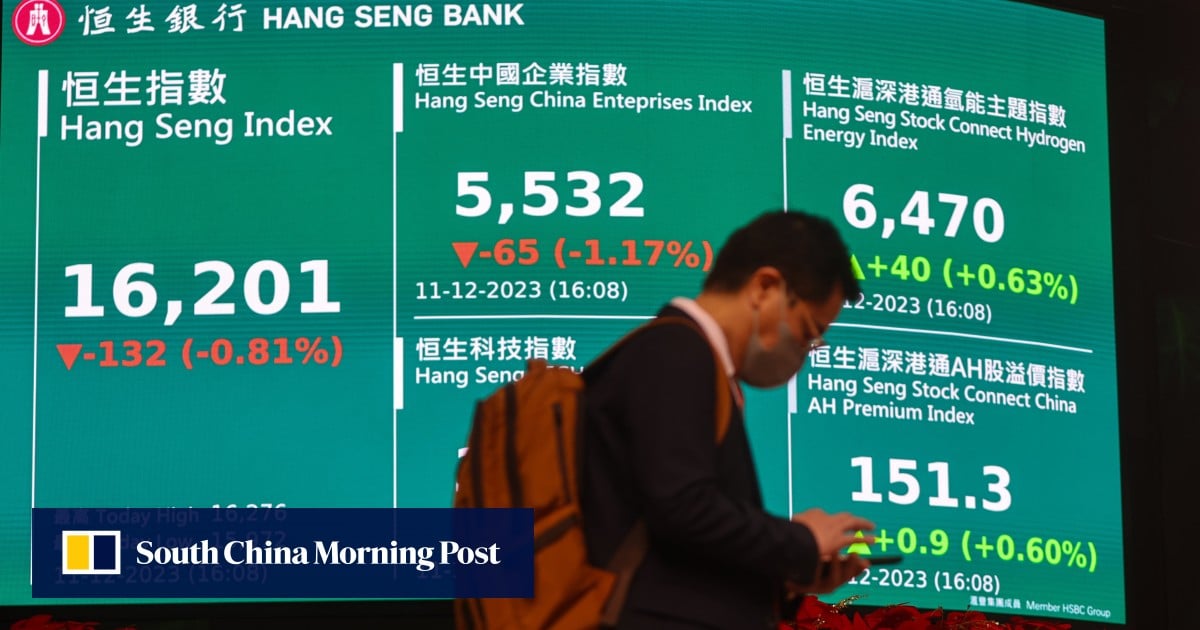

China’s weaker-than-expected economic recovery, underwhelming policy response, and rising U.S. interest rates have been plaguing investors’ lives lately. The real estate industry’s travails and concerns about regulation and enforcement in the technology industry added to the pressure. Things are changing for the better.

“All the worst news is priced into the market. [market] Players are locked into strong aversion and linear extrapolation,” said Chua, founder and chief investment officer of Asia Genesis Asset Management. “Chinese policymakers are taking further economic measures to combat the bear market and declining confidence.”

“For long-term investors looking for big upside in the future, quality Chinese stocks are a no-brainer. This is an unprecedented once-in-a-lifetime opportunity to invest in the Hong Kong and mainland stock markets.”

Yang Wang, chief China strategist at Alpine Macro, said on a podcast that Chinese stocks are unlikely to fall much from current levels as market valuations remain below their average over the past five years. But without a new policy tonic from the Chinese government, a stronger recovery may be difficult, he said.

“Unless the Chinese government makes a really fundamental change in policy direction, there is no clear trigger for a more positive reassessment,” he added.

The top three companies this year were electric car maker Li Auto, laptop maker Lenovo and state oil company PetroChina, which posted gains of 91%, 70% and 44%, respectively. Collectively, the trio captured an additional $74.9 billion in market value.

Li Ning, Country Garden Services and car dealership Zhongsheng Group finished the year last among the 82 companies in the Hang Seng Index, losing a total of US$28 billion in market capitalization.

But Hong Kong’s fourth consecutive year of record recession makes the potential rewards attractive for Mr. Chua, a former investment manager at the Monetary Authority of Singapore. His flagship macro fund has made a profit every year since its launch in May 2020, according to data on its website.

“China stocks and Hong Kong stocks are almost the cheapest compared to emerging markets,” he said. “Despite very negative views in the West, the profits of many Chinese companies are steadily improving. China’s top companies are moving into higher-margin businesses.

“The risk reward is the best I’ve seen in my 40 years of investing and trading. The best part is that it offers great scale and choice.”