If you want to become a successful trader, it’s important to understand the two primary types of trading strategies: discretionary and mechanical. Not understanding which one you are actually using can lead to unrealistic expectations, missed opportunities, and the belief that a strategy doesn’t work, when it actually does.

I failed to understand how important this concept is when I started in 2007, so I want to save you a lot of time and frustration by helping you understand it right now.

Key Takeaways

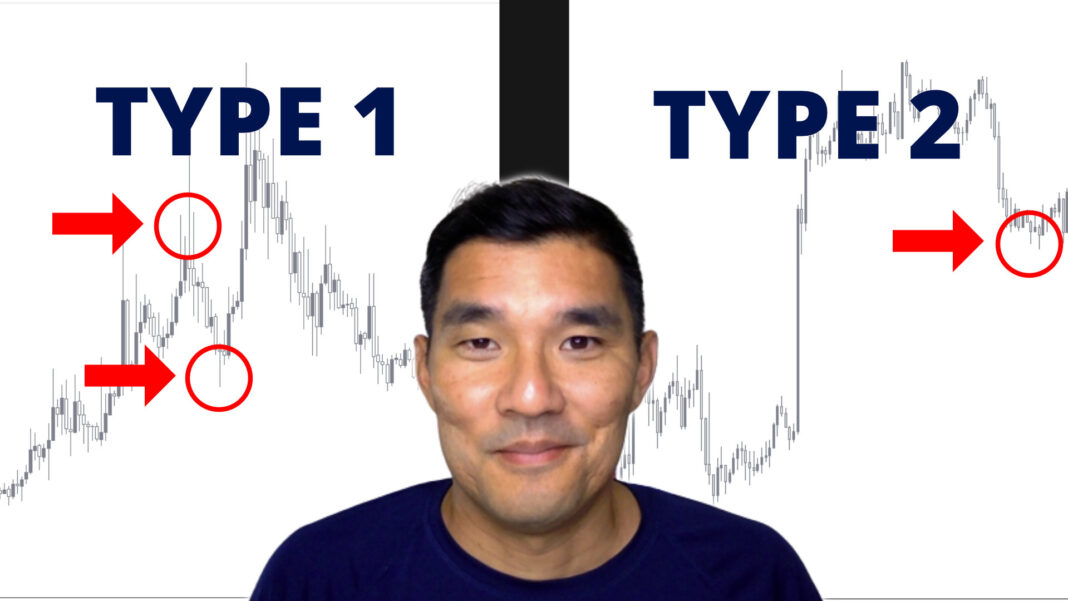

- There are two main categories of trading strategies: discretionary and mechanical.

- Both types of strategies work, but it’s important to find the one that works best for you.

- Misunderstanding your trading strategy can lead to inaccurate expectations and underperformance.

The Importance of Understanding the 2 Primary Types of Trading Strategies

Knowing which type of trading strategy you are using is crucial for 4 simple reasons.

First, you could be expecting results that are simply not possible with the type of strategy you’re using.

For example, discretionary strategies cannot be traded 24/7, like mechanical ones can.

So they will have fewer opportunities to make money.

A discretionary strategy might look fantastic in backtesting, but those results might not be possible in live trading.

Second, you could be limiting your returns by hanging on to a false understanding of the type of strategy you’re using.

If you’re trading a discretionary strategy and you treat it like a mechanical strategy, you might be limiting your creativity and blocking out your intuition, both of which could take your performance to the next level.

On the other side of the coin, you might be introducing discretion into your mechanical strategy by turning the strategy on and off too often, thereby limiting the return.

Third, you may think that a strategy doesn’t work when it does work if you adjusted your mindset.

You could backtest a mechanical strategy in one market and not be happy with the results.

However, if you traded that strategy across multiple markets and timeframes, which is very possible with mechanical strategies, the return could be significant.

That’s just one example of how a small shift in your thinking can lead to big returns.

Finally, understanding the differences between the 2 types of strategies will prevent you from endlessly jumping to new strategies without properly evaluating the current strategy.

When you know how each type works, you’ll have a better idea of when to give up on a strategy and when to keep going.

Giving up too early on a good strategy, and hanging on too long to a bad strategy, are both detrimental to your success.

But many traders do it.

I’ve done it before and it’s something I want to help you avoid.

Now that you understand the benefits of this knowledge, let’s jump into the definition of each type of strategy, and the pros and cons.

