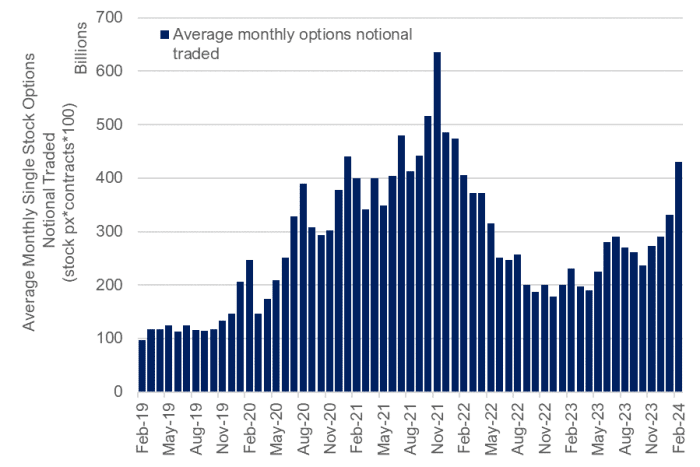

Surging demand for options contracts has accompanied a rally for stocks this year as both professional and retail traders have piled into bullish bets on individual stocks at the fastest pace since the meme-stock craze, according to data from Cboe Global Markets.

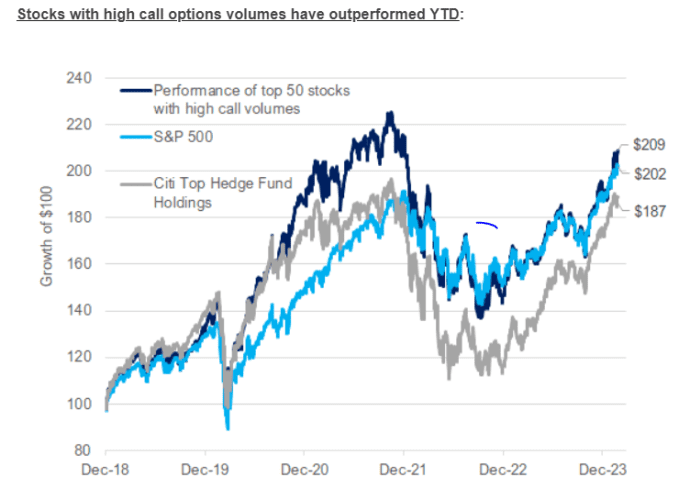

To illustrate the relationship between heavy call buying and stock-market returns, a team of equity strategists at Citigroup found that a group of 50 companies with the heaviest demand for bullish options has outperformed the S&P 500 since the advent of the COVID-19 pandemic.

In fact, since December 2018, the group of the most popular options plays has outperformed the S&P 500 by 7 percentage points, according to Citi’s data, featured in the chart below.

CITIGROUP

A call option gives the holder the right, but not the obligation, to buy the underlying asset at a set price by a set time. A put confers the right to sell. While both instruments can be used to hedge market trades, calls are a popular way to place bullish bets, while puts can be used to bet on a price decline.

The trend isn’t evidence that demand for bullish options conclusively drives outperformance, the Citi team said, but they did find the relationship noteworthy.

“An important characteristic of financial markets in the postpandemic era was the significant increase in options trading activity, particularly by retail investors,” wrote a team of strategists led by Stuart Kaiser, Citi’s head of U.S. equity trading strategy.

“These flows were skewed towards calls, and were largely concentrated in a select group of stocks. We find these stocks with high call volumes notably outperformed the broad market in the early years of the pandemic.”

“While it is hard to accurately determine the causality of this relationship, we believe it to be an important metric for investors in the context of the uptick in options volumes,” the team added.

February was a particularly busy month for options traders, as investors piled into bullish bets ahead of Nvidia Corp.’s

NVDA,

latest earnings report. Demand for options on individual stocks rose to its highest level since January 2022 last month, according to Citigroup.

CITIGROUP

See: Nvidia is now the king of the U.S. options market

U.S. stocks were trading lower on Tuesday, with the S&P 500

SPX

down 0.9% at 5,086, while the Nasdaq Composite

COMP

is off by 1.5% at 15960. Nvidia Corp., whose options rank as the most heavily traded based on the total value of the underlying shares each contract controls, was down 0.1% in recent trade at $852 per share.