Nanofoam Finland Oyj (HEL:NANOFH) I would like to shed some light on this company as it is probably about to make a big splash in business. Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharmaceutical and biotechnology industries in Europe and the United States. With a loss of 22 million euros in the most recent financial year and 21 million euros in the trailing 12 months, the company, which has a market capitalization of 139 million euros, has reduced its losses by moving closer to its break-even target. Path to profitability is a key topic for Nanoform Finland Oyj investors, so we decided to assess market sentiment. We’ve summarized industry analyst expectations for the company, breakeven year, and growth potential.

Check out our latest analysis for Nanoform Finland Oyj.

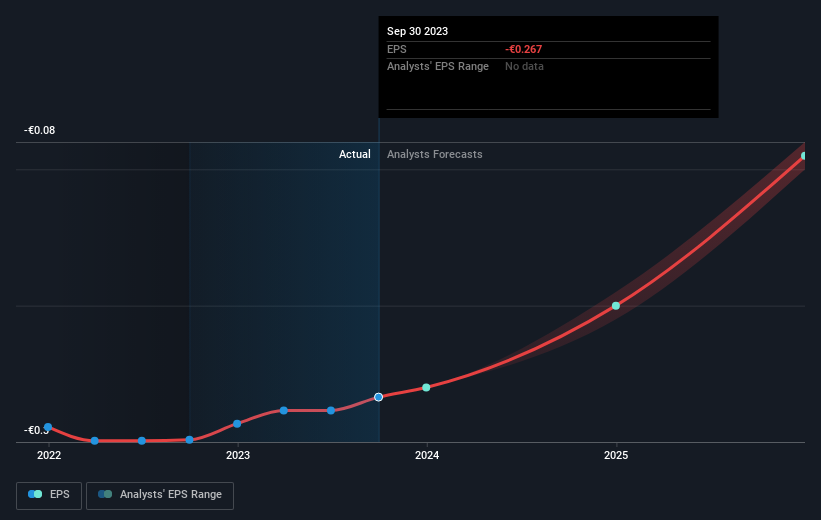

According to two industry analysts covering Nanoform Finland Oyj, the consensus is that breakeven is close. They expect that the company will incur a final loss in his 2025, but in 2026 he will be in the black of 2.6 million euros. Therefore, the company is expected to break even about two years from now. How fast does the company need to grow each year to break even by 2026? Working backwards from analyst forecasts, the company expects to grow 56% year over year on average. I understand that. This is quite optimistic. If your business is growing slowly, you’ll start seeing profits later than expected.

However, since this is an overview, we will not discuss the company-specific developments of Nanoform Finland Oyj. However, keep in mind that life sciences companies typically have irregular funding periods depending on the stage of product development. flow. Therefore, high growth rates are not unusual, especially when a company is in an investment period.

One thing we’d like to point out is that Nanoform Finland Oyj has no debt on its balance sheet. This is unusual for loss-making life sciences companies, which typically carry high debt relative to equity. This means that the company operates purely on equity investment and has no debt burden. This aspect reduces the risks associated with investing in loss-making companies.

Next steps:

There are too many aspects of Nanoform Finland Oyj to cover in one short article, but you can find all the important fundamentals of the company in one place. This is the company page for Nanoform Finland Oyj located in Simply Wall St. We have also compiled a list of important factors. Notable aspects:

- Achievements so far: What is Nanoform Finland Oyj’s past performance? Find out more with our past performance analysis and take a look at our free visual representation of the analysis for greater clarity.

- management team: Having an experienced management team at the helm increases our confidence in the business. View the biographies of Nanoform Finland Oyj’s board members and CEO.

- Other strong performing stocks: Are there other stocks with a proven track record that offer a better outlook? See our free list of these great stocks here.

Valuation is complex, but we help make it simple.

Please check it out Nanofoam Finland Oyj Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.