Asset owners have dramatically increased their allocations to private markets over the past two decades, driven largely by a mistaken belief that private debt and equity deliver returns that are orders of magnitude above those of public markets. What makes most investors believe that private capital funds are such clear outperformers? The use of since-inception internal rate of return (IRR) as the industry’s preferred performance metric and the media’s coverage of the sector’s performance are to blame.

The myth of the Yale model — a belief of superior returns stemming from a heavy allocation to private equity funds — is based solely on a since-inception IRR. While there is no ideal substitute for since-inception IRR, investors — especially retail investors — should understand that IRR is not equivalent to a rate of return on investment (ROI).

This is the first in a three-part series in which I frame the problem, offer techniques for critical evaluation of fund performance reports, and propose alternative approaches to metrics and benchmarks. The call to action is for regulators or the industry, through self-regulation, to ban the use of since-inception IRR in favor of horizon IRRs. This simple action would eliminate many of the most misleading figures that are presented to investors and would facilitate comparisons.

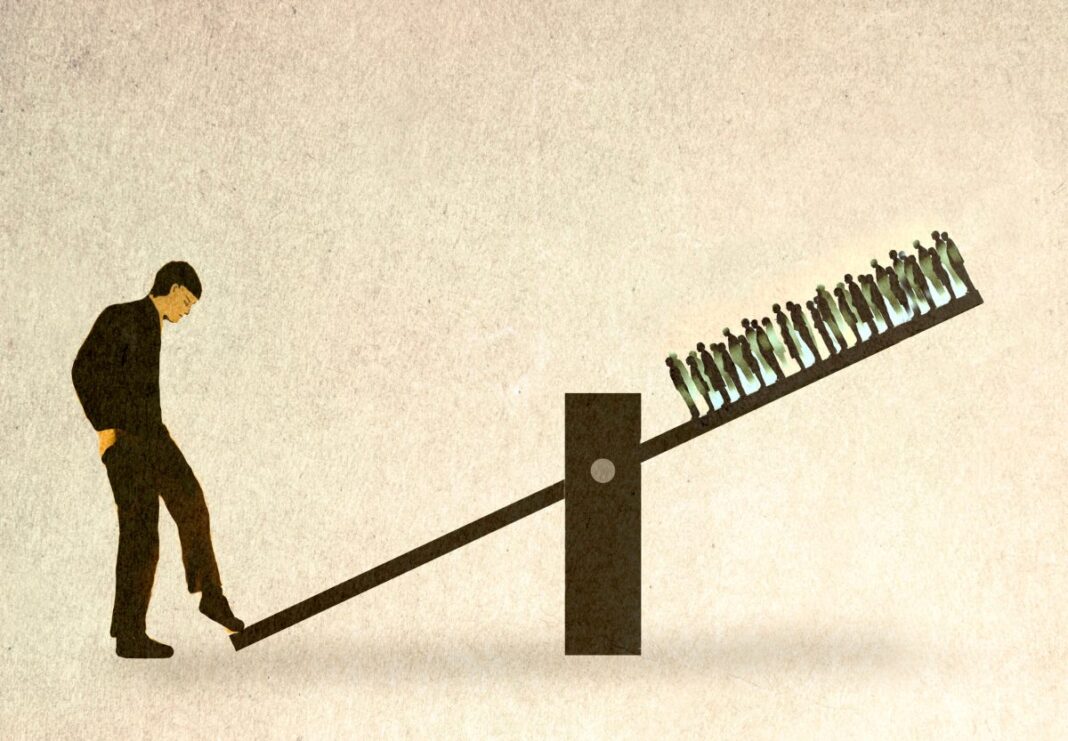

Figure 1 illustrates the migration of institutional assets to private capital over the past two decades. Recently, high-net-worth individuals and more broadly retail investors have joined the trend. The resulting growth in assets under management (AUM) might be unprecedented in the history of financial markets. Private capital fund AUM grew fifteen-fold — 14% per annum over the last 25 years.[1]

Figure 1: Evolution of AUM of all private capital funds.

Why did capital fly out of traditional asset classes and into private capital funds? The main cause seems to be a strong belief in superior returns.

But here’s a reality check on performance. Below are performance metrics, using one of the largest databases available — the MSCI (private-i) — and including all 12,306 private capital funds with a total of $10.5 trillion in AUM, over the entire history of the database.

- Median IRR of 9.1%

- Pooled IRR of 12.4%

- 1.52 total value to paid-in capital (TVPI): TPVI is the sum of distributed and current valuation, divided by the sum invested.

