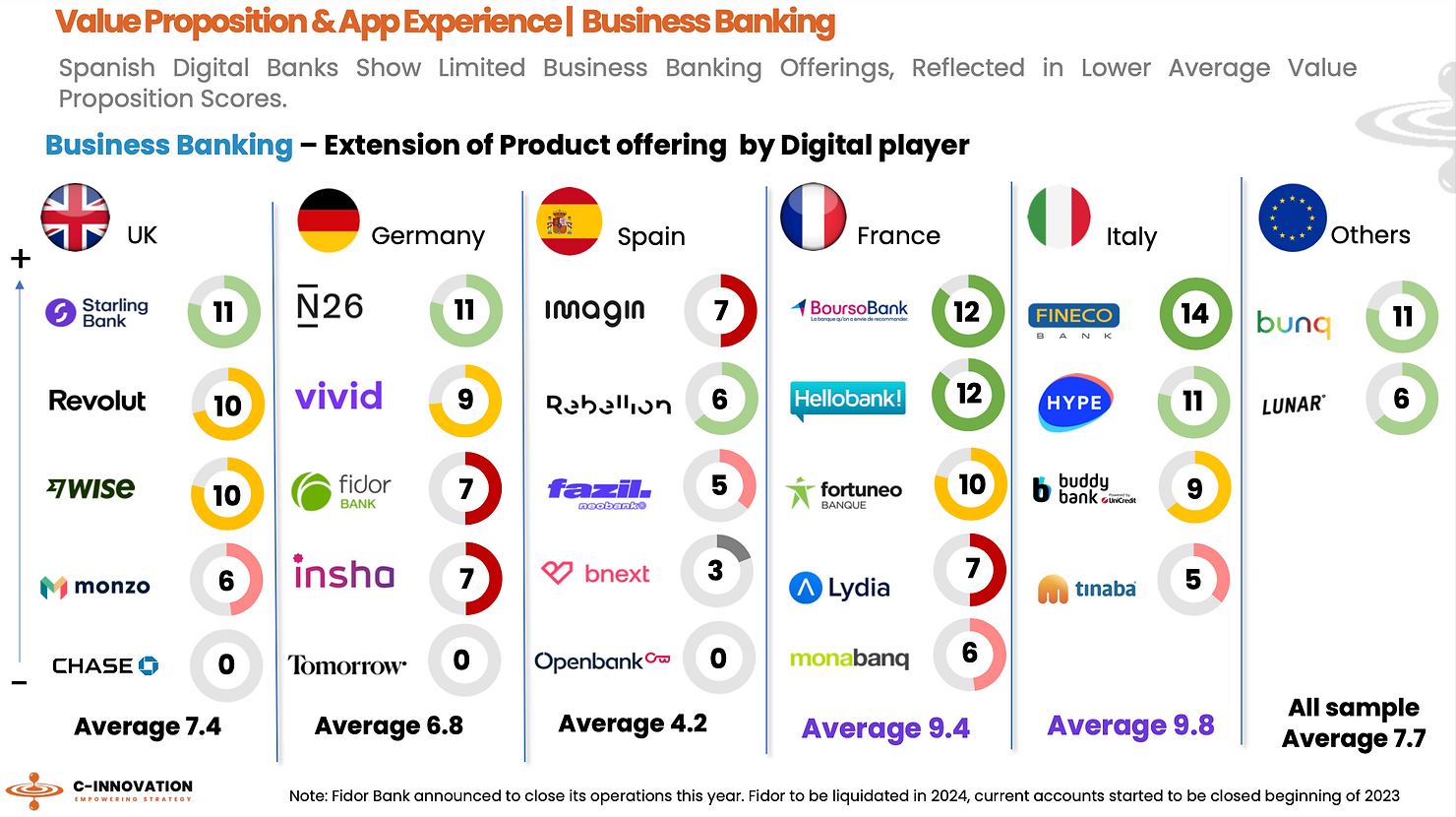

Looking at the current state of digital banking in Spain, the report states that innovation in Spain has mainly focused on the retail sector, with the business sector remaining largely untapped. From this year onwards, C-Innovation expects the Spanish digital bank to further deepen its penetration into the business banking sector, building on innovations in retail banking. Capitalizing on the introduction of Spanish fintech, these players will expand their product offerings and contribute to the creation of a diverse digital banking ecosystem.

