Could something like this not happen in the US market because the US market is special?

Written by Wolf Richter of Wolf Street.

Most of the world’s major stock markets rose in 2023, some by a lot, but many are still below their highs of 15, 20, and 35 years ago, and others remain flat. That’s barely above the previous generation’s high.

It’s been an interesting year for U.S. stocks, with seven great stocks leading the market, with the Dow and Nasdaq 100 hitting new all-time highs, while the S&P 500 ended just one bar below its all-time high two years ago. The Nasdaq ended slightly below its November 2021 high, and the Russell 2000, which tracks 2,000 small-cap stocks, ended at levels from three years ago. We discussed all this on Friday. I bring this up because the US market has been the exception rather than the norm in global stock markets.

First, let me explain the basic rules here. Stock markets are valued in local currencies. If a currency’s purchasing power plummets each year for decades due to inflation, stock market indexes will reflect inflation more than corporate performance. The 1,700% jump in Argentina’s Merval index in three years, from about 51,000 in January 2021 to 930,000 now, is a sign of the peso’s collapse, not of corporate performance. I’m going to ignore those markets. We intend to stick to major markets in large economies with relatively stable currencies and relatively low inflation rates. Inflation is relatively low at 6% y/y compared to 160% y/y (Argentina).

A huge bubble caused a long-term decline.

Yes, we all know that something like this will never happen in the US market because the US market is special. But it did happen in the US market as well, with the Nasdaq plummeting 78% during the dot-com bust from March 2000 to October 2002, and then 15 years later, in October 2015, to the highs of March 2000. I didn’t go back. It’s just because they printed a huge amount of money and the interest rate was 0%.

At the time, inflation was below the Fed’s target, so printing money and 0% was an option. Inflation rates were low in all developed countries. We are now in a different phase, with all developed countries experiencing a resurgence of inflation and an inflation shock.

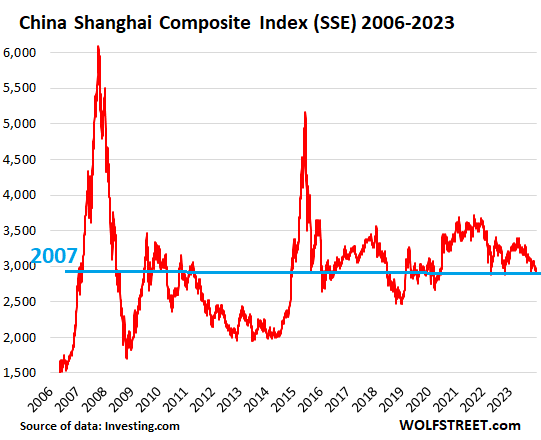

China’s Shanghai Stock Exchange (SSE) is back to where it was 17 years ago.

- Ended the year with 2,974

- YoY: -3.7%

- From record high in October 2007: -51%

- Returned to original location in January 2007

Hong Kong’s Hang Seng Index (HSI) has returned to the level of 24 years ago.

- Ended the year with 17,047

- YoY: -13.8%

- From all-time high in January 2018: -48.6%

- In January 2000, we returned to our original location.

Japan’s Nikkei 225 (NIK) returns to where it was 35 years ago:

- 2023 ends at 33,464

- YoY: +28%

- From all-time high in December 1989: -14%.

It took a huge amount of money printing starting in 2012 under Abenomics for this index to recover. Inflation is now back in Japan and quantitative easing is being systematically tapered and will likely end completely in 2024.

UK’s FTSE 100 Index (FTSE), +12% in 24 years.

- Ended the year with 7,733

- YoY: +3.8%

- From February 2023 all-time high: -3.6%

- From December 1999 high: +7%

France’s CAC 40 Index (PX1), +9% in 24 years.

- Ended the year with 7,543

- YoY: +16.5%

- From March 2000 high: +9.0%

Germany’s DAX Price Index (DAXK), +7% in 24 years.

The most widely cited German stock market index, the DAX, is a “total return index” that includes dividends, so it cannot be compared to a “price index” such as the S&P 500 index, which does not include dividends.

DAX Kursindex (DAXK) is a price index, does not include dividends and is comparable to the S&P 500 index and all stock indexes here. use it.

- Ended the year with 6,628

- YoY: +15.2%

- From all-time high in January 2021: -3.6%

- From March 2000 high: +7%

Spain’s IBEX 35 Index (IBEX) returns to initial levels 26 years ago:

- Ended the year with 10,102

- YoY: +22.8%

- From December 2007 all-time high: -36%

- Return to original location in 1998

Italy’s FTSE MIB index returns to levels from 26 years ago.

- Ended the year with 30,352

- YoY: +28%

- From all-time high in March 2000: -39%

- Return to original location in 1998

In contrast, Canada’s TSX Composite Index (a compromise between Germany’s DAXK and the US’ S&P 500?) was +39% over 24 years.

- Ended the year with 20,958

- YoY: +8.1%

- From March 2022 all-time high: -5.1%

- From March 2000 high: +39%

- Return to original location in 1998

Enjoy reading and supporting Wolf Street? You can donate. I appreciate it very much. Click on the beer and iced tea mugs to see how.

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()