- 1.05 Kaplan-Schoar Public Market Equivalent (KS-PME): KS-PME is the ratio of present value of capital distributed and current valuation, by present value of capital invested. A score of 1.05 indicates a slight outperformance over the benchmark S&P 500 Index and 1.4% per annum of direct alpha (annualized outperformance over that benchmark).

The Source of the Belief: Evidence from News Coverage and Practitioner Publications

These performance figures are good, but not spectacular when compared to long-term US stock market returns. According to data on Ken French’s data library, the US stock-market has averaged 12% per annum over nearly 100 years from 1927 and 2023.[2]

Most importantly, the returns do not seem commensurate with the spectacular growth in private market AUM. Thus, the puzzle: What makes most investors believe that private capital funds are such clear outperformers? It would be interesting to conduct a survey among both retail and institutional investors to ask for the source of their belief. However, it is difficult to obtain many responses to a survey of this type and to extract what really drives a given belief.

An alternative route is to collect information online, mostly from the media. This is the approach I take. While it has its own limitations and is necessarily imprecise, it can nonetheless give a sense of how people convey their beliefs.

Exhibits 1 to 9 show some potentially influential articles and statistics. They are spread over time, starting in 2002 (Exhibit 1) and ending in 2024 (Exhibit 9).

Exhibit 1 is an extract from a newspaper article covering the fact that a first-time fund was going to be the largest fund ever raised in Europe at the time. Such a situation is rather unusual as funds tend to start small and grow over time. There is, however, no such thing as a pure first-time fund, and the person raising the money had executed nine deals before raising that first-time fund.

The article mentions two performance metrics, one is spectacular (62% per annum), the other one not so spectacular (£2.1 per £1 invested gross of fees). Given that this track record led to the largest fund ever raised at the time (2002), it is possible that investors reacted to the 62% annual figure. Sixty-two percent feels extraordinary indeed.

In Exhibit 2, Bloomberg shares the Figure 1 from a widely distributed article, “Public Value, a Primer in Private Equity,” first published in 2005 by the Private Equity Industry Association. This figure compares an investment in the S&P 500 to one in top quartile private equity funds from 1980 to 2005. The S&P 500 delivered 12.3% per annum but the top quartile of private equity firms delivered 39% per annum. A 39% return for one quarter of all private equity funds is extraordinary indeed.

Exhibit 3 is an extract from an article by The Economist, which wanted to explain the sharp increase in AUM of private equity in 2011. The Economist points to the poster child for private equity investing: the Yale Endowment track record. The article says that the university’s private-equity assets have produced an annualized return of 30.4% since inception. That investment program was launched in 1987; hence Yale Endowment obtained a 30.4% annual return over a 25-year period. This is certainly extraordinary.

Exhibit 4 shows the investment memo of a large public pension fund, Pennsylvania’s Public School Employees’ Retirement System (PSERS). The investment committee recommends investing in Apax VII, and the main argument appears to be a gross return of 51% and a 32% net return. The memo states that this performance places Apax in the top decile of private equity firms.

No other performance metrics are mentioned. Once again, these numbers appear extraordinary. This fund (Apax VII) closed at €17 billion, which made it the second-largest fund ever raised in Europe at the time, right behind a €20 billion Blackstone fund that closed a year earlier. Possibly, many investors’ reactions were like PSERS’: a 51% annual performance figure is indeed extraordinary.

Exhibits 5 and 6 are from 2014 and 2015, which was when the industry was lobbying for retail investors to be allowed to invest in private capital funds. Exhibit 5 quotes the wealthiest private capital fund manager saying that private capital outperforms public equity by 10% per annum. That certainly is extraordinary, but there are no details on the time period in which the performance was measured, or the benchmark used. This statement, however, was enough to prompt a full article about the extraordinary attractiveness of these investments.

Exhibit 6 is a 2015 New York Times article. The journalist explains why retail investors would rush into private equity funds if given the opportunity and asks for this opportunity to be granted. The key reason for the rush is “obvious.” He says it is because of the returns and quotes three figures. First, Yale Endowment: 20 years at 36% return per annum. Second, Apollo: 25% return net of fees and an eye watering 40% gross of fees. Third, the journalist quotes a 26% return net of fees for KKR since inception, which is 1976. Quite unfortunate and perhaps a bit ironic for an article whose title states that fees should be ignored given the high returns, the journalist made a typo. KKR’s return is 26% gross of fees, not net. Net-of-fees, the figure is 19%. Nonetheless, over such a long time-period, these performance figures are all extraordinary indeed.

Exhibit 7 is about Yale Endowment again — a 2016 front page article in Fortune magazine. The journalist reports what Yale Endowment published in its annual report: venture capital returns since inception nearly double every year. The annual return is 93%, which is jaw dropping.