Discretionary Trading Strategies

A discretionary strategy, also known as a subjective strategy, cannot be programmed into a computer and requires the trader to use their own judgment or skill to enter and exit trades.

This type of strategy involves the use of inputs like support and resistance, chart patterns, candlestick patterns, fundamental analysis, news, or any method that requires the trader to make a relative value comparison between two or more markets.

With a discretionary strategy, you cannot expect the exact same results as someone else, as it requires input from the trader.

Your skill needs to be improved through practice and experience.

Benefits of Discretionary Strategies

There are a lot of benefits to learning and developing discretionary strategies.

Here are the best reasons to go this route.

More Flexible

Since discretionary strategies don’t have rules that are set in stone, this allows more leeway in terms of how the guidelines of the strategy are applied.

You can automatically adjust for different market conditions, based on your experience.

Trading in this way can lead to more profit opportunities.

More Available Trading Strategies

There is a relatively small number of trading strategies that can be fully programmed into a computer.

So by going the discretionary route, you have more trading strategies available to you.

You might find that exciting or overwhelming.

I personally like to have more options.

Can Take Advantage of Unique Market Opportunties

There may be world events or regulatory changes that have no president, and therefore cannot be backtested or incorporated into a mechanical strategy.

However, if you’re aware, you can use your logic and previous experience to profit from the situation.

This would not be possible with a mechanical strategy that has hard and fast rules.

Downsides of Discretionary Strategies

Like with everything else, this path does have its downsides.

Here’s what you need to know before you jump in.

Results Can Vary Widely Between Traders

Since there is so much trader input with discretionary strategies, backtesting and live results can vary a lot.

Some traders may say that a strategy doesn’t work, while others have fantastic success with it.

The key here is to find out what the successful traders are doing and emulate that.

So if someone says that a discretionary strategy doesn’t work (or does work), be sure to test it for yourself and come to your own conclusion.

Backtesting Takes Longer

Every single discretionary trade requires trader input, so backtesting usually takes significantly longer than with mechanical strategies.

This can be a benefit however, because you’re able to see price action in more detail and can start to see patterns that you might otherwise not see with an automated backtest.

You can also speed up the backtesting process by using partial automation.

Harder to Optimize

Since there are more variables with a discretionary strategy, they can be harder to optimize.

You’ll have to isolate each input individually and track its effect on your performance, which can be tricky.

When optimizing a strategy, it helps to track your psychological state and stick to one set of rules.

It can be easy to change the rules in the middle of a backtest or during live trading, but don’t do it.

That will only make it harder to isolate and improve your rules.

More Emotions Involved

Discretionary trading requires more inputs from the trader.

So if you’re having a bad day, or you aren’t fully focused, then your results could be less than ideal.

There are many ways to improve your trading mindset, but it requires a lot of awareness and practice.

Mechanical Trading Strategies

A mechanical strategy, also known as a fully automated strategy, is a strategy that can be 100% programmed into a computer.

It involves a defined set of rules, and there almost no input from the trader after the development phase.

Most trading strategies cannot be made mechanical, which can be frustrating.

Additionally, mechanical trading strategies are not flexible and usually cannot change with evolving market conditions, unless there is a built-in learning capability.

Benefits of Mechanical Strategies

Mechanical strategies provide more structure to traders who like having a well defined set of rules.

It’s not for everyone, but here are the benefits.

Fast Backtesting

Mechanical strategies can be programmed into a computer, making it easier to backtest and optimize them.

With just a few clicks, a strategy can be backtested over many markets and timeframes.

Many trading strategies and markets can be verified in just a couple of days.

Reproducible Results

Mechanical strategies can be reproduced between traders, unlike discretionary strategies which rely on an individual trader’s skill and judgment.

Therefore, traders can work together to develop strategies, which speeds up development.

When groups of traders backtest discretionary strategies, the results can vary greatly, which can lead to a lot of doubt as to if the strategy works or not.

Easier Optimization

Since mechanical strategies are a well defined set of rules, they can be easily tweaked and tested for optimal performance.

Many backtesting platforms like MetaTrader and TradeStation allow you to iteratively test settings like indicator values and position sizing, to find the best combination.

Testing this manually would take a long time, but you can get results from an automated backtest in as little as a few minutes.

