Alexander Spatari/Moment via Getty Images

Who would have imagined that Denmark would become one of the biggest beneficiary countries of weight loss drugs? with a weight of 23% iShares MSCI Denmark ETF (Bat: Eden), that’s natural That the fund is doing well. Of course, this ETF of his is more than just a single stock, and it’s worth considering the investment case here.

EDEN is a fund designed to closely track the investment results of a broad index of Danish stocks. This ETF offers investors the opportunity to gain exposure to a wide range of companies operating in Denmark, providing targeted access to Danish stocks. This is an ideal investment vehicle for those who want to express a single country perspective.

EDEN was founded on January 25, 2012 and trades on the Cboe BZX exchange, formerly known as BATS.of The ETF is managed with an expense ratio of 0.53% and has approximately $240 million in total assets under management (AUM). It’s a relatively small fund, but that’s fine if you’re looking for an undervalued and allocated part of the market.

Analysis of EDEN holdings

The iShares MSCI Denmark ETF consists of 45 individual stocks. Reflecting the concentration of the Danish stock market, the top five holdings account for a significant portion of the fund’s total assets. The top holdings are:

-

Novo Nordisk Class B: A global healthcare company specializing in diabetes treatment. The company accounts for approximately 23.62% of the ETF holdings. It was a big win thanks to his WeGovy on the GLP-1 side.

-

DSV: Global transportation and logistics company. This company accounts for approximately 6.30% of the ETF’s holdings.

-

Vestas wind system: A Danish company that manufactures, sells, installs and services wind turbines. The company accounts for approximately 5.48% of the ETF’s holdings.

-

Danske Bank: A Danish bank that offers a wide range of financial services, including retail banking, corporate banking, and wealth management. This company accounts for approximately 4.13% of the ETF’s holdings.

- Genmab: A biotechnology company focused on innovating and advancing unique antibody treatments to fight cancer. The company accounts for approximately 3.62% of the ETF’s holdings.

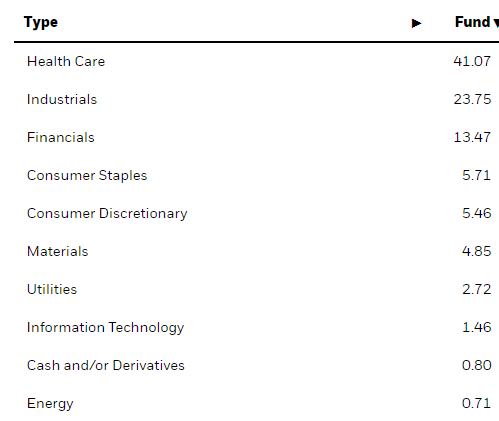

EDEN sector composition

The iShares MSCI Denmark ETF has a diverse sector composition, with the Healthcare sector being the highest (41.07%), followed by Industrials (23.75%), Financials (13.47%), and Consumer Staples (5.71%). Masu. Remaining sectors such as Materials, Consumer Discretionary, Utilities, Information Technology, and Energy together make up the remaining holdings of the ETF, providing a balanced spread across different sectors of the Danish economy.

shares.com

There are no other purely Danish funds that compete with EDEN, further reinforcing the argument that this is a fund to watch for single country exposure to a part of the world that most people don’t pay attention to.

Pros and cons of investing in EDEN

Like any investment, investing in iShares MSCI Denmark ETF comes with its own advantages and potential disadvantages. On the positive side, EDEN offers exposure to a wide range of Danish stocks, giving investors the opportunity to diversify their portfolios and gain access to the Danish market. Additionally, the ETF has a competitive expense ratio and has performed well to date.

On the downside, investing in ETFs involves risk. These include market risk – the risk that the value of the securities in the ETF portfolio will decline due to various market factors, foreign exchange risk – the risk that fluctuations in exchange rates may adversely affect the value of the Fund’s foreign investments; Contains concentration risk. – The risk of loss by focusing your portfolio on a particular country, sector or industry, in this case Denmark. And although it’s diversified, Novo Nordisk accounts for 20% of the allocation, so it’s somewhat dependent on the performance of that one stock.

Conclusion: To invest or not to invest?

EDEN is a good fund. I prefer global diversification here, but this country tends to attract less investment attention from US money. I think it’s worth considering a broader allocation.