The report highlights the introduction of ‘Lei Claire y Crese’ (Business Creation and Growth Act) as a key driver of innovation in business banking.

Approved by the Chamber of Deputies in September 2022, “Lei Claire y Crese” is a new law aimed at facilitating company formation, reducing regulatory hurdles and encouraging business growth and expansion. It’s a regulation. Among its key provisions, the law generalizes the use of electronic invoicing, establishes measures to address payment delays in commercial businesses, and encourages mechanisms such as crowdfunding, collective investment and venture capital (VC). This stipulates that this will encourage alternative financing.

The law also removes previous restrictions on the types of banking services that non-traditional entities can provide, attracts digital banks that cater to the demands of small and medium-sized enterprises (SMEs), and creates a more competitive banking environment. Promote.

These provisions lay the foundation for neobanks to expand and offer a wider range of services, providing promising prospects for expansion and evolution in the coming years, the report said.

Spain’s business digital banking sector is currently under development. Domestic digital-only banks such as Imagin Bank, Rebellion, and bnext have established a successful presence in retail banking, but these banks compare with European banks such as France’s Boursorama and Hello Bank! , the business services value proposition is relatively modest. , Italy’s Fineco Bank and Britain’s Starling Bank.

The report found that French business finance management provider Qonto has already taken advantage of the new ‘Ley Crea y Crece’ regulation to expand its services into areas once dominated by incumbents and to improve agility, efficiency and It points out that it offers a wide range of services that appeal to small and medium-sized businesses seeking efficiency. User-focused banking solutions.

European digital players expand business banking product offerings, Source: C-Innovation, January 2024

Status of digital banking in Spain

Spain has seen rapid growth in the digital banking sector, but this growth has been primarily driven by traditional banks. Imagin Bank, a subsidiary of CaixaBank, currently leads the market, offering approximately 4.2 million customers a comprehensive range of digital products tailored to the convenience-oriented demands of modern consumers. This figure means that Imagine Bank has a market share of 28% in Spain.

Imagin Bank operates as a mobile-only bank, offering a banking experience tailored to young, tech-savvy customers. The bank’s services go beyond traditional banking and serve as a lifestyle hub, integrating lifestyle and e-commerce capabilities such as entertainment, travel and technology discounts.

The second most popular digital bank in Spain is Fintonic. This neo-banking startup, which focuses on personal financial management, is expanding into the domestic market by providing a centralized platform where users can manage their finances, track spending, and aggregate accounts from different banks. We have developed a niche market. This strategy helped it reach 2.8 million customers and a 19% market share in Spain.

In third place is WiZink with 2 million customers. WiZink, owned by investment firm Varde Partners, specializes in flexible credit options and competitive savings products, serving the credit segment of the market. The platform holds a 13% market share.

OpenBank, the digital banking arm of the Santander Group, is Spain’s fourth largest digital bank with 1.7 million customers and an 11% market share. Openbank offers a full range of banking services, from standard checking and savings accounts to investment and lending products.

In addition to homegrown brands and players, Spain is also witnessing the emergence of global digital banking leaders. Companies such as Britain’s His Revolut and Germany’s His N26 are gaining traction in the country, currently boasting a total of 3 million customers and a staggering 20% market share.

According to the report, these companies are actively expanding their footprint in the Spanish market, offering attractive products including reward-based accounts, small consumer loans, and the integration of popular payment methods in the country such as Bizum. The company is said to be focusing on developing a suite of services.

Digital-only bank in Spain, Source: C-Innovation, January 2024

Featured image credit: Edited from freepik