“‘When I look at the U.S. stock market using these criteria, it — and even some of the parts that have rallied the most and gotten media attention — doesn’t look very bubbly.’”

Stocks have made big gains off their October lows, rallying four straight months and sending the S&P 500

SPX

and Dow Jones Industrial Average

DJIA

to a string of record highs. The narrow, tech-led nature of the advance has stoked talk of a potential bubble and drawn inevitable comparisons to the dot-com boom of the late 1990s, which ended with a devastating bust.

But Ray Dalio, founder of hedge-fund titan Bridgewater Associates, argued in a Thursday LinkedIn post that bubble talk appears misplaced according to his six-part checklist.

He breaks down the criteria for his “bubble gauge” here, in his own words:

- High prices relative to traditional measures of value (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates).

- Unsustainable conditions (e.g., extrapolating past revenue and earnings growth rates late in the cycle when capacity limits mean that that growth can’t be sustained).

- Many new and naive buyers who were attracted in because the market has gone up a lot, so it’s perceived as a hot market.

- Broad bullish sentiment.

- A high percentage of purchases being financed by debt.

- A lot of forward and speculative purchases made to bet on price gains (e.g., inventories that are more than needed, contracted forward purchases, etc.).

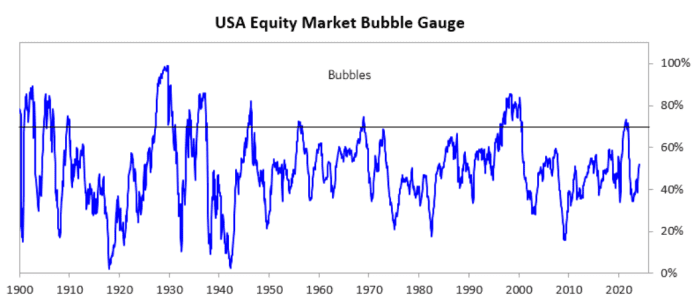

Based on Dalio’s equity bubble gauge, the market right now is in the middle of the range at the 52nd percentile, a level that hasn’t been associated with past bubbles (see chart below).

Ray Dalio

What about the so-called Magnificent Seven, the cohort of megacap tech stocks supercharged by a frenzy over artificial intelligence, that have led the rally and accounted for an ever-growing chunk of the S&P 500?

Indeed, the market cap of the basket has increased by over 80% since January 2023, with the companies now accounting for more than a quarter of the S&P 500’s total market cap, Dalio observed.

That’s left the Magnificent Seven looking “a bit frothy” but not in a “full-on bubble,” he argued.

“Valuations are slightly expensive given current and projected earnings, sentiment is bullish but doesn’t look excessively so, and we do not see excessive leverage or a flood of new and naive buyers,” Dalio explained. “That said, one could still imagine a significant correction in these names if generative AI does not live up to the priced-in impact.”

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.