The largest private capital firms are publicly listed in the United States and therefore file reports with the Securities and Exchange Commission (SEC). Exhibit 8 shows extracts from the 10K of the two firms mentioned above: KKR and Apollo. The two firms disclose their AUM and track record. The figures they provide are the same as those seen above. Apollo mentions the gross IRR of 39%, and KKR mentions its 26% IRR. Notice that no other performance metrics are provided. Again, such performance figures over a long period of time feel extraordinary.

Finally, Exhibit 9 shows the start of an article published in 2024. The author highlights a method to select the best private capital funds and argues that these funds returned 40% per annum.

The Problem with Determining a Rate of Return for Assets not Continuously Traded with Intermediary Cashflows

It is difficult to determine a meaningful rate of return for assets that are not continuously traded and have intermediary cashflows. A hypothetical scenario illustrates the problem with applying ROR to private equity.

Assume that you paid $100,000 for a house in 1976 and sell it for $1 million 40 years later, in 2016. The rate of return is 1mn/100k-1=900%. You can also annualize this figure, so it is more palatable: (1mn/100k)^(1/40)-1= 5.92%.

Let’s say that you did major renovation work in 1981 at a cost of $500,000 and rented it out in 2000 for five years. To make this exercise simple, assume the tenant paid five years of rent up front and that totaled $200,000. You did the same thing in 2010 for $400,000. What is the rate of return on this investment?

It is not defined. You cannot say that you invested $600,000 and earned $1.6 million over 40 years because most of the $600,000 occurred in 1981 and you earned some of the $1.6 million well before 2016. Hence, it is more like a $1 million gain from a $600,000 investment over a 30-year period.

The only way to get back to a rate of return would be to have the market value of the house each period to which we can add the net profit. Absent this, the only other option is to assume both a re-investment and a financing rate for the intermediary cash flows.

For example, you could assume that you set aside some money in 1976 and that earned a rate f = 5% per annum so that you have $500,000 in 1981. That is, you need to put aside 500/(1+5%)^5. Thus, the initial investment is $392,000 in 1976. Assuming you re-invested the rental income at 10% per annum, you end up in 2016 with 919+709+1000= 2628. Hence, the rate of return is (2628/392)^(1/40)-1= 4.9%. In an equation form, this situation translates as follows:

Where r is the reinvestment rate, f is the financing rate, and ror is the rate of return.

The bottom line is that to obtain a rate of return, you need to make strong assumptions. How is it then that Exhibits 1-9 displayed rates of return for private equity funds without any assumptions disclosed?

None of These Figures Are Rates of Return

The fact is, none of the performance figures in Exhibits 1 to 9 are rates of return. Whether explicitly stated or not, each time an annual performance figure was provided for a private capital fund, it is an IRR. All the press articles and comments we have just reviewed present the IRR as a rate of return.

One hypothesis for the sharp rise in AUM of private capital funds is that investors believe these IRR numbers are rates of return, or at the very least, they are positively influenced by these impressive numbers that look return-like. In fact, as seen in the exhibits, IRRs are typically presented as rates of return, and these figures are high by any standard.

It is also important to bear in mind that most investors in private capital funds are not investing their own money. Hence, the investor may know that an IRR is not a rate of return but it can be in their best interest to present IRR as a performance figure to their principal (e.g., board of trustees).[3] For example, the person writing the investment memo for PSERS probably works in the private equity team, and probably knows that the 32% figure net of fees is not a rate of return achieved by Apax. The decision to use the statistic may have been driven by a desire to impress members of the board of trustees.

Key Takeaways

The rise of private markets over the past two decades appears to have been driven by a strong belief in their superior returns compared to traditional investments. One major issue that explains this trend is the industry’s reliance on IRR to present the performance of private market funds. Indeed, the myth of the Yale model — a belief of superior returns stemming from a heavy allocation to private equity funds — is solely based on a since-inception IRR. Investors should be careful not to misconstrue IRR as a rate of return and should remember that a rate of return is difficult to determine for assets that are not continuously traded and have intermediary cashflows.

In Part II, I will delve deeper into an explanation of IRR and its pitfalls.

[1] These funds are structured as limited partnership, may invest in debt or equity instruments, with or without control (minority), across a broad range of industries (utilities, hotels, restaurants, tech, healthcare), a broad range of countries and age of companies (early stage to mature).

[2] The figure is very consistent over time. It is 11.9% from 1964 to 2023 (last sixty years), and 12.6% from 1984 to 2024, 11.8% from 1994 to 2023. Etc.

[3] Their principal is likely to not know any better, and showing such string performance figures is likely to result in the agent obtaining more capital and resources.