China loves bargains. If you have ever seen prices on Chinese websites such as Temu or Alibaba (Nasdaq: Baba), it turns out that it features a pretty amazing price. The old adage of be a cautious buyer still applies, and the prices are still impressive. And, in a slight turnaround, retail giant Walmart (New York Stock Exchange:WMT) and Costco (Nasdaq:Cost) is increasingly welcomed in China.

China’s current favorite is not Walmart, but Sam’s Club, Walmart’s bulk-buying store that functions much like Costco in the marketplace. But the Chinese appear to be particularly obsessed with bulk buying right now, with shoppers rushing to Costco’s newest store in the southern Chinese city of Shenzhen on its first day of operation. One shopper even pointed out that what he bought at Costco would have cost twice as much as if he had shopped in Hong Kong.

They came for prizes ranging from food to Lotso Haggin the bear from Disney/Pixar’s “Toy Story 3.” In fact, this is Costco’s sixth store to open in China, and the opening was greeted with such enthusiasm that local authorities had to resort to crowd control measures to maintain security.

Many Costco shoppers stock up on food

Crowds were active at the opening of the new Costco, but reports say the crowds are probably not as big as some people think.Report from south china morning postHe noted that while there are still plenty of shoppers in line at Costco, overall crowds have decreased. It’s also worth noting what those customers were buying. Many customers came for cheap packages, but they also stocked up on food. The report found that “discounted food” was high on the list of shoppers at Costco in Shenzhen.

Is Walmart or Costco a better place to shop?

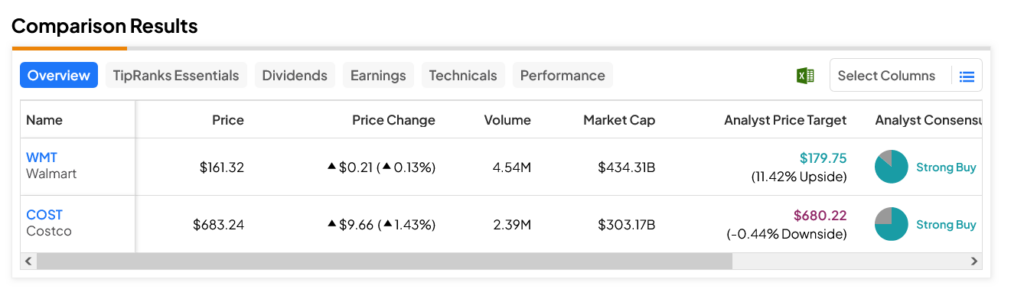

Turning to Wall Street, analysts believe that both Costco stock and Walmart stock are strong buys right now. However, WMT stock has the strongest upside potential, with an average price target of $179.75, giving the stock 11.42% upside potential. On the other hand, COST stock has an average price target of $680.22 per share, so there is a downside risk of 0.44%.

disclosure