Automation Potential

Once a mechanical strategy is developed, it can be coded into a fully automated strategy for any trading platform that allows automated trading.

All you need are the rules for the strategy and you can hire a programmer to do the rest.

Having an automated trading strategy will free up your time to develop new strategies, or do just go surfing.

Minimal Emotional Input

Mechanical strategies require minimal decision-making, reducing the impact of emotions on trading decisions.

Usually the only decision that could involve emotions is the decision to turn the strategy off or on.

This eliminates many trading decisions that can be impacted by the mood or psychology of the trader.

Downsides of Mechanical Strategies

Mechanical trading strategies have their advantages, but they also come with some downsides.

Here are the downsides that you should be aware of.

Most Trading Strategies Cannot be Made Mechanical

It’s important to understand that not all trading strategies can be programmed into a computer.

In fact, most trading strategies cannot be made mechanical.

This means that it can be frustrating to find those few strategies that do work, and it can take longer to find them.

Mechanical Trading Strategies are Not Flexible

Mechanical trading strategies cannot change with evolving market conditions.

This means that if the market changes, your mechanical trading strategy may stop working, and you’ll need to update the strategy or find a new one.

There can be ways to create “AI” strategies that continually learn from new data, but that is a complex process to set up and monitor.

Emotions are Still Involved

While mechanical trading strategies are often touted as a way to eliminate emotions from trading, this is not entirely true.

There are still emotions involved with mechanical trading strategies, especially when your strategy is losing.

You may feel fear and be tempted to turn the strategy off, which can lead to missed opportunities.

In my experience, the moment you turn an automated strategy off is usually when it starts to win again.

That’s not always the case obviously, but it sure feels that way.

Which Type of Trading Strategy is Better?

Both discretionary and mechanical trading strategies work, but the key to success is finding the one that works best for YOU.

Some people can do both, but most people will gravitate to one or the other.

With a discretionary trading strategy, you cannot expect the exact same results as someone else.

You have to practice and improve your skills, and this will not happen just by learning a few rules.

With a mechanical trading strategy, there are minimal emotions involved, but most trading strategies cannot be made mechanical.

So there is no one best type for everyone.

The key to success to figure out which one works best with your trading personality and avoid the following common misconceptions about trading strategies.

Common Misunderstandings With Trading Strategies

Now that you understand the 2 types of strategies, this is the most important part.

Don’t mix them up!

Here are some common misunderstandings that you should avoid.

Thinking a Discretionary Strategy is Mechanical

Many traders believe that their strategy is “rules-based” and therefore mechanical, when in fact, it requires their own judgment and skill to enter and exit trades.

If you’re trading a discretionary strategy and you think it’s actually a mechanical one, you may give up too early on the strategy because you think the rules “don’t work.”

So take some time to figure out if your strategy really is mechanical or if it’s discretionary.

You’ll have to backtest a discretionary strategy multiple times to get the hang of it, so don’t get discouraged. You may also have to consult with successful traders using the strategy to get some pointers.

It usually takes longer to learn a discretionary strategy, so don’t give up too early.

Expecting the Same Results as Someone Else With a Discretionary Strategy

With a discretionary strategy, it’s important to understand that you cannot expect the exact same results as someone else.

This is because it requires the input of the trader and their own judgment and skill, which will vary from person to person.

So always test a discretionary strategy yourself, never take anyone’s word that it works or doesn’t work.

Hopping to New Strategies Without Proper Evaluation

Understanding the differences between discretionary and mechanical strategies can prevent you from continually hopping to new strategies without properly evaluating each strategy.

I call this the Trading Silodrome, the perpetual cycle of jumping from strategy to strategy.

When you know how each type of strategy works, you’ll evaluate your strategies accordingly:

- With a discretionary strategy you’ll give yourself a little more time to figure out the nuances of the strategy and if they can be optimized.

- With a mechanical strategy you’ll test as many markets, timeframes and settings as possible, before you give up on it.

If you do that, you’ll know when to hold ’em and when to fold ’em.

Conclusion

On the surface, you may not think that understanding the difference between the 2 primary types of trading strategies is important.

But upon closer inspection, it’s one of the most important things that you need to know about trading.

Other trading strategy types like: trend following, price action and candlestick patterns are secondary types and are covered in deeper detail in other articles.

If you want to learn more about secondary trading strategy types, check out the related articles below.