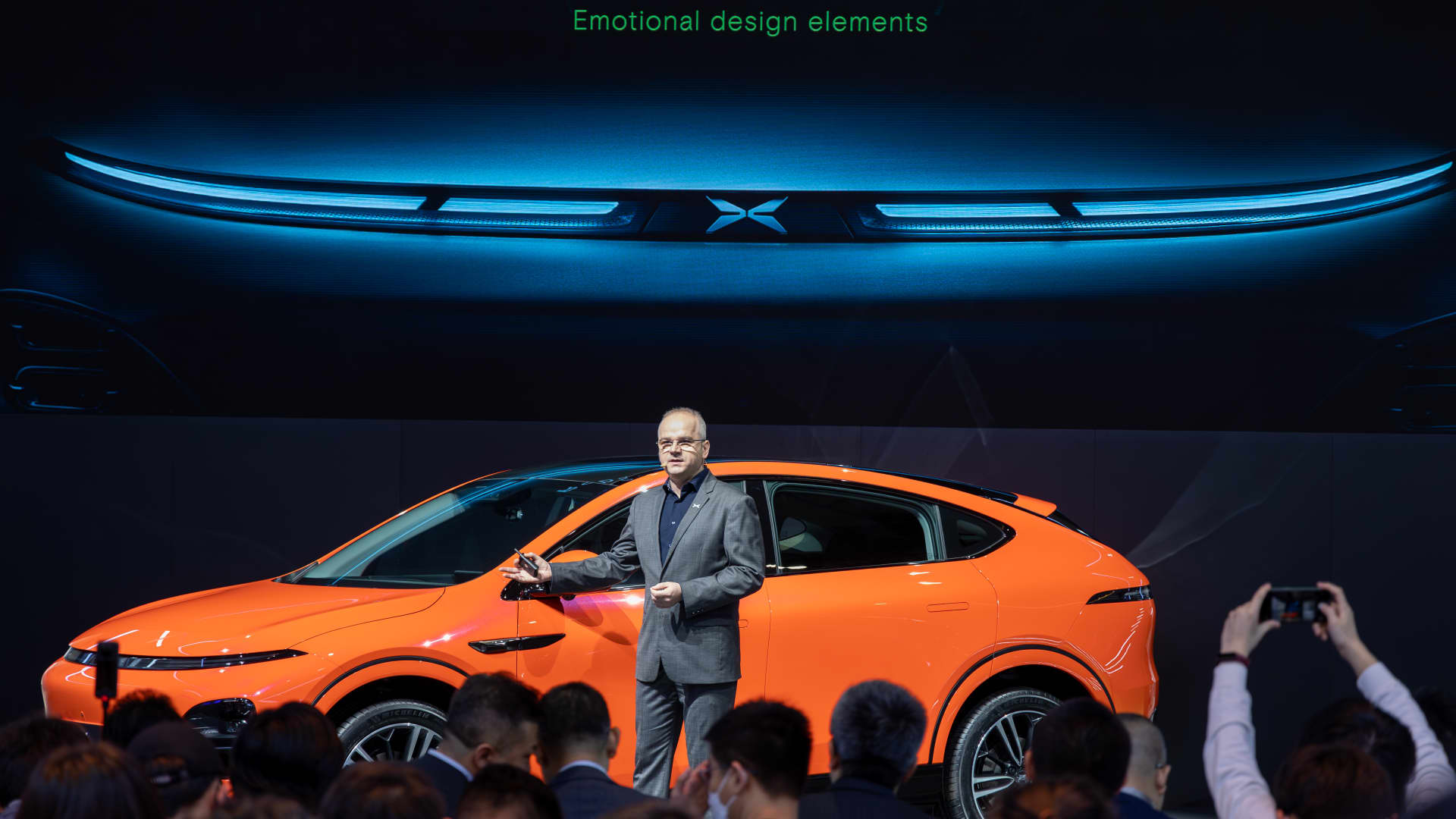

With China’s stock market lagging further behind, China has launched fiscal and monetary policies to stabilize the market. With Chinese stock valuations falling and the government using multiple levers to boost confidence, I’m looking for opportunities in struggling stocks like EV maker XPEV. Despite increased competition in an already crowded industry, XPEV has proven its ability to execute organic growth and profit expansion during these challenging times. This provides an opportunity for oversold and undervalued stocks to rebound significantly. The stock has fallen more than 55% in the past six months and is down 85% from its peak, leaving nearly all investors in the water now since its 2020 IPO. However, in my opinion, this is an opportunity as there are signs that the sell-off is running out. This type of chart setup can lead to significant gains in a short period of time. Additionally, XPEV has formed a series of lows since the October 2022 bottom and is trading just against the support of this major trend line. This provides an opportunity to start adding long-term exposure with an attractive risk/reward ratio. And valuing the business, XPEV is expected to increase its revenue by more than 85% next year, far outpacing its big rivals. Despite this, the company currently trades at less than 1x EV/Sales, while its peers trade at well above 1.5x EV/Sales. The recent launch of his X9 model, together with the recent European launch, completes a strong pipeline for 2024 and 2025. XPEV has a significantly better outlook than its competitors, trades at a relative discount, and shows significant upside potential. Trading Considering the macro environment in China and the oversold and undervalued shares of his XPEV stock, my preference is to add long exposure with a simple call option. I’m looking at his April call and he’s going to buy a $10 call with a $1.33 debit. This puts $133 per contract at risk of participating in unlimited appreciation, and the breakeven point by April expiration is $11.33. Considering XPEV’s price history, we expect a strong rebound targeting the $17.50 level as an initial upside. Disclosure: (none) The above is subject to our Terms of Use and Privacy Policy. This content is provided for informational purposes only and does not constitute financial, investment, tax, or legal advice or a recommendation to purchase any securities or other financial assets. The content is general in nature and does not reflect your unique personal circumstances. The above may not be appropriate for your particular situation. Before making any financial decisions, you should strongly consider seeking the advice of your own financial or investment advisor. Click here for full disclaimer.